Tuesday Mar 10, 2026

Tuesday Mar 10, 2026

Wednesday, 18 September 2024 02:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yields last week experienced a notable rise, driven by uncertainties surrounding the upcoming Presidential election and against the backdrop of a Rs. 290 billion Treasury bond auction.

The secondary bond market yields last week experienced a notable rise, driven by uncertainties surrounding the upcoming Presidential election and against the backdrop of a Rs. 290 billion Treasury bond auction.

Initially yields were seen increasing, leading to the bond auction. However, following the conclusion of the auction, yields were observed recovering as market sentiment improved and strong buying interest brought rates below the weighted average levels determined at the auction, showcasing resilience in the face of considerable headwinds. Despite this recovery, rates were observed closing the week higher against its previous weeks closing levels. As a result, the yield curve was observed shifting upwards.

Prior to the auction, yields were observed increasing across the board. Accordingly, the shorter tenor 01.07.25 was seen trading at the rate of 10.25%, the 01.02.26 maturity up from 10.55% to 10.65%. The 2028 tenors saw a considerable increase in yields. Accordingly, the yields on the 15.03.28 and 15.12.28 maturities were observed increasing from 12.95% to 13.40% and 13.20% to 13.80% respectively. The 15.07.29 and 15.09.29 maturities saw yields increase from 13.35% to 13.45% to 13.50% respectively. Additionally, trades were observed on the medium tenor 15.05.30/15.10.30 and 01.07.32 maturities within the ranges of 13.3650% to 13.4150% and 13.50% to 13.60%.

The market attention shifted to the auction maturities, post auction: The 15.02.28 auction maturity which had started off the week trading at the rate of 12.85% and peaked at a high of 13.80%- immediately post-auction, subsequently recovered to 13.58%. The 15.06.29 maturity, initially began trading at the weighted average level of 13.98% but a rally saw its yield decline to a low of 13.70%.

Meanwhile, at the weekly Treasury bill auction conducted last Wednesday (11 Sep.), rates continued on an upward trajectory. As such, rates across all three maturities rose for a second consecutive week. Accordingly, the rate on the 91-day tenor rose steeply by 38 basis points to 9.99% and the 182-day tenor by 30 basis points to 10.24%. The 364-day tenor also saw its weighted average increase by a marginal 04 basis points to 10.07%. The auction only managed to raise 91.54% or Rs. 164.77 billion in successful bids, out of the Rs. 180.00 billion, total offered amount. This marks the first instance that a T-bill auction has gone undersubscribed since 7 August at its 1st phase.

This was followed by a Rs. 290 billion Treasury bond auction conducted last Thursday (12 Sep.) one of the largest in the country’s history. Which also saw yields rise, in line with trends in the secondary and primary markets. However, the results were significantly below market expectations, amidst the prevailing Presidential election related uncertainties and considered impressive given the large scale of the auction. As such, the outcome showed resilience against headwinds the market has been facing. A 15.02.28 maturity was issued at a weighted average yield of 13.79% and raised the entire Rs. 150.00 billion on offer. Meanwhile, the 15.06.2029 maturity bond was issued at a weighted average yield of 13.98%, and managed to raise Rs. 145.961 billion out of the Rs. 150.00 billion on offer. The relatively longer tenor 15.09.34 maturity saw all bids rejected. In conclusion, the auction overall raised 81.81% or Rs. 245.96 billion against a total offered amount of Rs. 290.00 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 42.05 billion.

