Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 17 May 2024 00:28 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yesterday started off the day with selling pressure causing yields to move upwards, as market participants looked to realise gains. However, renewed buying interest kicked in at the elevated levels, causing yields to be reined back in and stabilise, closing the day broadly steady. The market remained active, with trading primarily focused on 2026 to 2032 durations.

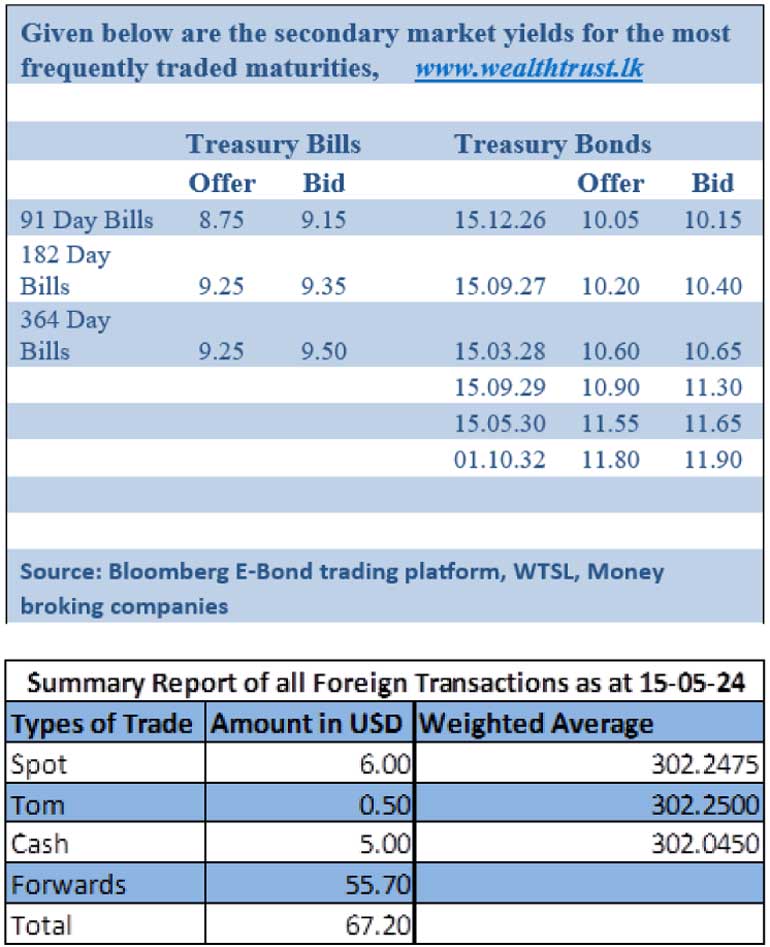

The 2028 tenors of 01.07.28 and 15.12.28 saw the most action with yields initially moving up to hit intraday highs of 10.90% on a wave of profit taking before dropping to hit an intraday low of 10.70% collectively, on a fresh wave of buying interest. Similarly, the shorter tenor 15.03.28 and 01.05.28 were also seen following the same momentum, hitting intraday highs of 10.75% and 10.80% before declining to intraday lows of 10.60% and 10.70%. This movement extended across the yield curve as the liquid 2027 tenor of 15.09.27 was seen hitting an intraday high of 10.50% as against an intraday low of 10.25%. The 2026 tenor of 15.12.26 were seen trading at 10.10%, which was also above the opening market two-way quote. Additionally, the medium tenor maturity of 15.10.32 was observed moving up to a high of 11.90% before settling at a low of 11.80%.

The total secondary market Treasury bond/bill transacted volume for 15 May was Rs. 102.94 billion. In money markets, the weighted average rates on overnight call money and Repo stood at 8.65% and 8.74% respectively. The DOD (Domestic Operations Department) of Central Bank continued to abstain from injecting liquidity by way of overnight or term reverse repo auctions.

The net liquidity surplus stood at Rs. 138.94 yesterday. An amount of Rs. 2.42 billion was withdrawn from the Central Banks SLFR (Standing Lending Facility Rate) of 9.50% as against

Rs. 141.36 billion been deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed day up at Rs. 300.70/300.90 against its previous day’s closing level of Rs. 302.00/302.40.

The total USD/LKR traded volume for 15 May was $ 67.20 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)