Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 16 July 2024 00:52 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market kicked off the trading week on a bullish note, with significant buying interest driving down yields, resulting in a recovery from the recent uptick in rates. Activity was concentrated in the early part of the day, showing a notable improvement over last week with healthy transaction volumes. However, the action moderated and tapered off in the latter part of the day.

Accordingly, the most active 15.12.27 maturity was seen dropping from an intraday high of 11.80% to 11.70%, on the back of sizeable volumes. Meanwhile, the 15.02.28 and 15.03.28 maturities were seen transacting at the rates of 11.80% and 11.85% respectively. More notably, the 01.05.28 and 01.07.28 tenors were seen trading at 11.90% and down from 12.00% to 11.95% respectively, reflecting the renewed vigour in the market. Similarly, the 01.02.26 and 15.09.29 maturities were seen transacting at the lower levels of 10.45% to 10.40% and 12.10% respectively. The other 2026 tenors were seen holding broadly steady, with the 01.06.26 and 15.12.26 were seen trading at 10.45% to 10.40%, 10.70% and 10.85% respectively. The medium tenor 15.05.30 and 15.10.30 were observed changing hands at the rate of 12.15%.

The total secondary market Treasury bond/bill transacted volume for 12 July was Rs. 7.93 billion.

In money markets, the weighted average rate on overnight call money was at 8.75% and repo was at 9.08%.

The net liquidity surplus stood at Rs. 122.38 billion yesterday as an amount of Rs. 6.69 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 9.50% against an amount of Rs. 139.07 billion been deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%.

Further, the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight reverse repo auction for Rs. 10.00 billion at the weighted average rate of 8.90%.

Forex Market

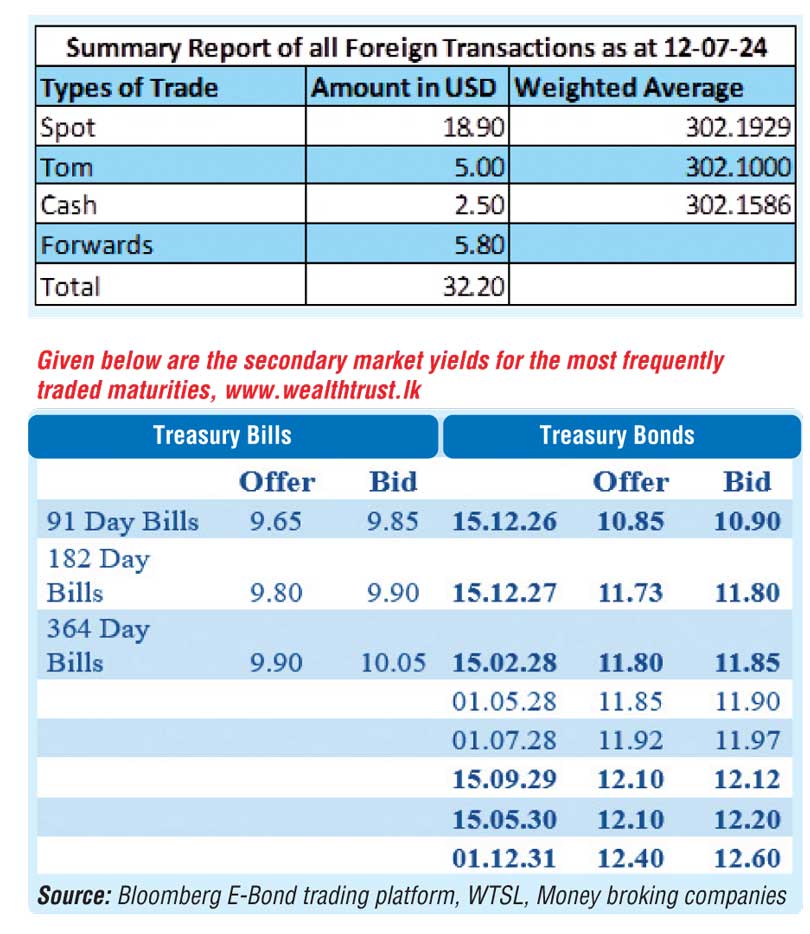

In the Forex market, the USD/LKR rate on spot contracts closed the slightly up, at Rs. 301.90/302.40 against its previous day’s closing level of Rs. 301.70/302.00.

The total USD/LKR traded volume for 12 July was $ 32.20 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)