Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 4 December 2023 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market during the trading week ending 1 December saw yields decline on the back of aggressive buying interest with sizeable volumes transacted. This was driven by the impressive outcomes at the two auctions, the market moving news that the ADB was looking to provide $ 400 million in funding and that Sri Lanka’s official creditor committee has reached an agreement to restructure external debt of around $ 5.9 billion, that is expected to facilitate approval by the IMF Executive Board of the first review of Sri Lanka’s program allowing for the next tranche of about $330 million in financing as well.

The secondary bond market during the trading week ending 1 December saw yields decline on the back of aggressive buying interest with sizeable volumes transacted. This was driven by the impressive outcomes at the two auctions, the market moving news that the ADB was looking to provide $ 400 million in funding and that Sri Lanka’s official creditor committee has reached an agreement to restructure external debt of around $ 5.9 billion, that is expected to facilitate approval by the IMF Executive Board of the first review of Sri Lanka’s program allowing for the next tranche of about $330 million in financing as well.

Activity centered mainly on the very short end of the yield curve from durations of 2024 to 2028. Accordingly, the yields on the maturities of the two 24’s (01.05.24 and 15.11.24), two 25’s (01.06.25 and 01.07.25), three 26’s (15.05.26,01.06.26 and 01.08.26), three 27’s (15.01.27,01.05.27 and 15.09.27) and two 28’s (01.05.28 and 01.07.28) were seen dipping to weekly lows of 14.00%, 13.85% each, 14.05%, 14.16% respectively from its weeks opening highs of 14.65%, 14.05%, 14.50%, 14.60% and 14.57%. In addition, on the medium end of the curve, the 01.07.29 and 01.07.32 maturities changed hands at levels of 14.25% and 14.40% to 14.20% respectively as well, which translated to a parallel shift down of the yield curve.

In secondary market bills, January, March and May 2024 maturities were seen changing hands at the end of the week at 14.00% to 13.25%, 14.30% to 14.25% and 14.25% to 14.00% respectively.

The Treasury bond auctions conducted last Tuesday, 28 November recorded a robust outcome as the entire Rs 45 billion on offer was fully subscribed at its 1st and 2nd phases. The 15 January 2027 maturity that recorded a weighted average 14.48% and the 1 September 2028 maturity recorded a weighted average yield of 14.52%. A further Rs 4.50 billion was raised on the 1 September 2028 maturity at the direct issuance window as well.

