Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 16 August 2024 00:16 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yesterday experienced a resurgence in buying interest which saw increased activity and yields decline marginally.

The secondary bond market yesterday experienced a resurgence in buying interest which saw increased activity and yields decline marginally.

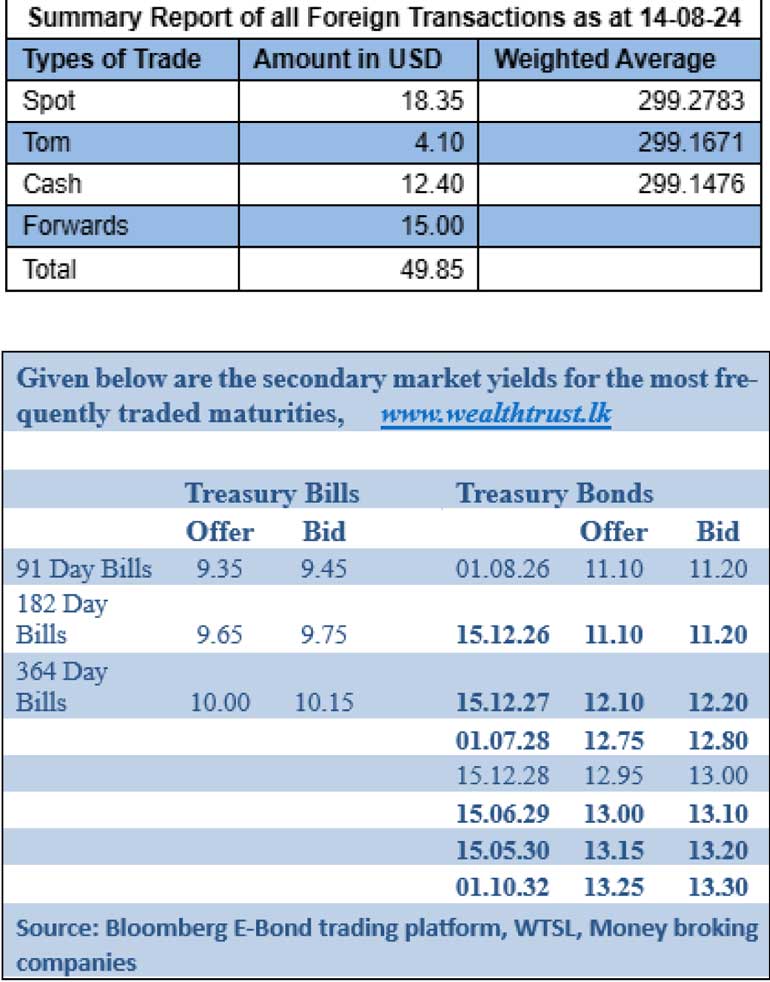

Accordingly, trades were observed on the 01.05.28 and 01.07.28 maturities at the rate of 12.80%, while the yield on the 15.12.28 was seen down from a high of 13.05% to a low of 12.98%. Similarly, the 15.06.29 maturity was seen declining from an intraday high of 13.15% to 13.05%. The 01.10.32 maturity was also observed trading from an intraday high of 13.36% to a low of 13.25%. However, the shorter tenors were seen closing broadly steady. The 01.02.26 traded at 10.70% and the 01.06.26 and 01.08.26 maturities were seen changing hands at the rates of 11.05% to 11.10%.

The total secondary market Treasury bond/bill transacted volume for 14 August was Rs. 51.80 billion.

In money markets, the weighted average rate on overnight call money was at 8.57% and repo was at 8.70%.

The net liquidity surplus stood at Rs. 90.46 billion yesterday as an amount of Rs. 122.03 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.25% against an amount of Rs. 11.57 billion been withdrawn from the Central Banks SLFR (Standing Lending Facility Rate) of 9.25%.

Further, the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight reverse repo auction for Rs. 20.00 billion at a weighted average rate of 8.60%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts appreciated further to close the day at Rs. 298.95/299.05 against its previous day’s closing level of Rs. 299.15/299.25.

The total USD/LKR traded volume for 14 August was $ 49.85 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)