Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 11 June 2024 01:18 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market on 22 May 2024 kicked off the week on a dull note. Sparse trades were observed on thin overall transaction volumes, with the market at a standstill for much of the day and yields holding broadly steady. Market participants adopted a wait-and-see approach ahead of the massive back-to-back Treasury bill and bond auctions, as well as the IMF Board Meeting on Sri Lanka’s second review of the EFF program scheduled for this week.

The secondary bond market on 22 May 2024 kicked off the week on a dull note. Sparse trades were observed on thin overall transaction volumes, with the market at a standstill for much of the day and yields holding broadly steady. Market participants adopted a wait-and-see approach ahead of the massive back-to-back Treasury bill and bond auctions, as well as the IMF Board Meeting on Sri Lanka’s second review of the EFF program scheduled for this week.

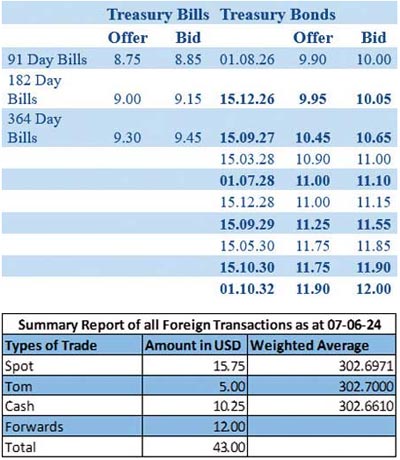

Limited trades were observed on selected maturities. Accordingly, the 01.07.28 maturity was seen transacting at the rate of 11.10% and the 01.10.32 maturity within the range of 11.93% to 11.95%.

The upcoming round of Treasury bond auctions due on 13 June, will have on offer in total Rs. 295.00 billion, making it the largest Treasury bond auction is Sri Lanka’s history. The auction will comprise of Rs. 60 billion from a bond due on 15 October 2027 bearing a coupon of 10.30%, Rs. 125.00 billion from a bond due on 15 September 2029 bearing a coupon of 11.00% and Rs. 110.00 billion from a bond due on 1 December 2031 with a coupon rate of 12.00%.

For context, the previous round of Treasury bond auctions conducted on 13 May 2024, recorded a bullish outcome. Yields declined sharply, and the entire offered amount of Rs. 70 billion was snapped up in the first phase. The total bids received exceeded the offered amount by a staggering 3.63 times. Strong demand was observed for all three maturities, resulting in weighted averages of 11.01% for the 01.05.28 maturity, 11.85% for the 15.10.30 maturity, and 12.17% for the 01.10.32 maturity.

The total secondary market Treasury bond/bill transacted volume for 7 June was Rs. 12.26 billion.

In money markets, the weighted average rate on overnight call money was at 8.67% and repo was at 8.69%.

The net liquidity surplus stood at Rs. 162.70 billion yesterday as an amount of Rs. 5.34 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 9.50% against an amount of Rs. 183.04 billion been deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%.

Further, the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of a 4-day term reverse repo auction for Rs. 15.00 billion at the weighted average rate of 9.01%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day edging up, at Rs. 303.20/303.50 against its previous day’s closing level of Rs. 302.70/302.80.

The total USD/LKR traded volume for 7 June was $ 43.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)