Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 20 August 2024 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

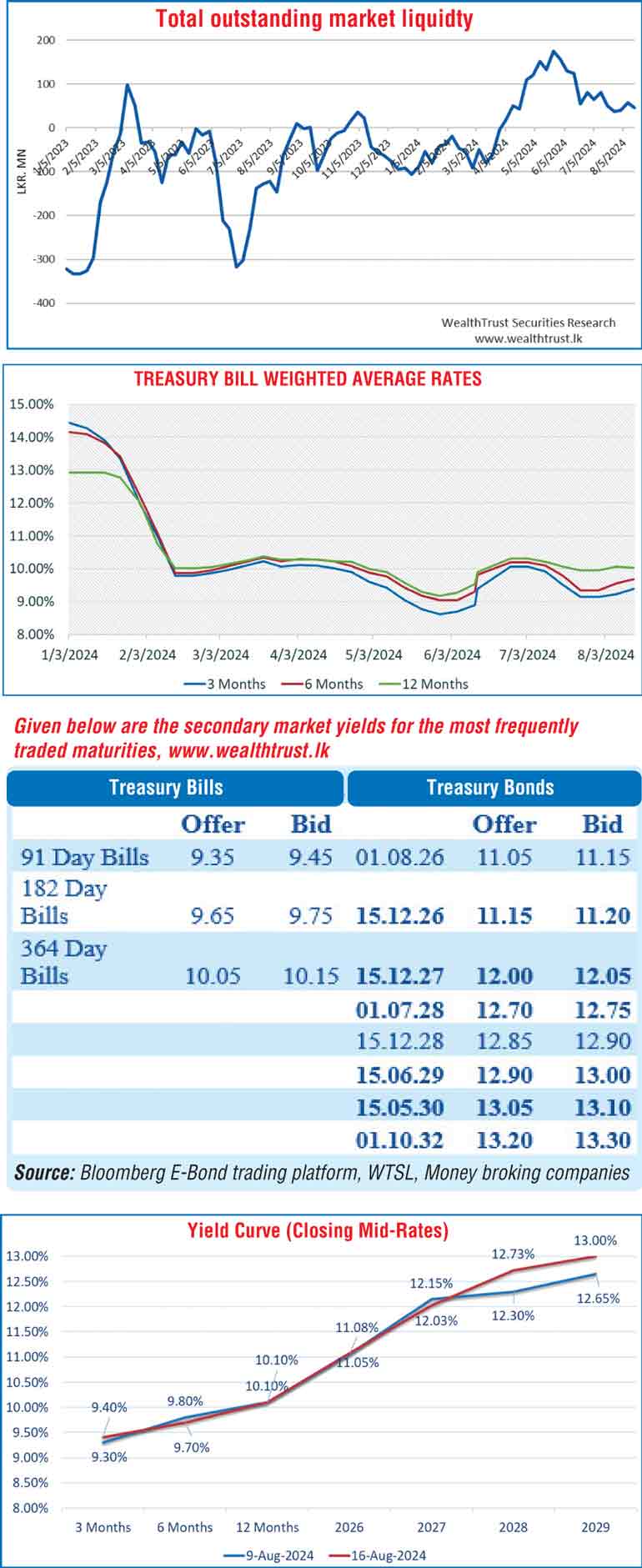

The secondary bond market during the week ending 16 August, started off on a subdued note ahead of the Treasury bond auctions, as market participants adopted a watchful approach. Following the bond auction, activity continued to be restrained with yields moving up further until midweek. However, towards the end of the week, a resurgence in buying interest saw an increase in activity, which curtailed further upward movement in rates and led to a slight recovery. Despite this, the short end of the yield curve (beyond 2027 tenors) was seen shifting up steeply, week on week, while the very short end of the yield curve (2026 to 2027 tenors) was seen holding broadly steady.

Accordingly, the shorter tenor 2026 durations were seen moving up to elevated levels, with trades observed on the 01.02.26, up from 10.45% to 10.70% and the 01.06.26 maturity, up from 10.80% to 11.05%. The 15.12.28 maturity was seen moving up to an intraweek high of 13.05% from an intraweek low of 12.70%, before settling at the rate of 12.85% at the close of the week. The 01.07.28 maturity also followed this pattern, moving up to an intraweek high of 12.80% before closing the week at the rate of 12.75%. Similarly, the yield on the 15.06.29 auction bond declined from highs of 13.15% to lows of 12.95% by the close of the week. In addition, maturities of 15.05.30 and 01.10.32 were seen dipping to intraweek lows of 13.05% and 13.25% respectively against its intraweek highs of 13.30% and 13.36%.

