Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 29 January 2024 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market saw frenzied buying interest during the shortened trading week ending 26 January, pushing yields down drastically, carrying over the bullish sentiment from the previous week.

The secondary bond market saw frenzied buying interest during the shortened trading week ending 26 January, pushing yields down drastically, carrying over the bullish sentiment from the previous week.

Activity surged during the week and sizable volumes were transacted while trading was centred predominantly on the short to medium durations, with particular emphasis on 2026, 2027 and 2028 maturities.

This was spurred by the impressive outcome at last week’s Treasury bill auction. In addition, this was against the backdrop of an outright purchase auction by the Domestic Operations Department (DOD) of CBSL on the 01.06.26 and 01.05.27 maturities, last Friday. Rs. 2.00 billion was taken up at a weighted average rate of 13.20% on the 01.06.26 maturity, while all bids were rejected on the 01.05.27 maturity.

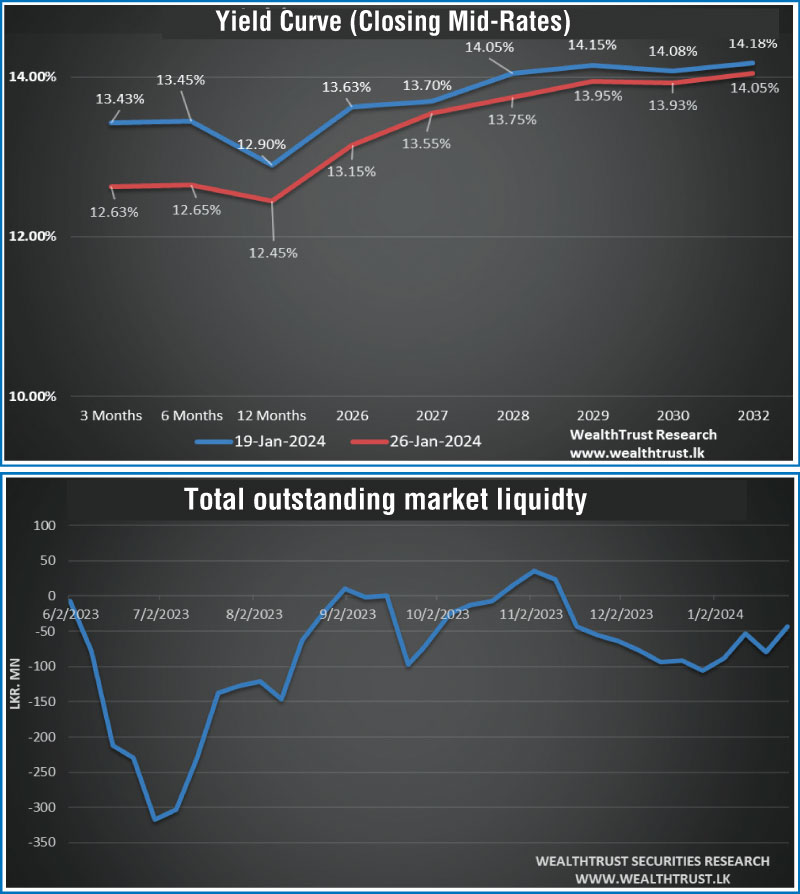

Accordingly, the maturities of three 26’s (01.02.26, 01.06.26 and 01.08.26), two 27’s (01.05.27 and 15.09.27), four 28’s (of 15.03.28, 01.05.28, 01.07.28 and 15.12.28) and 15.05.30 were seen trading within the range of intraweek high and low levels of 13.70% to 13.10%, 13.90% to 13.45%, 14.05% to 13.65%, 14.10% to 13.89% respectively, on the back of considerable activity. The close of the week saw some profit taking that saw yields marginally edge up, however still well below its week’s opening highs across all liquid maturities. As such, the yield curve was seen shifting down and steepening upwards across maturities, on a week-on-week basis.

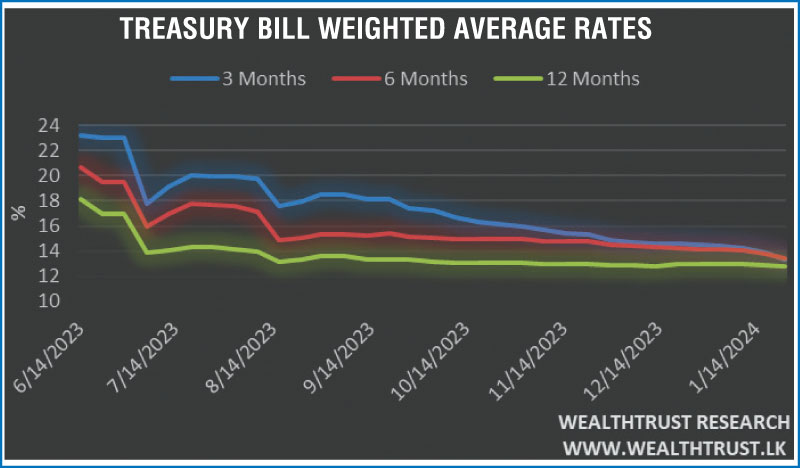

At last week’s Treasury bill auction, the weighted average yields dropped across the board. The heavy demand witnessed on the 91-day and 182-day maturities led to the steep declines, with bids exceeding the offered amounts. The 91-day maturity reduced by a drastic 56 basis points to 13.35%, which saw it drop below the 182-day maturity level for the first time in over a year, while the 182-day maturity also dropped by 42 basis points to 13.41%. The 364-day bill also reduced by 14 basis points to 12.78%, but went undersubscribed. The auction overall, at the 1st phase saw total bids received exceeding the total offered amount by 2.78 times. The entire offered amount of Rs. 130.00 billion was raised at the 1st phase, while an additional amount of Rs. 32.50 billion was raised at the 2nd phase only on the 364-day maturity.

