Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 18 December 2023 00:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market witnessed a rally as bullish buying interest in the primary and secondary markets drove yields down during the trading week ending 15 December.

The secondary bond market witnessed a rally as bullish buying interest in the primary and secondary markets drove yields down during the trading week ending 15 December.

Activity continued to be robust and centred mainly on the short end of the yield curve from durations of 2025 to 2028. This was against the backdrop of the news that the IMF Board completed its first review under the 48-month Extended Fund Facility program with Sri Lanka, providing the country with access to a further SDR 254 million (about $ 337 million) to support its economic policies and reforms. In addition, it was reported that Sri Lanka had witnessed positive GDP growth in the third quarter of 2023 of 1.6%, a significant improvement over the first and second quarters which registered negative growth of 11.50% and 3.1% respectively on a year-on-year basis.

Accordingly, the yields on the maturities of the two 25’s (01.06.25 and 01.07.25), three 26’s (15.05.26, 01.06.26 and 01.08.26), three 27’s (15.01.27, 01.05.27 and 15.09.27) and three 28’s (01.05.28 and 01.07.28, 15.12.28) were seen dipping to intraweek lows of 13.45%, 13.80%, 13.85% and 14.00% respectively against its week opening highs of 13.53%, 14.15%, 14.22% and 14.25%. In addition, on the medium end of the curve, 15.05.30 and 01.07.32 maturities changed hands at 14.25% to 14.00% and 14.30% to 14.17% respectively as well, leading to a continued bunching up of the yield curve while reflecting a parallel shift down.

The Treasury bond and bill auctions conducted last week recorded positive outcomes. The bond auctions on Tuesday 12 December saw the amounts of Rs. 50 and 80 billion on the short tenures of 2026 and 2028 been fully taken up at its 1st phase at weighted averages of 14.07% and 14.32% respectively. However, no bids were accepted for the Rs. 30 billion on the medium tenor 15 March 2031 maturity. As such Rs. 130 billion of the Rs. 160 billion on offer was raised at the 1st phase, with an additional amount of Rs. 26 billion raised on the 2026 and 2028 maturities at the Direct Issuance Window at the respective weighted averages.

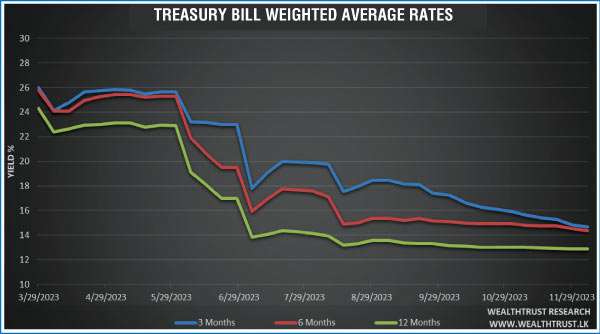

Meanwhile last week’s Treasury bill auction conducted on Wednesday 13 December, saw the largest ever offered amount in Sri Lanka’s history, of Rs. 220 billion. The Treasury bills continued to receive a bullish response as weighted average yields decreased across the board for a third consecutive week. The 91-day and 182-day tenors continued to see the most demand, which led to its weighted average yields declining by 8 basis points and 9 basis points respectively to 14.59% and 14.29%. The 364-day bills also declined by 5 basis points to record a weighted average of 12.83. The historically high total offered amount of Rs. 220 billion saw Rs. 216 billion been raised at the 1st phase of the auction, with an additional amount of Rs. 0.24 raised on the 364-day tenor at the 2nd phase.

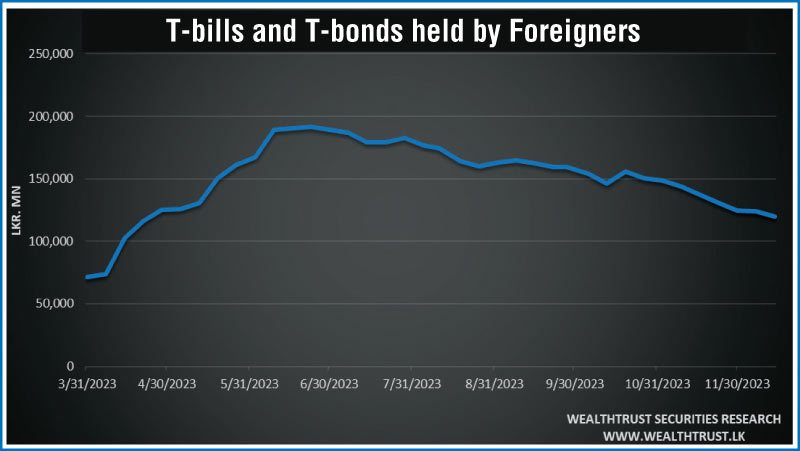

The foreign holding in Rupee bonds and bills continued to decline for an eighth consecutive week, with a net outflow of Rs. 3.97 billion, bringing the total holding to Rs. 119.86 billion as at 14 December.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 50.01 billion.

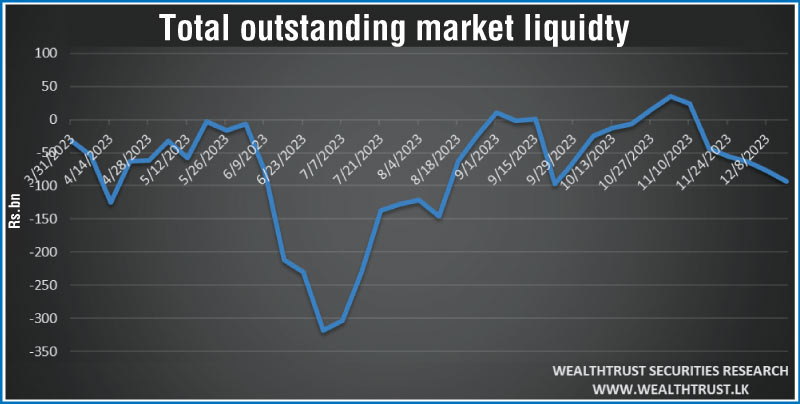

In money markets, the total outstanding liquidity deficit increased to Rs. 93.78 billion by the week ending 16 December from its previous week’s deficit of Rs. 77.19 billion. The Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight and term reverse repo auctions at weighted average yields ranging from 9.06% to 10.89%.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,739.35 billion, unchanged against its previous week’s level.

In the forex market, the USD/LKR rate on spot contracts was seen appreciating slightly during the week to close at Rs. 326.90/327.10. This is as against its previous week’s closing level of Rs. 327.00/327.30 and subsequent to trading at a high of Rs. 326.72 and a low of Rs. 327.25.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 46.45 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)