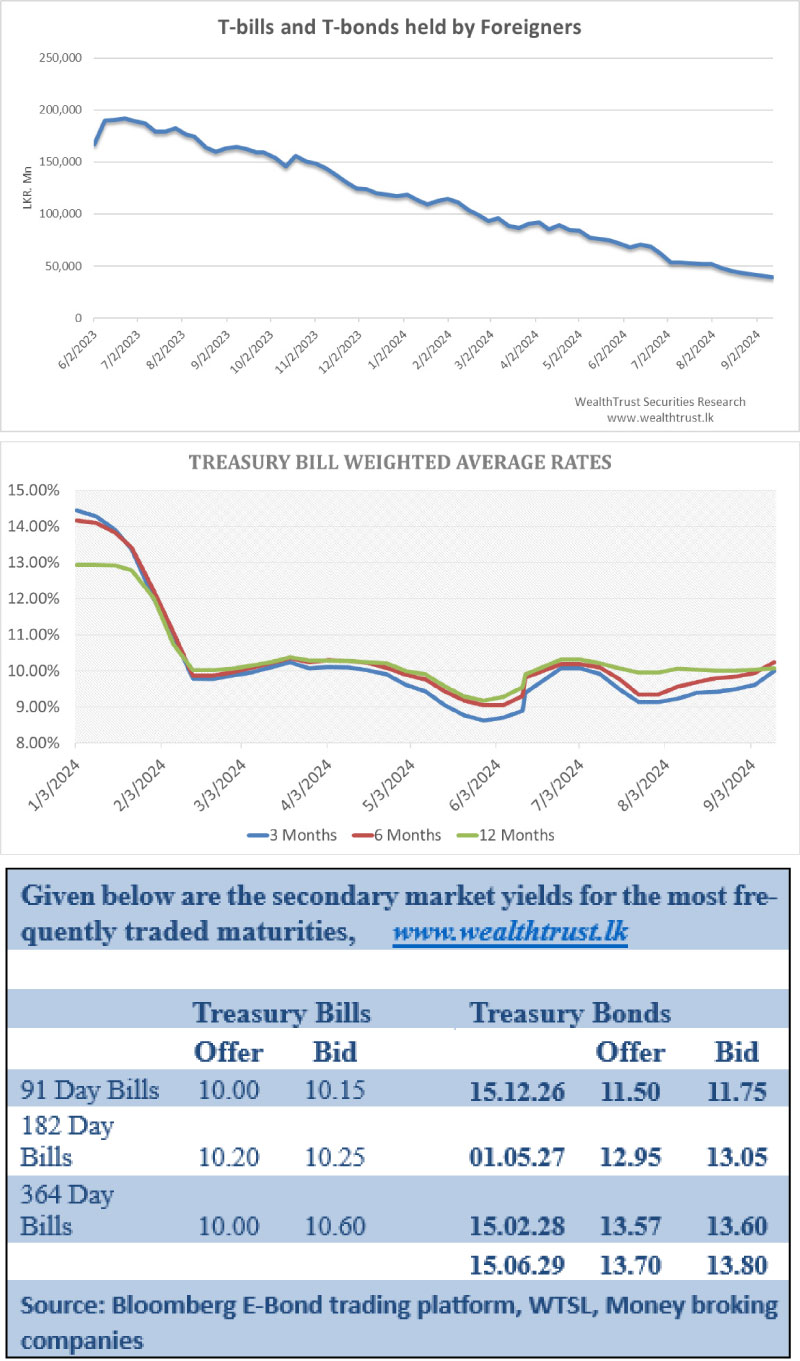

The foreign holding in rupee Treasuries continued to steadily decline, recording a net outflow for the ninth straight week, amounting to Rs 1.00 billion for the week ending 12th September 2024. As a result, the overall holding dropped Rs 39.38 billion, falling below Rs 40.00 billion for the first time since February 2023.

In money markets, the total outstanding liquidity surplus decreased to Rs. 38.58 billion by the week ending 13th September as compared to a surplus of Rs. 48.08 billion from the previous week. The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of overnight reverse repo auctions and a 3-day term reverse repo auction at weighted average rates of 8.51% and 8.81% respectively. The weighted average interest rate on call money and repo ranged between 8.55% to 8.61% and 8.65% to 8.73% respectively.

The Central Bank of Sri Lankas (CBSL) holding of Government Securities was seen declining during the week ending 13th September to Rs. 2,523.92 billion as against the previous week’s level of Rs 2,535.62 billion.

Forex market

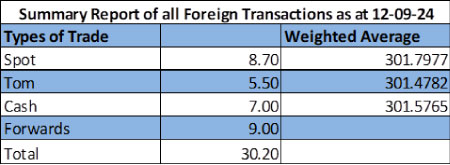

Despite some volatility during the week, the USD/LKR rate closed at Rs 302.25/302.80, subsequent to trading at a high of Rs. 299.45 and a low of Rs. 302.50, depreciating in comparison to its previous week’s closing level of Rs 299.20/299.60.

The daily USD/LKR average traded volume for the first four trading days of the week stood at a healthy $ 55.79 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)