Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 23 August 2021 00:05 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

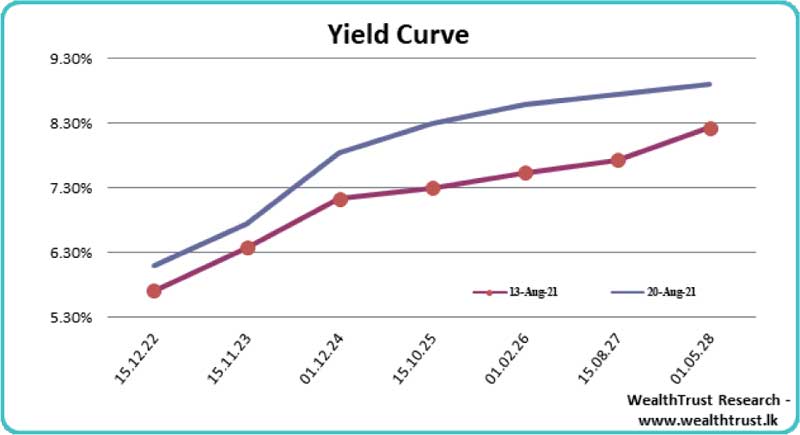

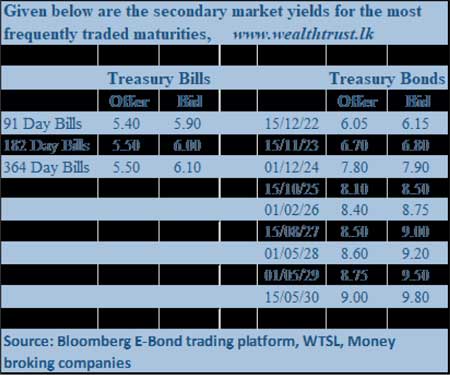

The secondary market bond yields increased across the board during the week ending 20 August, driven by the outcome of the sixth monetary policy announcement for the year, at where the Central Bank of Sri Lanka increased its policy rates by 50 basis point each to 5.00% and 6.00% on its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) respectively. In addition, it increased the Statutory Reserve Requirement by 200 basis points to 4.00% as well.

The secondary market bond yields increased across the board during the week ending 20 August, driven by the outcome of the sixth monetary policy announcement for the year, at where the Central Bank of Sri Lanka increased its policy rates by 50 basis point each to 5.00% and 6.00% on its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) respectively. In addition, it increased the Statutory Reserve Requirement by 200 basis points to 4.00% as well.

Bond market activity focused mainly on the liquid 01.12.24 maturity as its yield was seen increasing steeply by 90 basis points to register over a 14-month high of 8.02% against its previous weeks closing level of 7.10/15.

In addition, a limited amount of activity was witnessed of the 2023 maturities (i.e. 15.07.23 and 15.11.23) with its yields hitting highs of 6.43% and 6.90% respectively against its previous weeks closing levels of 6.02/10 and 6.35/40. However, buying interest at these levels saw yields dip marginally once again by the end of the week but went on to reflect a parallel shift upwards of the yield curve on a week on week basis.

The weekly Treasury bill auction which was conducted prior to the monetary policy announcement, saw its subscription level decrease to 45.16% of its total offered amount while the weighted average rates on the 91 day and 182 day bills increased by 06 and 07 basis points respectively to 5.33% and 5.34%.

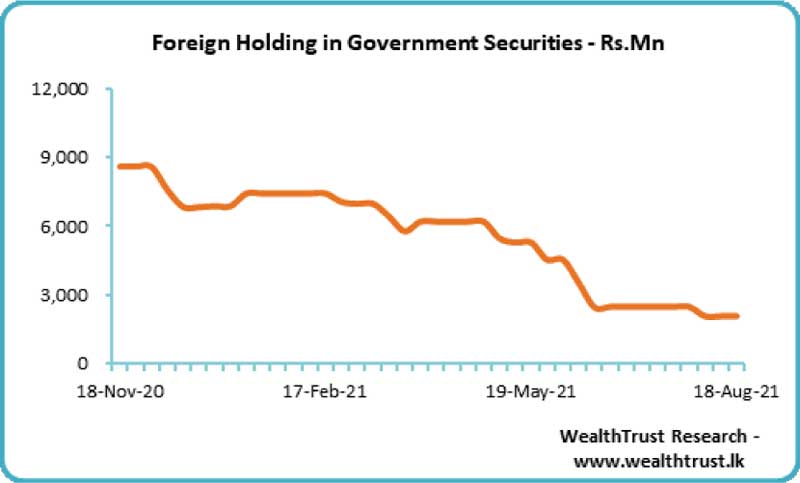

The foreign holding in rupee bonds remained steady for the second consecutive week at Rs. 2.087 billion for the week ending 18 August while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 6.67 billion.

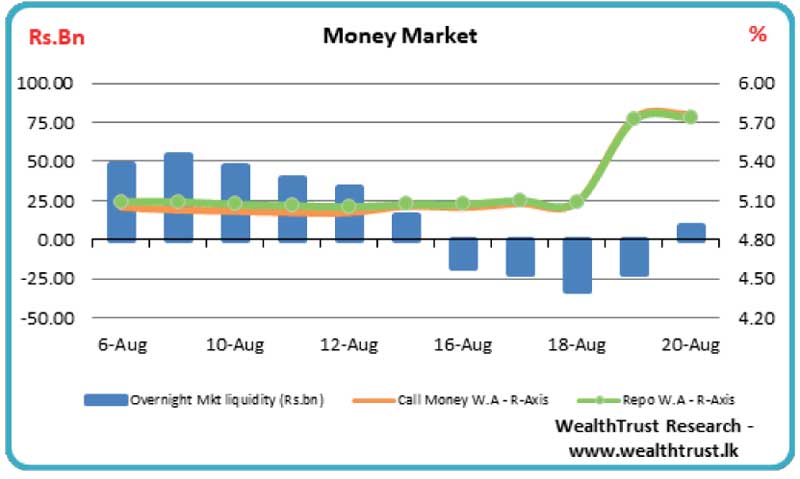

In the money market, the base rate increase resulted in weighted average rates on overnight call money and repo increase during the last two days of the week to average 5.75% and 5.73% respectively, as against its first three days of 5.07% and 5.09%.

The overnight liquidity in money markets fluctuated during the week from a deficit of Rs. 32.37 billion to a surplus of Rs. 9.15 billion by the end of the week. The CBSL’s holding of Government securities increased to Rs. 1,203.44 billion from its previous weeks Rs. 1,174.21 billion.

USD/LKR

The Forex market continued to remain inactive during the week.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 20.38 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)