Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 29 October 2024 02:34 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

The secondary bond market yesterday kicked off the week with sideways trading action. Sporadic bouts of buying interest were met with profit-taking selling pressure. The Rs. 32.50 billion Treasury bond auction conducted yesterday recorded a bullish outcome. Even with the bullish outcome at the bond auction, yields in the secondary market were seen closing broadly steady. Market activity and transaction volumes were seen at moderate levels.

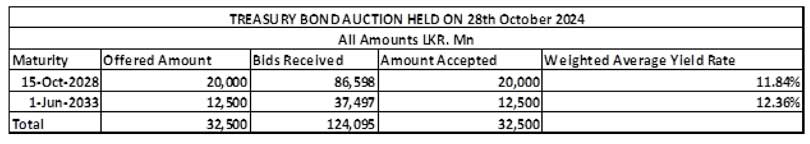

A 15.10.28 maturity (bearing an 11.00% coupon) was issued at a weighted average yield of 11.84% and with the entire Rs. 20 billion offered raised at the first phase of subscription. For context, at the previous auction just a little over two weeks ago, on 11 October, a shorter duration 2028 tenor 15.03.28 maturity was issued at the weighted average rate of 11.79%.

In addition, a 01.06.33 maturity (bearing a 9.00% coupon) was issued at a weighted average rate of 12.36%. However, the bond failed to raise the entire offered amount of Rs. 12.50 billion at the first phase, leading to the opening of the second phase. Upon the conclusion of the auction, the maturity was fully subscribed across both phases. For a frame of reference, at the last auction, a shorter duration 01.10.32 maturity was also issued at the weighted average rate of 12.36%.

In conclusion, the auction overall saw total bids received exceed the offered amount by 3.82 times and the entire Rs. 32.50 billion successfully raised across both phases.

The direct issuance window of 10% will be on offer on the 15.10.28 maturity until close of business of the day prior to settlement (i.e., 4 p.m. on 30.10.2024).

The popular and liquid 15.02.28 and 15.03.28 maturities were seen trading within the range of 11.75% to 11.70%. The relatively longer 2028 tenors of 01.07.28 and 15.12.28 changed hands at the rates of 11.85%-11.80% and 11.95%-11.90%, respectively. Additionally, trades were seen on the medium tenor 15.06.29 and 15.09.29 maturities at the rate of 12.00%.

Meanwhile, the secondary bill market yesterday saw April and October 2025 maturities changing hands within the range of 9.60% and 9.93% respectively.

This comes ahead of the Treasury bill auction due today, which will have a total amount of Rs. 145 billion on offer, an increase of Rs. 20.00 billion over the previous week. This will consist of Rs. 55.00 billion on the 91-day, Rs. 55.00 billion on the 182-day, and Rs. 35.00 billion on the 364-day maturities.

For context, at the weekly Treasury bill auction held last Wednesday, weighted average rates remained unchanged, following four consecutive weeks of decline. Accordingly, the weighted average rate for the 91-day tenor was registered at 9.32%, the 182-day at 9.65%, and the 364-day tenor at 9.95%. Total bids received exceeded the offered amount by 2.32 times, and the entire Rs. 125.00 billion on offer was successfully raised at the first phase. The second phase of subscription, opened on the 182- and 364-day tenors, also saw the entire Rs. 12.50 billion on offer fully subscribed; however, demand in the second phase was seen moderating considerably compared to the last few weeks.

The total secondary market Treasury bond/bill transacted volume for 25 October was Rs. 8.78 billion.

In money markets, the weighted average rates on overnight call money and repo stood at 8.55% and 8.71%, respectively. The DOD (Domestic Operations Department) of the Central Bank injected liquidity by way of an overnight repo auction for Rs. 19.27 billion at the weighted average rate of 8.40%.

The net liquidity surplus stood at Rs. 186.62 billion yesterday. No funds were withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 9.25%, while an amount of Rs. 205.89 billion was deposited at the Central Bank’s SDFR (Standard Deposit Facility Rate) of 8.25%.

Forex market

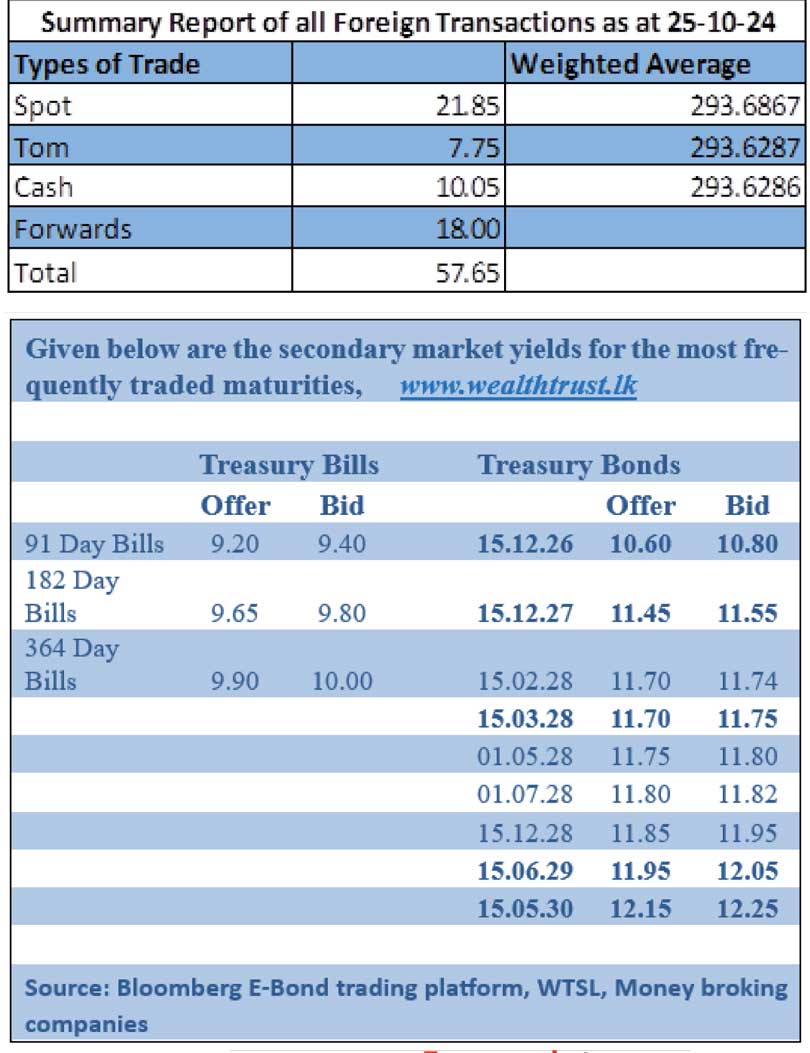

In the Forex market, the USD/LKR rate on spot contracts closed the day unchanged at Rs. 293.60/293.70.

The total USD/LKR traded volume for 25 October was $ 57.65 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)