Thursday Feb 26, 2026

Thursday Feb 26, 2026

Monday, 26 August 2024 02:22 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

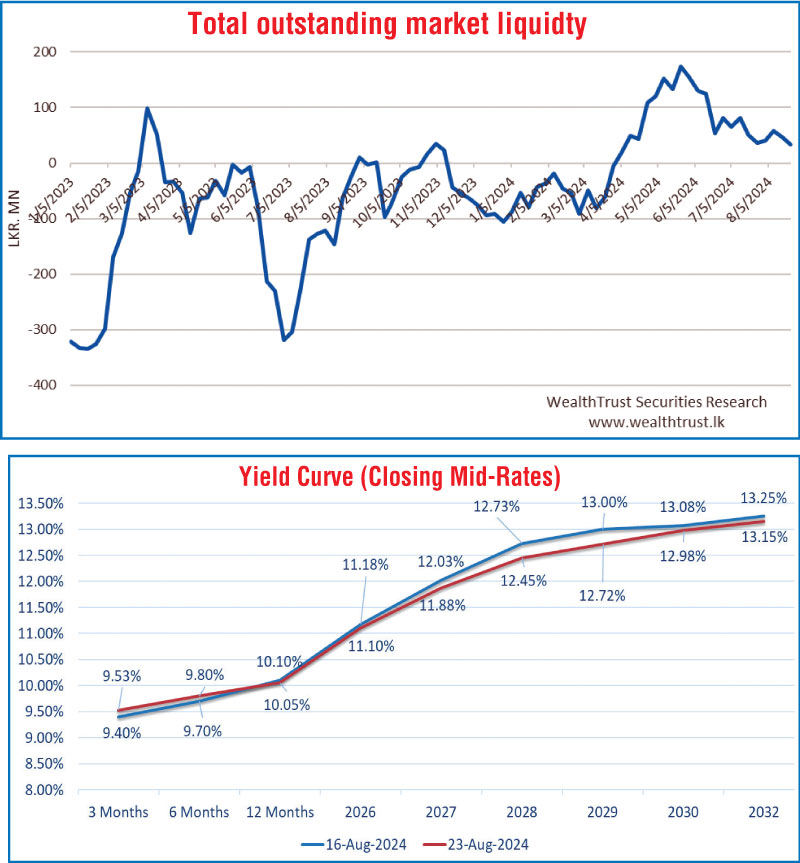

The secondary bond market last week started off slow, but quickly changed gears as renewed enthusiasm sparked a fresh wave of buying interest. This led to the market rallying, with rates dropping on the back of increased activity and healthy transaction volumes. This marked the second week where rates were seen declining, indicating a recovery after rates reached elevated levels due to political uncertainties and a trend of rising yields at recent primary T-bond auctions.

The secondary bond market last week started off slow, but quickly changed gears as renewed enthusiasm sparked a fresh wave of buying interest. This led to the market rallying, with rates dropping on the back of increased activity and healthy transaction volumes. This marked the second week where rates were seen declining, indicating a recovery after rates reached elevated levels due to political uncertainties and a trend of rising yields at recent primary T-bond auctions.

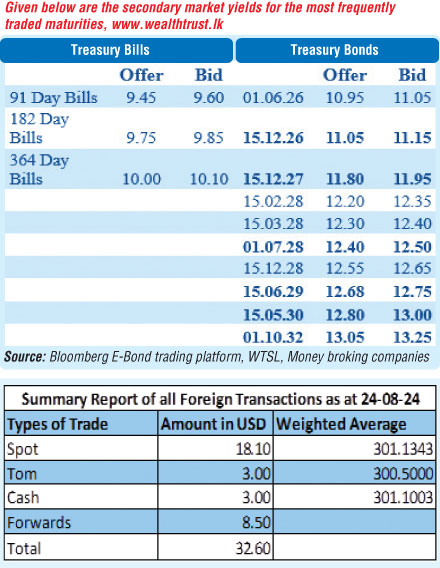

Accordingly, the 01.02.26, 01.06.26 and 15.12.26 maturities were seen trading at the rates of 10.50%, 11.10% to 11.00% and 11.10% respectively. The 2028 tenors experienced significant buying, with yields on the 15.03.28, 01.07.28, and 15.12.28 maturities declining from 12.60% to 12.35%, 12.70% to 12.42%, and 12.85% to 12.60%, respectively, over the course of the week. The yield on 15.06.29 maturity declined steeply from an intraweek high of 13.00% to a fresh low of 12.70%, also on the back of strong demand. Additionally, trades were observed on the medium tenor 15.05.30 down from 13.10% to 13.00%.

