Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 17 December 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

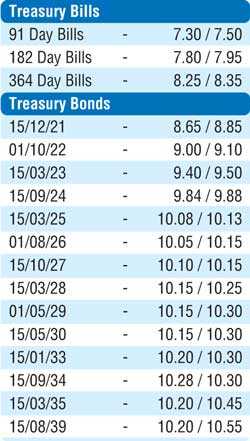

The trading week commenced on a sluggish note as activity in the secondary bond market came to a standstill yesterday due to most market participants opting to stay on the sidelines.

The total secondary market Treasury bond transacted volume for 13 December was Rs. 5.71 billion.

In money markets, the Open Market Operations (OMO) Department of the Central Bank of Sri Lanka was seen infusing amounts of Rs. 6.85 billion and Rs. 10 billion respectively on an overnight basis and seven day basis by way of Reverse Repo auctions at a weighted average rate of 7.55% and 7.53% as the overnight net liquidity surplus in the system decreased to Rs. 16.24 billion yesterday. The overnight call money and repo rates averaged 7.53% and 7.58% respectively.

Rupee remains mostly unchanged

In the Forex market, the USD/LKR rate on spot contracts remained mostly unchanged yesterday to close the day at Rs. 181.20/30 as the market was trading at equilibrium.

The total USD/LKR traded volume for 13 December was $ 59.31 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 181.60/75; three months - 182.40/60 and six months - 184.20/50.

(References: Central Bank of Sri Lanka, Bloomberg E-bond trading platform, money broking companies)