Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 1 January 2025 00:06 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yesterday saw yields remain broadly stable with activity and transaction volumes at subdued levels.

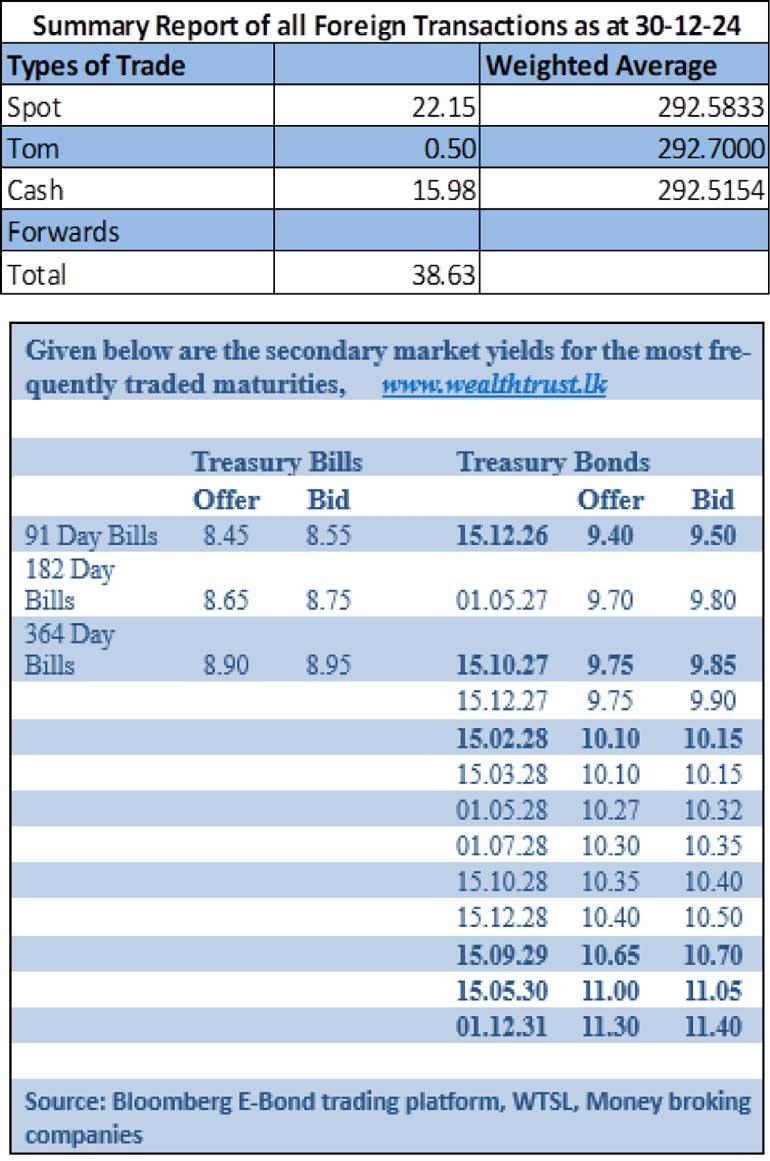

Limited trades were observed on selected maturities. The 01.06.26, 15.10.28, 15.09.29 and the 01.07.32 maturities were seen trading at the rates of 9.26%-9.25%, 10.38%, 10.75%-10.68% and 11.47%-11.46% respectively.

This comes ahead of the Treasury bill auction due today, which will have a total amount of Rs. 120 billion on offer, an increase of Rs. 48 billion over the previous week. This will consist of Rs. 43 billion on the 91-day maturity and Rs. 60 billion on the 182-day and Rs. 65 billion on the 364-day maturity.

For reference, at the weekly Treasury bill auction conducted last Wednesday (27 December), weighted average rates declined across all three maturities for the 3rd consecutive week. As such rates were seen continuing on a downward trajectory with a reduction in yields observed on at least one tenor over the last 7 weeks. Accordingly, the weighted average rates on the 91-day tenor dropped by 04 basis points to 8.62%, the 182-day tenor by 04 basis points to 8.77% and the 364-day tenor by 06 basis point to 8.96%. Total bids received exceeded the offered amount by 2.13 times, and the entire Rs. 120 billion on offer was successfully raised at the 1st phase in competitive bidding. An additional amount of Rs. 12 billion was raised at the 2nd phase, being the maximum aggregate amount offered, out of a total market subscription of Rs. 63 billion.

On the inflation front, the Colombo Consumer Price Index - CCPI (Base: 2021=100) for the month of December 2024 was recorded at - 1.70% on a year-on-year basis as against - 2.10% recorded in November 2024. This marked the 4th consecutive month that the index had recorded negative inflation.

The total secondary market Treasury bond/bill transacted volume for 30 December was Rs. 12.36 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.00% and 8.11% respectively yesterday. The DOD injected liquidity via a 7-day term reverse repo auction amounting to Rs. 20 billion at the weighted average rate of 8.15%. The net liquidity surplus stood at Rs. 168.11 billion yesterday. Rs. 6.19 billion was withdrawn from Central Banks SLFR (Standing Lending Facility Rate) of 8.50%, while an amount of Rs. 194.30 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 7.50%.

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating to Rs. 293.25/293.75, subsequent to trading at a low of 293.50 and a high of 292.55, against its previous day’s closing level of Rs. 292.55/292.75.

The total USD/LKR traded volume for 30 December was $ 38.63 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)