Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 25 November 2024 01:55 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

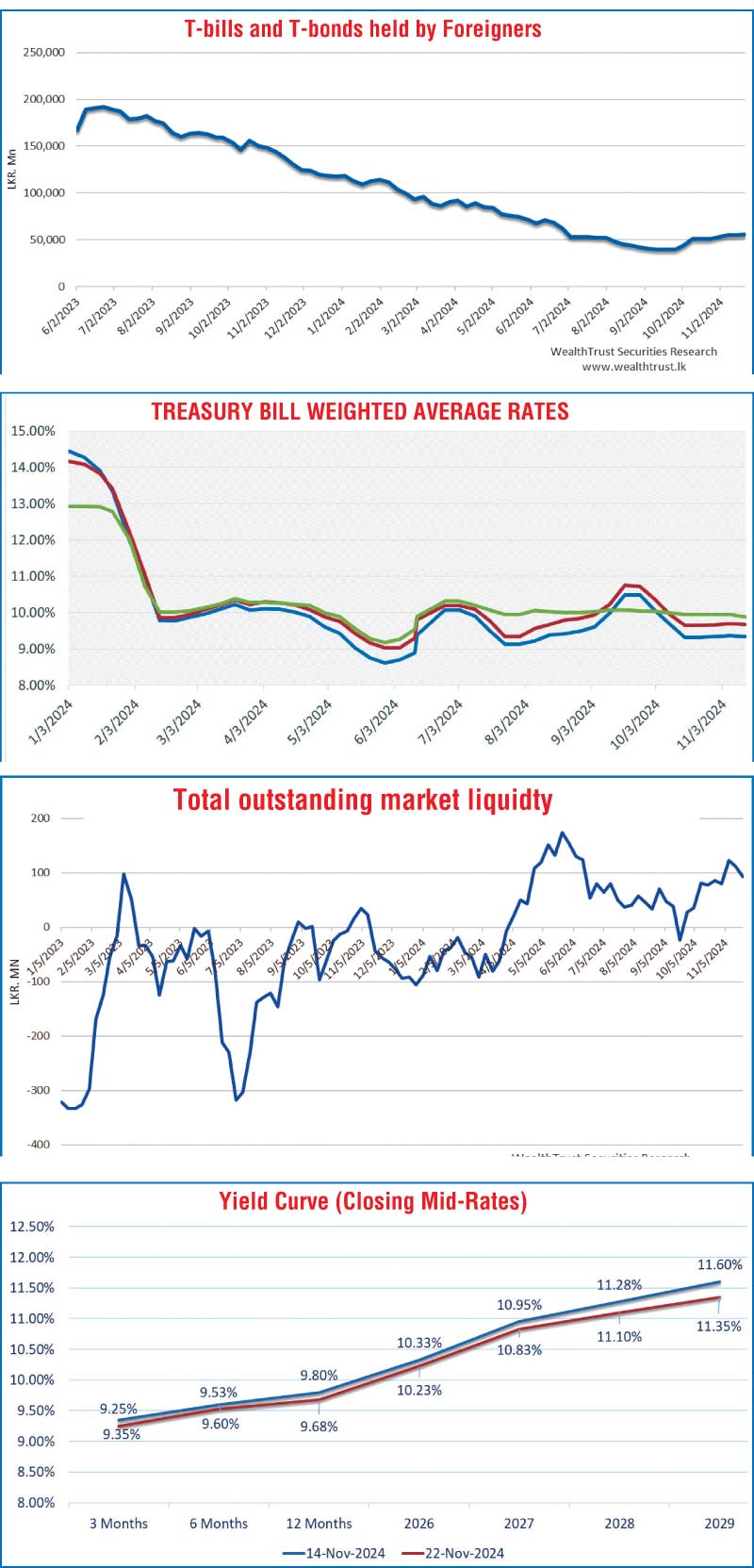

The secondary bond market last week started off on a positive note, carrying over the bullish momentum from the week prior. A buying frenzy saw yields plummet to hit fresh lows, on the back of strong demand, following the outcome from the Parliamentary election. Trading activity and transaction volumes were seen at robust levels. However, as the week progressed, profit taking saw yields pushed back up, partially reversing some of the gains from the recent Bull Run. Activity and transaction volumes began to moderate as yields were seen consolidating at the newly established levels, supported by renewed buying interest that kept a cap on rates. Despite these fluctuations, two-way quotes were seen closing significantly lower on a week-on week basis, which resulted in a downward shift of the yield curve.