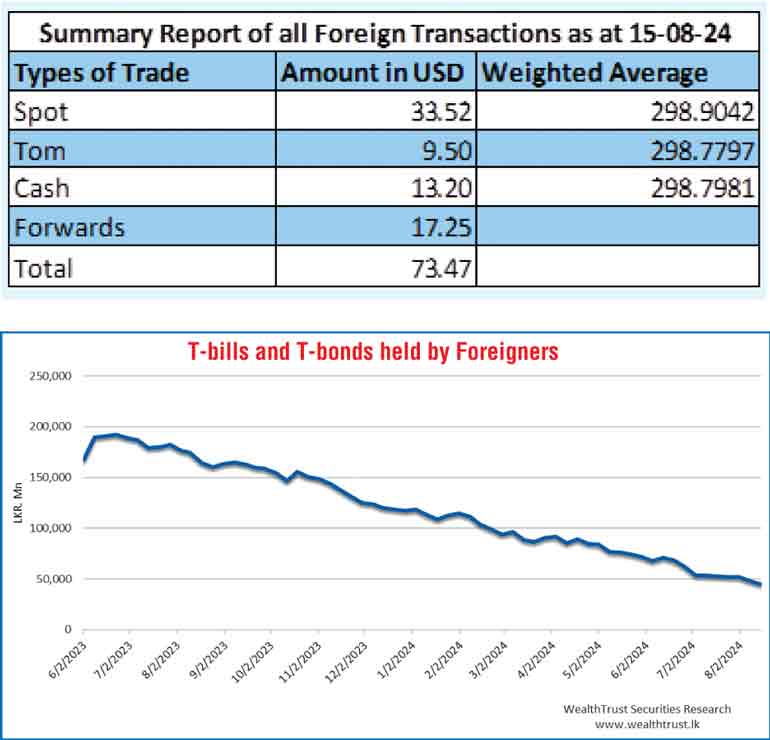

The renewed momentum was well supported by the continued positive trend in the Forex market, where the USD/LKR rate appreciated noticeably during the week, closing at Rs. 299.00/299.10, compared to the previous week’s closing level of Rs. 300.00/300.20, subsequent to trading at a high of Rs. 298.60 and a low of Rs. 300.00. The USD/LKR rate was reported at Rs. 306.00/306.20 as of 28 June 2024.

Furthermore, the Treasury bill auction conducted last week reflected a positive outcome overall, when compared against the rest of the yield curve. The 91-day tenor rate rose by 17 basis points to 9.39%, and the 182-day rate increased by 12 basis points to 9.68%, while the 364-day tenor saw a slight decline, with its rate dipping by 3 basis points to 10.03%. The auction was fully subscribed, raising the entire Rs 130.00 billion on offer in the first phase. The total bids received exceeded the offer by 1.87 times, with strong demand for the shorter tenors, which accounted for 84% of the accepted amount.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 20.67 billion while the daily USD/LKR average traded volume for the first four trading days of the week stood at a healthy $ 59.29 million.

Meanwhile, the Treasury bond auctions conducted last Tuesday (13/08/24) saw yields increase further, continuing the recent upward trend in both the secondary and primary markets. The new 15.06.2029 bond was issued at a weighted average yield of 12.98%, above the pre-auction rate of 12.65/80 on a similar maturity. An amount of Rs. 36.09 billion (80.20%) was raised at the first phase (in competitive bidding) and the remainder in subsequent phases, achieving full subscription. The 01.10.2032 bond achieved full subscription at the 1st phase and was issued at a weighted average yield of 13.25%, also exceeding market expectations. This marked the first time since January that a primary bond auction rate surpassed 13.00%. In conclusion, the round of auctions successfully raised the total Rs. 60 billion on offer in its entirety, with the total bids received to the total offered amount ratio standing at 1.72:1.

The foreign holding in rupee Treasuries continued to steadily decline, recording a net outflow for a fifth consecutive week, to the tune of Rs. 2.97 billion for the week ending 15 August 2024. As a result, the overall holding stood at Rs. 45.13 billion.

In money markets, the total outstanding liquidity surplus decreased to Rs. 46.11 billion by the week ending 16 August from its previous week’s surplus of Rs. 57.39 billion. The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of overnight reverse repo auctions and a 7-day term reverse repo auction at weighted average rates of 8.52% to 8.88% respectively. The weighted average interest rate on call money and repo ranged between 8.55% to 8.57% and 8.67% to 8.86% respectively.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities had remained steady at Rs. 2,575.62 billion.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)