Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 25 September 2024 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Secondary Bond Market yesterday saw sustained bullish momentum following the conclusion of the Presidential Election and continued to rally. Aggressive buying interest drove yields to fresh lows, supported by robust market activity and transaction volumes.

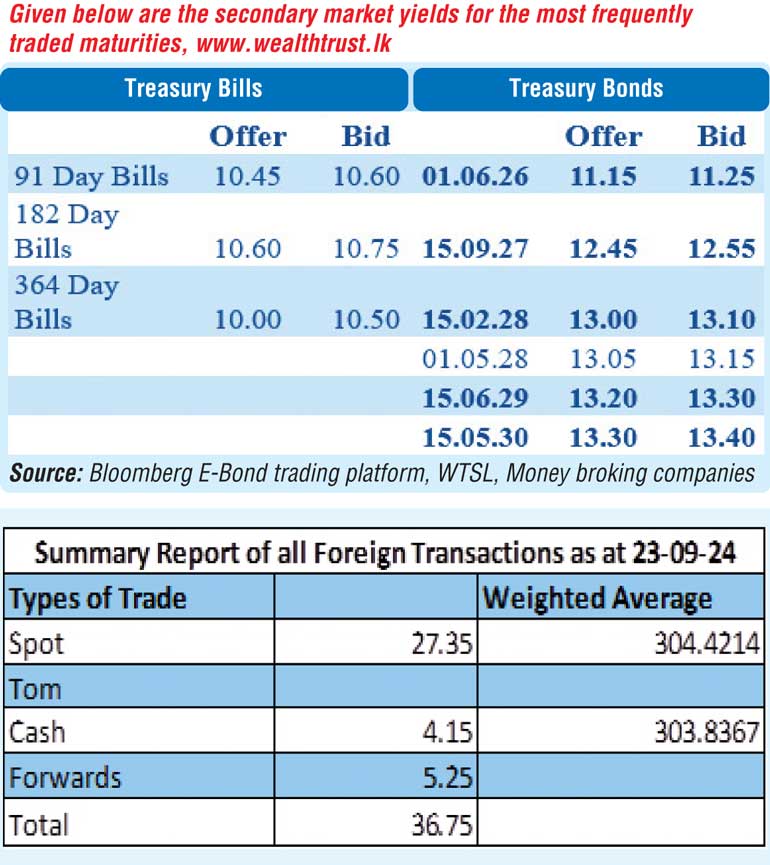

Accordingly, yields on the 2028 tenors, specifically the liquid 15.02.28 and the 01.05.28 maturities dropped to an intraday low of 13.05%, down from an intraday high of 13.25%, driven by strong demand. Similarly, the shorter tenors 01.06.26, traded lower, ranging down from 11.30% to 11.20%. The 01.05.27 and 15.09.27 maturities saw yields decline from 12.60% to 12.50%. The yield on the popular 15.06.29 maturity declined from 13.60% to 13.20% intraday, with sizeable volumes transacted. Additionally, trades were observed on the 15.05.30 maturity trading down from an intraday high of 13.65% to a low of 13.40%.

This coincided with the news that Moody’s Rating agency in a statement said that it does not expect significant disruption to Sri Lanka’s reform agenda or macroeconomic policies following the presidential election. As such, the statement opines that they do not see significant shifts in ongoing debt restructuring and structural adjustments under Sri Lanka’s International Monetary Fund loan program. However, the issuer comment from the rating agency states: credit risks are expected to be elevated for some time as “some policies are likely to be reprioritized amid challenges in maintaining fiscal consolidation”.

Meanwhile, the secondary bill market yesterday saw December 2024 (approx. 3 months) and March 2025 maturities (approx. 6 months) changing hands at the rate of 10.50% and 10.75% respectively.

This comes ahead of the Treasury bill auction due today, which will have a total amount of Rs. 120 billion on offer, a decrease of Rs. 55 billion over its previous week. This will consist of Rs. 70 billion on the 91-day, Rs. 40 billion 182-day and Rs. 10 billion on the 364-day maturity.

For context at the last Treasury bill auction conducted last Wednesday (18 Sep), rates continued on an upward trajectory. Accordingly, the rate on the 91-day tenor rose steeply by 50 basis points to 10.49% and the 182-day tenor by 52 basis points to 10.76%. However, the weighted average rate on the 364-day tenor bucked the trend and remained unchanged at 10.07%. As such rates across all three tenors were seen crossing 10.00% for the first time since April this year.

The total secondary market Treasury bond/bill transacted volume for 23 September was Rs. 14.35 billion. In money markets, the weighted average rates on overnight call money and Repo stood at 8.62% and 8.92% respectively. The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight repo auction for Rs. 40.00 billion at a weighted average rate of 8.64%.

The net liquidity surplus stood at Rs. 45.73 yesterday. An amount of Rs. 11.29 billion was withdrawn from the Central Banks SLFR (Standing Lending Facility Rate) of 9.25% as against an amount of Rs. 97.02 billion deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.25%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day considerably higher at Rs. 303.00/303.15 against its previous day’s closing level of Rs. 304.25/304.75.

The total USD/LKR traded volume for 23 September was

$ 36.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)