Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 1 April 2024 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market for the shortened week ending 28 March 2024 witnessed moderate activity overall, while yields were observed moving sideways, fluctuating within a narrow band. Trading as usual centred on the short end of the yield curve, with specific emphasis on tenors between 2026-2028. The market started off the week on a subdued note with market participants adopting a wait-and see approach ahead of the Monetary Policy announcement. After the release of the outcome of the 2nd Monetary policy review, yields were initially seen edging down on a knee-jerk reaction to the rate cut, however subsequently moved back up as profit taking pressure kicked in. The market continued to maintain a holding pattern for the remainder of the week, despite yields declining at the Treasury bill auction midweek. As such, two-way quotes were seen closing the week broadly steady, week on week.

The secondary bond market for the shortened week ending 28 March 2024 witnessed moderate activity overall, while yields were observed moving sideways, fluctuating within a narrow band. Trading as usual centred on the short end of the yield curve, with specific emphasis on tenors between 2026-2028. The market started off the week on a subdued note with market participants adopting a wait-and see approach ahead of the Monetary Policy announcement. After the release of the outcome of the 2nd Monetary policy review, yields were initially seen edging down on a knee-jerk reaction to the rate cut, however subsequently moved back up as profit taking pressure kicked in. The market continued to maintain a holding pattern for the remainder of the week, despite yields declining at the Treasury bill auction midweek. As such, two-way quotes were seen closing the week broadly steady, week on week.

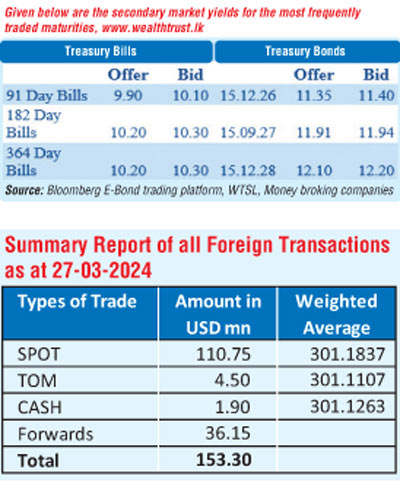

Accordingly, during the week the popular liquid 2026 tenors of 15.12.26 and 15.05.26 were seen changing hands within the range of 11.28% to 11.35%, while the shorter tenor 01.02.26 was seen trading within the range of 10.85% to 10.90%. While the liquid 2028 tenors of (01.07.28 and 15.12.28) were seen hitting intraweek lows of 12.00% as against intraweek highs of 12.15%. Additionally, trades were observed on the medium tenor 15.05.30 within the range of 12.36% to 12.38%.

At the second Monetary Policy review meeting for the year 2024 which was announced last Tuesday (26 March 2024) the Central Bank of Sri Lanka resumed monetary easing, cutting policy rates for a sixth time since June 2023. A decrease of 50 basis points saw the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) reduce to 8.50% and 9.50% respectively accumulating a total decrease of 700 basis points or 7.00% since June 2023. The Statutory Reserve Ratio (SRR) remained steady at 2.00%. The official press release stated that the decision aimed to maintain inflation at 5% over the medium term while supporting economic growth. The statement went on to outline that the decision was made considering factors including subdued demand conditions, lesser-than-anticipated impact of recent tax changes on inflation, favourable electricity tariff adjustments, stable inflation expectations, and absence of major external pressures. The Board reiterated the importance of transmitting these measures swiftly to market lending rates to normalise market conditions.

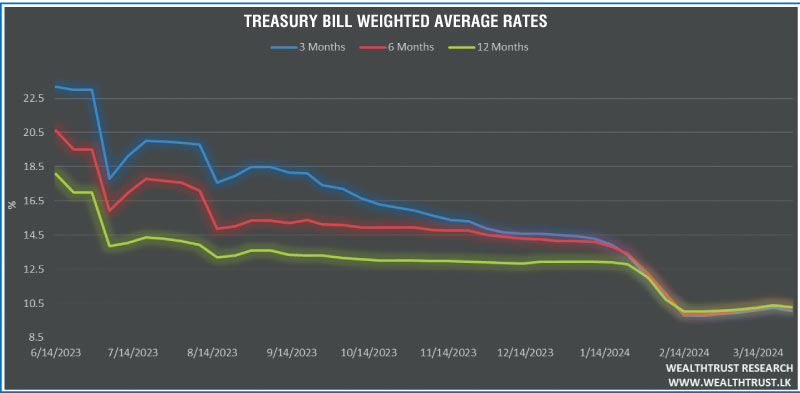

At the weekly Treasury bill auction last Wednesday (27 March 2024), the weighted average rates were seen decreasing for the first time in five weeks, following the monetary policy rate cut. The 91-day bill recorded the sharpest dip of 16 basis points to 10.07% closely followed by the 182-day bill by 12 basis points to 10.23% and the 364-day bill by 10 basis points to 10.28%. The total offered amount of Rs. 80 billion was successfully raised at the auction as the total bids received to total offer ratio was seen increasing to a five-week high of 2.31:1.

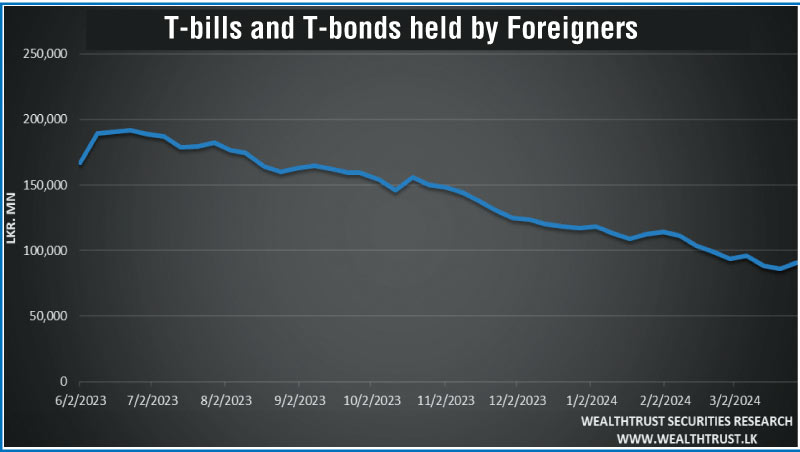

The foreign holding in Rupee bonds and bills for the week ending 28 March 2024 recorded a net inflow for the first time in 2 weeks, amounting to Rs. 4.24 billion. As a result, the total holding increased to Rs. 90.60 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first three days of the week averaged at Rs. 21.13 billion.

In money markets, the total outstanding liquidity deficit decreased to Rs. 5.28 billion by the week ending 22nd March from its previous week’s deficit of Rs. 61.29 billion. The Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight and term reverse repo auctions at weighted average yields ranging from 8.57% to 9.23%.

The Central Bank of Sri Lankas (CBSL) holding of Government Securities was registered at

Rs. 2,691.27 billion as at 22 March 2024, unchanged from its previous week’s level.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating during the week to close at Rs. 300.40/300.50. This is as against its previous weeks closing level of Rs. 303.40/303.50 and subsequent to trading at a high of Rs. 300.25 and a low of Rs. 302.90.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 144.41 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)