The secondary bond market last week started off on a positive note, carrying over the bullish momentum from the week prior. A buying frenzy saw yields plummet to hit fresh lows, on the back of strong demand, following the outcome from the Parliamentary election. Trading activity and transaction volumes were seen at robust levels. However, as the week progressed, profit taking saw yields pushed back up, partially reversing some of the gains from the recent Bull Run. Activity and transaction volumes began to moderate as yields were seen consolidating at the newly established levels, supported by renewed buying interest that kept a cap on rates. Despite these fluctuations, two-way quotes were seen closing significantly lower on a week-on week basis, which resulted in a downward shift of the yield curve.

The 2027 tenors of 15.09.27 and 15.12.27 were seen moving down from opening highs to hit intraweek lows of 10.80%-10.65% and 10.85%-10.70% respectively at the start of the week, before moving back up to settle at the closing two-way quotes of 10.80%/10.85% and 10.85%/10.95% respectively. The rest of the yield curve followed suit, with a similar trading pattern observed across maturities. For example, the 01.05.28 maturity settled at the closing two-way of 11.10%/11.20%, subsequent to trading between the intraweek highs and lows of 11.26%-10.95%. The 15.09.29 maturity closed at the rates of 11.30%/11.40%, subsequent to trading between the intraweek highs and lows of 11.53%-11.35%.

This week the Central Bank of Sri Lanka (CBSL) is due to make a monetary policy announcement scheduled for 27 November (Wednesday). In addition, the CBSL is scheduled to conduct a Rs. 205.00 billion round of Treasury bond auctions on 28 November (Thursday) as per the Tentative Treasury bond and Treasury bill Issuance/ Settlement Calendar.

At the weekly Treasury bill auction conducted last Wednesday (20 November), weighted average rates were seen declining across the board for a second consecutive week. Accordingly, the weighted average rates on the 91-day tenor decreased by 05 basis points to 9.30%, the 182-day tenor dropped by 04 basis points to 9.60% and the 364-day tenor declined by 10 basis points to 9.78%. Total bids received exceeded the offered amount by 2.27 times, and the entire Rs. 145.00 billion on offer was successfully raised at its first phase. In addition, an amount of Rs. 14.50 billion being the maximum amount offered was raised at the second phase out of a total market subscription of a staggering

Rs. 89.14 billion.

For the week ending 21 November 2024, the foreign holdings in Sri Lankan Rupee-denominated Treasury securities saw a net inflow of Rs. 702.00 million. This marked the 10th consecutive week of positive inflows. As a result, total foreign holdings reached

Rs. 55.55 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at

Rs. 29.28 billion.

In money markets, total outstanding liquidity declined to

Rs. 93.29 billion by the end of the week ending 22 November, down from

Rs. 112.54 billion recorded the previous week. The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of overnight reverse repo auctions and a seven-day term reverse repo auctions at weighted average rates of 8.48% to 8.77% respectively. The weighted average interest rate on call money and repo ranged between 8.57% to 8.58% and 8.63% to 8.70% respectively. The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,515.62 billion as at 22 November, unchanged from the previous week’s level.

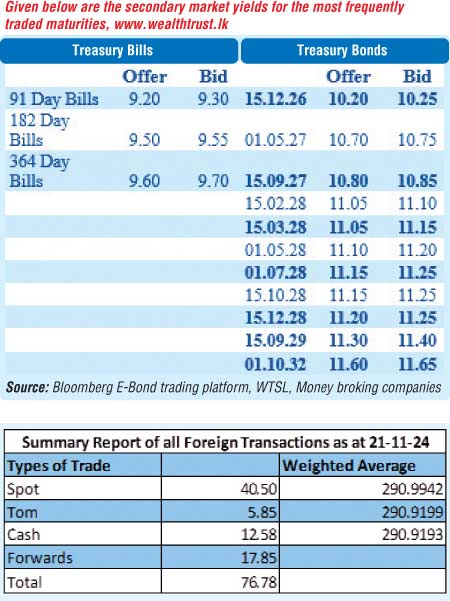

In the Forex market, the

USD/LKR rate on spot contracts was seen appreciating, to close the week at Rs. 291.00/291.10 as against its previous week’s closing level of Rs. 292.25/292.30 and subsequent to trading at a high of Rs. 290.70 and a low of Rs. 292.00.

The daily USD/LKR average traded volume for the first four trading days of the week stood at

$ 122.17 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money

broking companies)