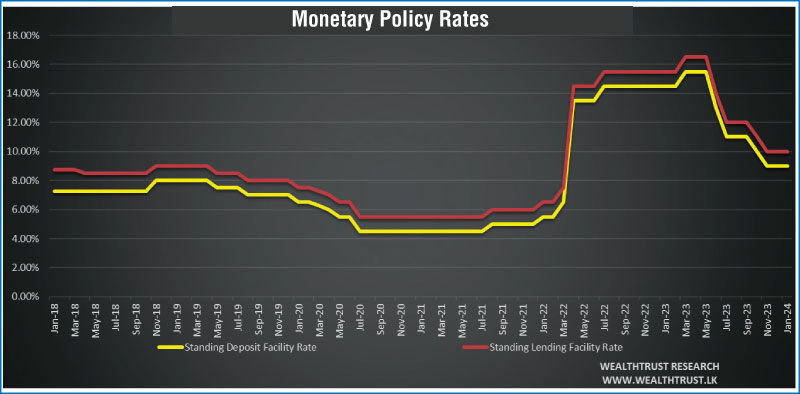

Furthermore, last Tuesday (23 January) saw the inaugural Monetary Policy announcement of 2024. The Monetary Policy Board of the Central Bank of Sri Lanka decided to maintain the Standing Deposit Facility Rate (SDFR) at 9% and the Standing Lending Facility Rate (SLFR) at 10%. The press release was cited as saying the decision was based on an assessment of domestic and international macroeconomic factors, aimed to maintain inflation at the targeted 5% over the medium term while supporting economic growth. Despite recognising potential inflationary pressures from recent taxation and supply-side factors, the Board concluded that these developments would not significantly impact the medium-term inflation outlook.

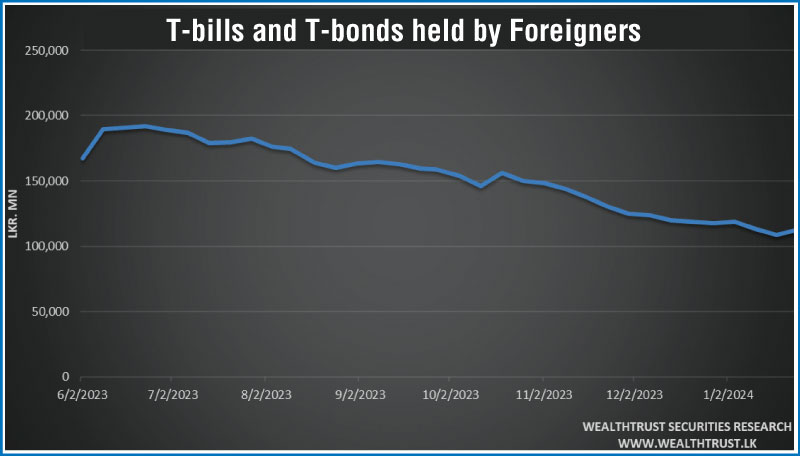

On the inflation front, the National Consumer Price Index – NCPI (Base: 2021=100) or National inflation for the month of December 2023 was recorded at 4.20% on its point to point as against 2.80% recorded in November 2023. The foreign holding in Rupee bonds and bills recorded a net inflow after two consecutive weeks of outflows. As such, the week ending 25 January 2024 saw an inflow of Rs. 3.64 billion, while the total holding increased to Rs. 112.58 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first three days of the week averaged at Rs. 41,224 billion.

In money markets, the total outstanding liquidity deficit decreased to Rs. 43.15 billion by the week ending 26 January from its previous week’s deficit of Rs. 79.27 billion. The Domestic Operations Department (DOD) of the Central Bank continued to inject liquidity during the week by way of overnight and term reverse repo auctions at weighted average yields ranging from 9.14% to 10.75%.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,753.62 billion, unchanged against its previous week’s level.

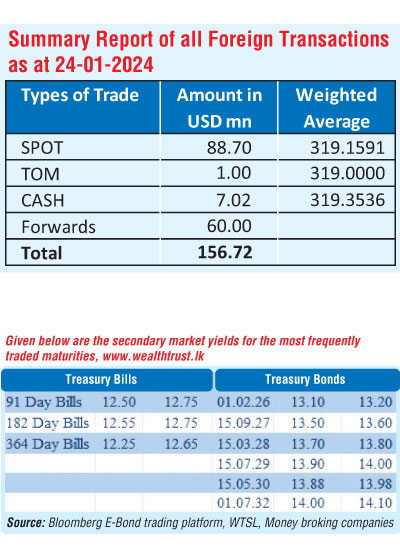

In the forex market, the USD/LKR rate on spot contracts was seen appreciating during the week to close at Rs. 317.50/317.80. This is as against its previous week’s closing level of Rs. 320.20/320.40 and subsequent to trading at a high of Rs. 320.25 and a low of Rs. 317.40.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 105.47 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)