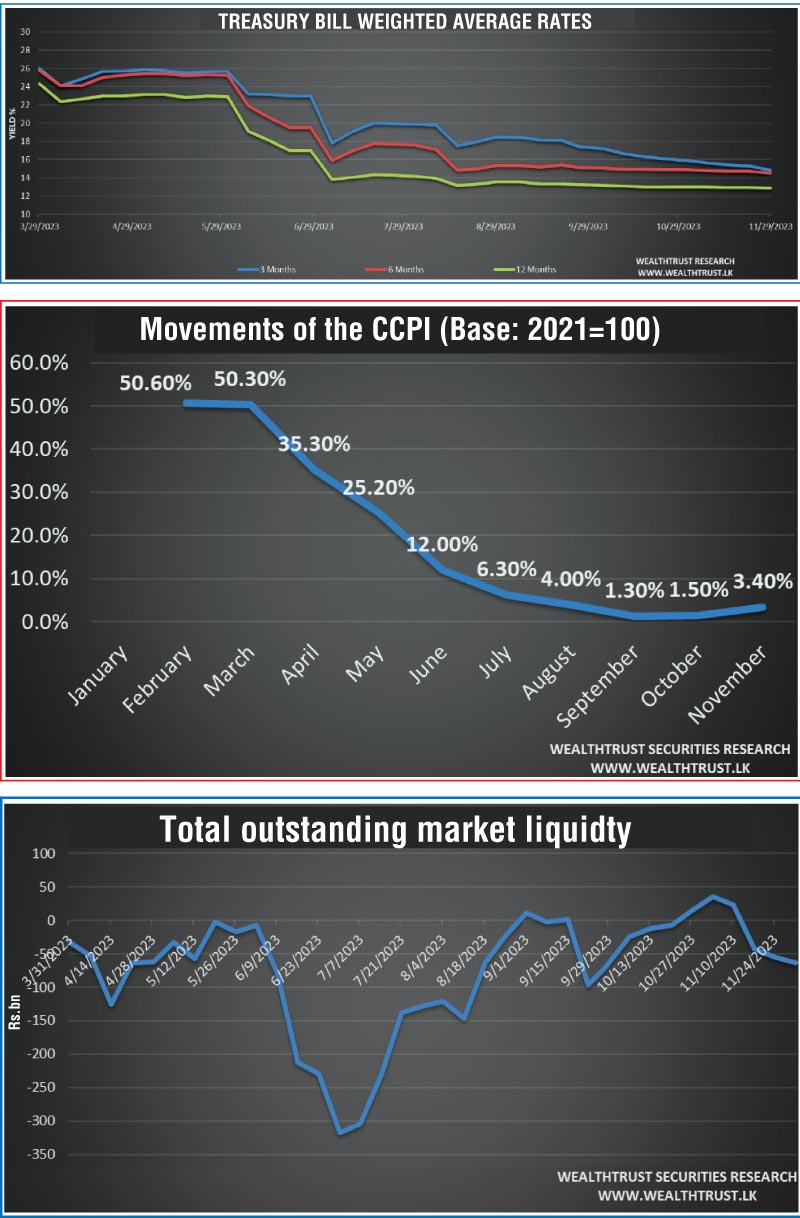

Furthermore, last week’s Treasury Bill received a positive response once again, as weighted average yields decreased across the board. The 91-day and 182-day bills saw the most demand, which led to its weighted average yield declining by 43 basis points and 23 basis points respectively to 14.86% and 14.52%. The 364-day bills also declined by 05 basis points to record a weighted average of 12.89%. The total bids received was 1.82 times greater than the total offered amount. The entire offered amount of Rs. 160 billion was raised at the 1st phase of the auction, with an additional Rs. 30.97 billion raised at the 2nd phase.

Meanwhile, the Colombo Consumer Price Index -CCPI (Base: 2021=100) or inflation for the month of November was recorded at 3.40% on its point to point as against 1.50% recorded in October. This is the second straight month that inflation has accelerated, albeit marginally. Since peaking in February 2023 at 50.60%, inflation was seen on a steady and rapid disinflation path, reaching the current significantly moderated levels compared to a year ago.

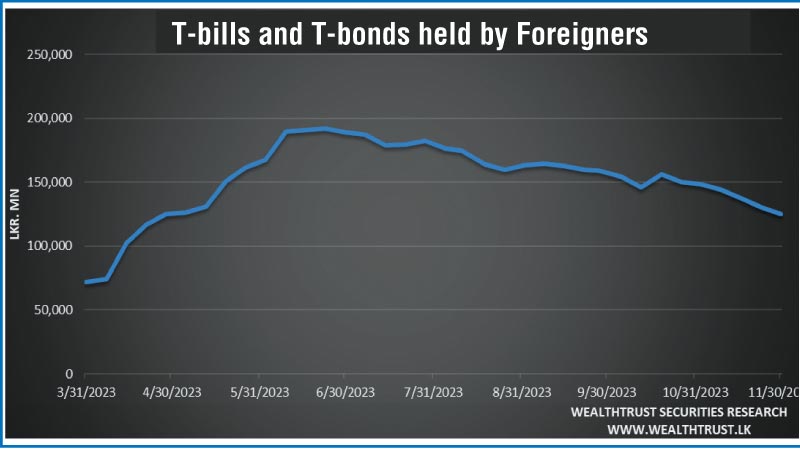

The foreign holding in Rupee bonds and bills continued to decline for a sixth consecutive week, with a net outflow of Rs 5.72 billion, bringing the total holding to Rs 124.88 billion as at 30 November, 2023.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs.29.32 billion.

In money markets, the total outstanding liquidity deficit increased marginally to Rs 63.61 billion by the week ending 1 December from its previous week’s deficit of Rs 55.23 billion. The Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight Reverse repo auctions at weighted average yields ranging from 9.15% to 9.31%.

In money markets, the total outstanding liquidity deficit increased marginally to Rs 63.61 billion by the week ending 1 December from its previous week’s deficit of Rs 55.23 billion. The Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight Reverse repo auctions at weighted average yields ranging from 9.15% to 9.31%.

The Central Bank of Sri Lanka’s (CBSL) holding of Gov. Security’s was registered at Rs. 2,759.35 billion, against its previous week’s level of Rs. 2,779.35 billion.

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating slightly during the week to close at Rs.328.00/328.10. This is as against its previous week’s closing level of Rs. 328.70/328.80, subsequent to trading at a high of Rs.327.80 and a low of Rs.329.25.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 78.74 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)