Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 14 November 2024 00:34 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

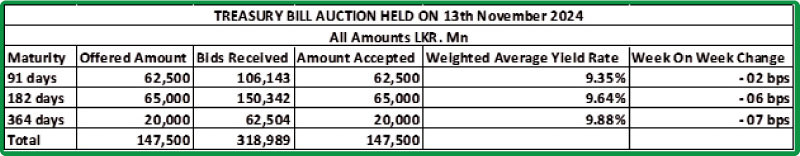

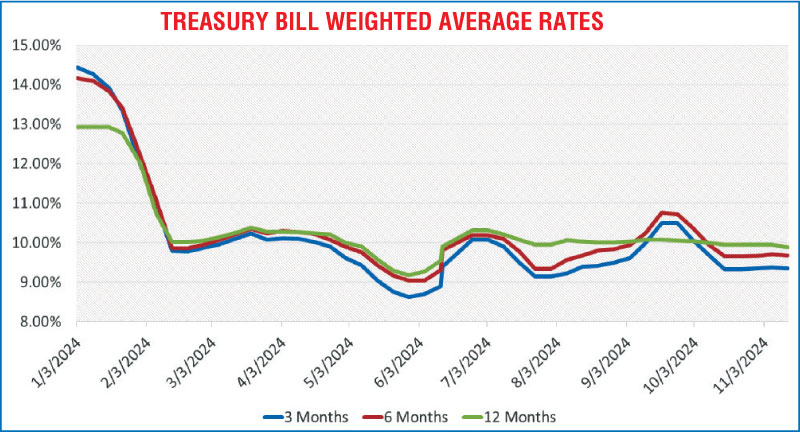

At the weekly Treasury bill auction conducted yesterday, weighted average rates were seen declining across the board for the first time in four weeks. This reversed the previous trend of yields creeping up on the shorter tenors over the past two consecutive weeks. Accordingly, the weighted average rates on the 91-day tenor decreased by 02 basis points to 9.35%, the 182-day tenor dropped by 06 basis points to 9.64% and the 364-day tenor declined by 07 basis points to 9.88%. The bulk or 86.35% of the funds raised were on the 91-day and 182-day maturities. Total bids received exceeded the offered amount by 2.16 times, and the entire Rs. 147.50 billion on offer was successfully raised at its 1st phase. This reflected the bullish outcome.

At the weekly Treasury bill auction conducted yesterday, weighted average rates were seen declining across the board for the first time in four weeks. This reversed the previous trend of yields creeping up on the shorter tenors over the past two consecutive weeks. Accordingly, the weighted average rates on the 91-day tenor decreased by 02 basis points to 9.35%, the 182-day tenor dropped by 06 basis points to 9.64% and the 364-day tenor declined by 07 basis points to 9.88%. The bulk or 86.35% of the funds raised were on the 91-day and 182-day maturities. Total bids received exceeded the offered amount by 2.16 times, and the entire Rs. 147.50 billion on offer was successfully raised at its 1st phase. This reflected the bullish outcome.

The 2nd phase of subscription for the auction will be opened for all 3 tenors at the weighted average rates until close of business of the day prior to settlement (i.e., 4.00 p.m. on 14.11.2024).

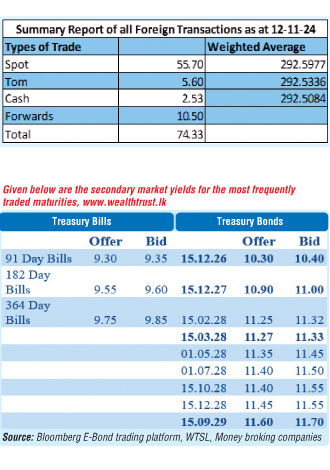

Meanwhile, the Secondary bond market yesterday extended its bull run to a third straight session. Yields continued to drop down further, to hit fresh lows driven by aggressive buying interest. This was on the back of heightened market activity and transaction volumes, with trades observed across the yield curve. As a result, two-way quotes were seen closing markedly down, despite slight profit taking seen at the tail end of the day.

The shorter tenor 01.06.26 and 15.01.27 maturities were seen trading at the rate of 10.15% and 10.35% respectively. The rate on the 01.05.27 and the 15.12.27 maturities were seen declining from intraday highs to lows of 10.85% - 10.80% and 11.15% - 10.90% respectively. The yield on the 15.02.28 and 15.03.28 maturities declined from an intraday high of 11.40% to a low 11.14%. The other 2028 tenors also followed suit. The recently auctioned 01.05.28 maturity traded down the range of 11.45%-11.23% intraday, a steep decline from the 11.62% weighted average that the bond was issued at just the day prior. The 01.10.28 and 15.12.28 maturities also saw yields decline from 11.50% -11.35% and 11.55% - 11.40% respectively. The 15.06.29 and 15.09.29 maturities also saw a steep drop from intraday highs to lows of 11.75%-11.50%. The medium tenor 15.05.31 and 01.10.32 maturities saw rates decline down the ranges of 12.25%-12.08% and 12.15%-11.95% respectively.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.55% and 8.69% respectively.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight reverse repo auction for Rs. 20.00 billion at the weighted average rate of 8.54% respectively.

The net liquidity surplus stood at Rs. 169.59 billion yesterday. Rs. 1.80 billion was withdrawn from the Central Banks SLFR (Standing Lending Facility Rate) of 9.25% as against an amount of Rs. 191.39 billion deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.25%.

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed the day appreciating to Rs. 292.20/292.30 against its previous day’s closing level of Rs. 292.45/292.55.

The total USD/LKR traded volume for 12 November was $ 74.33 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money

broking companies)