As a result, at the close of the week, the yield curve was observed flattening overall and in particular registering a downward shift on the T-bond section.

These market developments come ahead of a Rs. 30 billion Treasury bond auction scheduled for this Thursday, 29 August, comprised of four-year and six-year tenors.

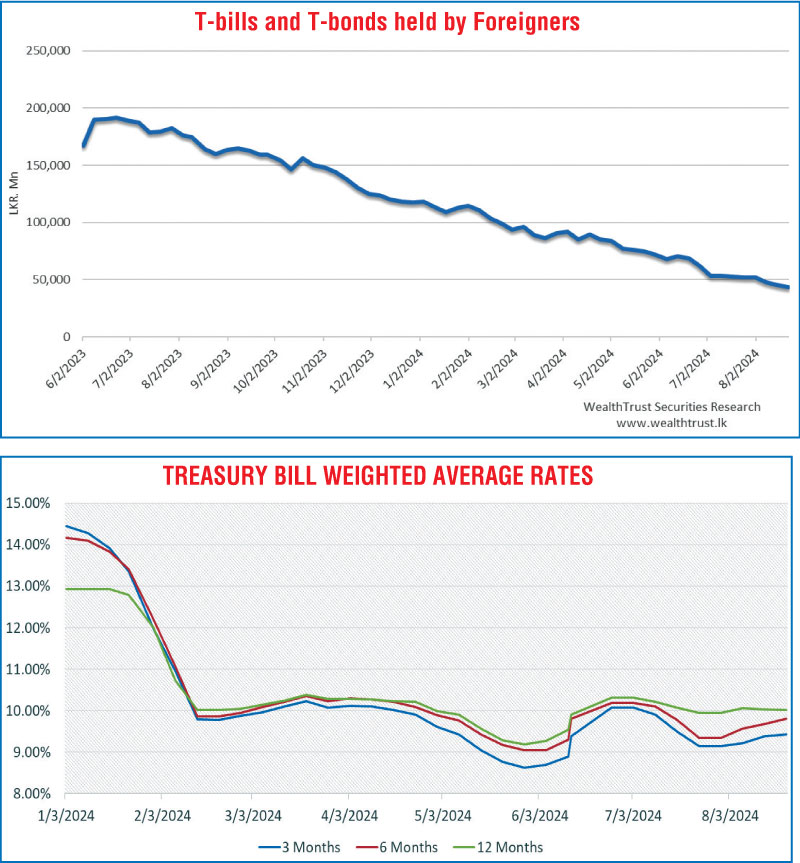

The weekly Treasury bill auction conducted last Wednesday, exhibited mixed results while the overall outcome was positive in relation to the rest of the yield curve. The weighted average yields on the shorter tenor securities were seen increasing for the second consecutive week. Accordingly, the rate on the 91-day tenor increased by 03 basis points to 9.42% and the 182-day tenor by 12 basis points to 9.80%. In contrast, the 364-day tenor saw its weighted average dip marginally by 02 basis points to 10.01%, declining for the second week. Despite these varied outcomes, the entire Rs. 120.00 billion on offer was raised at the 1st phase. The total bids received exceeded the offered amount by 1.94 times.

The daily secondary market Treasury bond/bill transacted volumes for the first three days of the week averaged at Rs. 12.81 billion.

The foreign holding in rupee Treasuries continued to steadily decline, recording a net outflow for the sixth straight week, to the tune of Rs. 1.59 billion for the week ending 22nd August 2024. As a result, the overall holding stood at Rs. 43.53 billion.

In money markets, the total outstanding liquidity surplus decreased to Rs. 33.979 billion by the week ending 23 August from its previous week’s surplus of Rs. 46.11 billion. The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of overnight reverse repo auctions and a 7-day term reverse repo auction at weighted average rates of 8.54% and 9.09% respectively. The weighted average interest rate on call money and repo ranged between 8.57% to 8.61% and 8.71% to 8.73% respectively.

The Central Bank of Sri Lankas (CBSL) holding of Government Securities was seen declining to Rs. 2,555.62 billion as against the previous week’s level of Rs. 2,575.62 billion.

Despite significant volatility the during the week the USD/LKR rate closed at Rs. 299.70/300.00, subsequent to trading at a high of Rs. 298.90 and a low of Rs. 301.50, depreciating in comparison to its previous week’s closing level of Rs. 299.00/299.10.

The daily USD/LKR average traded volume for the first four trading days of the week stood at a healthy $ 44.38 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)