Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 26 July 2024 00:08 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

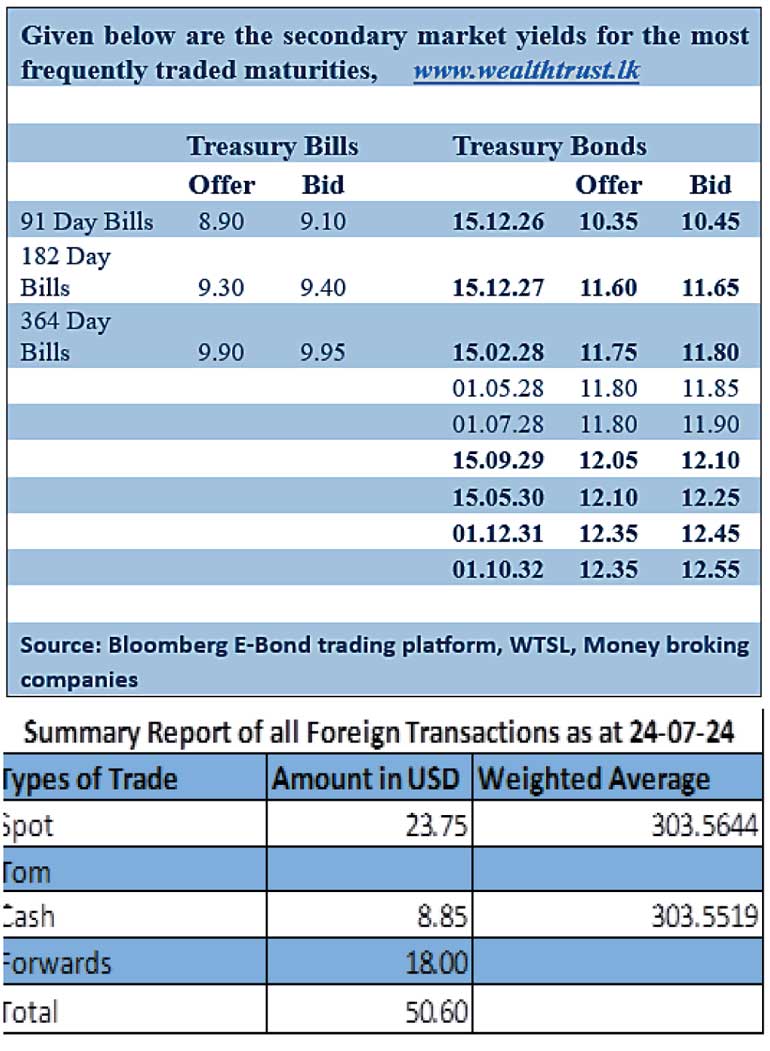

The secondary bond market yesterday was virtually at a complete standstill with only sparse trades observed on thin overall transaction volumes. However, yields closed broadly steady as most market participants continued to be on the sidelines ahead of the upcoming T-bond auction scheduled for next week.

The details of the upcoming Rs. 200 billion Treasury bond auction due to be held next Tuesday, 30 July, were announced. The auction will comprise of Rs. 80.00 billion from a bond due on 15 February 2028 bearing a coupon of 10.75%, Rs. 80.00 billion from a bond due on 15 October 2030 bearing a coupon of 11.00% and Rs. 40.00 billion from a bond due on 01st June 2033 bearing a coupon of 09.00%

In secondary bonds market, limited trades were observed with the 01.06.26 and 15.05.30 maturities changing hands at the rate of 10.20% and 12.20% respectively.

The secondary market T-bills continued to see interest, as market participants gravitated towards shorter tenor securities. The September 2024, December 2024 and February 2025 maturities were seen transacting at the rate of 9.05%, 9.25% and 9.35% respectively.

The total secondary market Treasury bond/bill transacted volume for 24 July was Rs. 68.11 billion.

In money markets, the weighted average rate on overnight call money was at 8.55% and repo was at 8.63%.

The net liquidity surplus stood at Rs. 82.56 billion yesterday as an amount of Rs. 158.71 billion been deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.25%.

Further, the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight reverse repo auction for Rs. 21.12 billion at the weighted average rate of 8.43%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day appreciating slightly, at Rs. 303.25/303.40 against its previous day’s closing level of Rs.303.55/303.65.

The total USD/LKR traded volume for 24 July was

$ 50.60 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)