Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 28 October 2024 02:13 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market during the week ending 25 October, started off slow but subsequently saw sporadic bouts of buying interest push yields down, leading to a slight recovery mid-week. However, as the week progressed, profit-taking pressures caused yields to edge up once again, erasing earlier gains and ultimately leading to a reversal. As a result, despite the sideways trading, two-way quotes were seen increasing slightly on a week-on-week basis. Market activity and transaction volumes were seen easing at the end of the week, as market participants took a cautious stance ahead of the upcoming Treasury bond auction.

The secondary bond market during the week ending 25 October, started off slow but subsequently saw sporadic bouts of buying interest push yields down, leading to a slight recovery mid-week. However, as the week progressed, profit-taking pressures caused yields to edge up once again, erasing earlier gains and ultimately leading to a reversal. As a result, despite the sideways trading, two-way quotes were seen increasing slightly on a week-on-week basis. Market activity and transaction volumes were seen easing at the end of the week, as market participants took a cautious stance ahead of the upcoming Treasury bond auction.

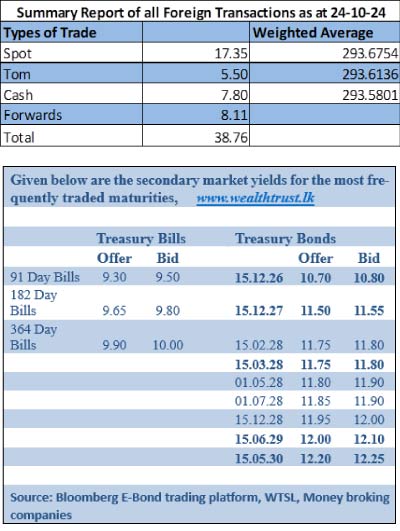

The 15.09.27 and 15.12.27 maturities were seen trading up from an intraweek low of 11.40% and 11.35% respectively, to highs of 11.55% and 11.50%. The rest of the yield curve followed suit. The popular and liquid 15.02.28 and 15.03.28 maturities saw yields increase from an intraweek low of 11.70% to a high of 11.77% at the tail end of the week. The relatively longer 2028 tenors of 01.05.28 and 15.12.28, saw rates move up from 11.80%-11.85% and 11.90%-11.95% respectively. The yield on the 15.06.29 maturity increased to an intraweek high of 12.08% from a low of 11.85%.

In conclusion, at the close of the week the yield curve registered an upward shift.

The upcoming Treasury bond auction due today, 28 October will have an offer of Rs. 20.00 billion from 15 October 2028 maturity bearing a coupon of 11.00% (a new maturity) and Rs. 12.50 billion from a 1 June 2033 maturity bearing a coupon rate of 09.00%.

For context, at the previous Treasury bond auction on 11 October, a bullish response saw the entire Rs. 95.00 billion offered subscribed at the first phase. The 15.03.28 maturity, carrying a 10.75% coupon, was issued at a weighted average yield of 11.79%, successfully raising the entire Rs. 70 billion on offer. Additionally, the 01.10.32 maturity, with a 9.00% coupon, was issued at an average rate of 12.36%, securing the full Rs. 25 billion.

Meanwhile, at the weekly Treasury bill auction held last Wednesday: weighted average rates remained unchanged, following four consecutive weeks of declines. Accordingly, the weighted average rate for the 91-day tenor was registered at 9.32%, the 182-day at 9.65% and the 364-day tenor at 9.95%. Total bids received exceeded the offered amount by 2.32 times, and the entire Rs. 125.00 billion on offer was successfully raised at the 1st phase. The 2nd phase of subscription opened on the 182- and 364-day tenors, also saw the entire Rs. 12.50 billion on offer fully subscribed, however demand on the second phase was seen moderating considerably as compared to the last few weeks.

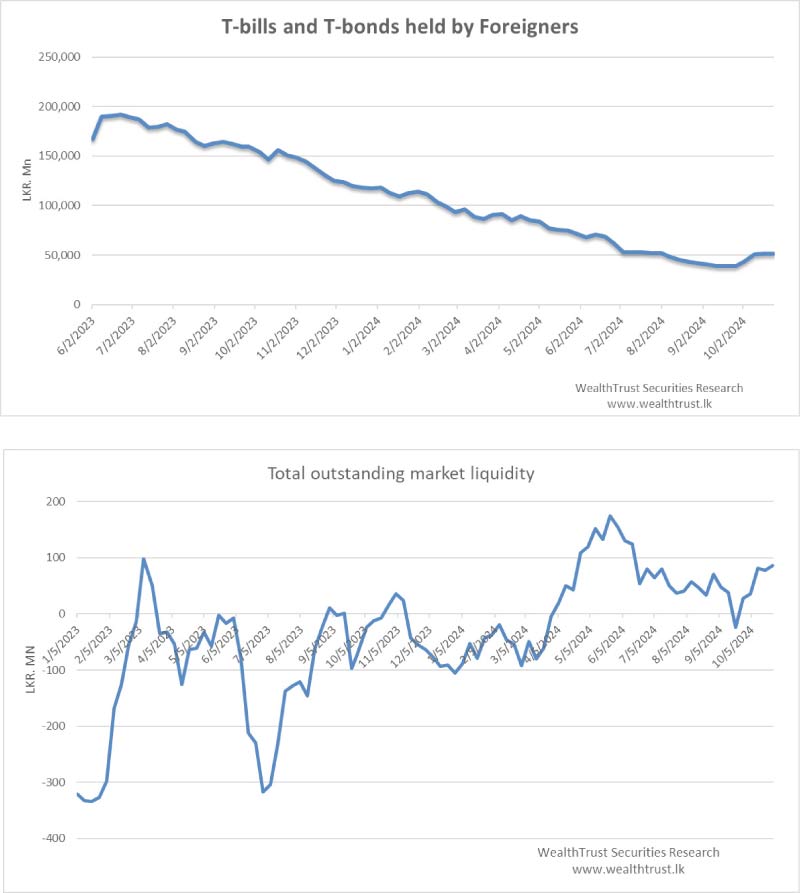

For the week ending 24 October 2024, the foreign holdings in Sri Lankan rupee-denominated Treasury securities saw a very marginal net inflow of Rs. 1.00 million. This marked the sixth consecutive week of positive inflows. As a result, total foreign holdings reached Rs. 51.14 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 17.04 billion.

In money markets, total outstanding liquidity increased to Rs. 86.30 billion by the end of the week ending 25 October, up from Rs. 78.10 billion recorded the previous week. The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of overnight reverse repo auctions and a 7-day term reverse repo auctions at weighted average rates of 8.41% to 8.63% respectively. The weighted average interest rate on call money and repo ranged between 8.55% to 8.57% and 8.65% to 8.71% respectively.

The Central Bank of Sri Lankas (CBSL) holding of Government Securities was registered at Rs. 2,515.62 billion as at 25 October 2024, unchanged from the previous week’s level.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating, to close the week at Rs. 293.60/293.70 as against its previous week’s closing level of Rs. 293.00/293.20 and subsequent to trading at a high of Rs. 293.00 and a low of

Rs. 293.85.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 44.60 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)