Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 22 July 2024 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

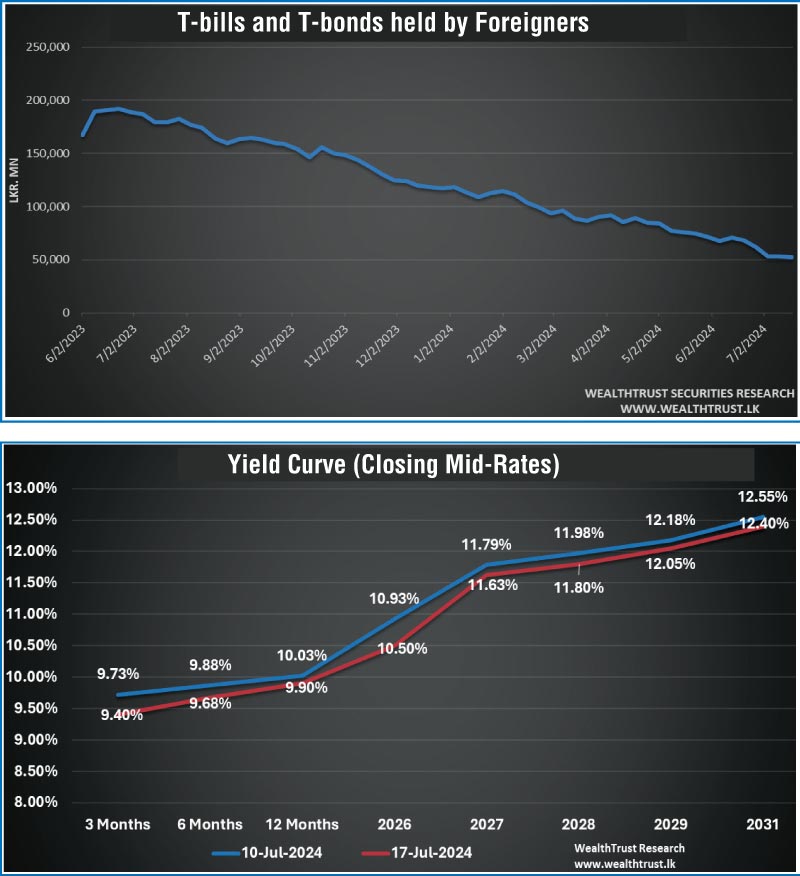

The secondary bond market witnessed renewed buying interest, mainly during the early part of the week ending 19 July, leading to a change in sentiment from a bearish to positive. The expectations on the monetary policy decision coupled with the continued reduction in the weekly Treasury bill weighted average rates was seen as the main reasons behind the change in sentiment.

The 4th monetary policy announcement for the year 2024 is due at 7.30 a.m. on 24 July 2024 (this Wednesday).

At the previous meeting on 28 May 2024, the Central Bank of Sri Lanka (CBSL) maintained the Standing Deposit Facility Rate (SDFR) at 8.50% and the Standing Lending Facility Rate (SLFR) at 9.50%. As such, the CBSL was seen taking a pause on its monetary easing cycle, which has seen a cumulative reduction of 700 basis points since June 2023. As per the official press release, this decision was based on a comprehensive assessment of macroeconomic conditions and risks, aiming to keep inflation at the target level of 5% while supporting economic growth. Further, the monetary board noted that there remains space for market lending interest rates to decline further given the prevailing accommodative monetary policy stance and the continued decline in the cost of funds of financial institutions.

In an article titled “Sri Lanka Likely to Cut Rates by 50 bps in July – Three Reasons”, Bloomberg Economics cited the low inflation, weak private demand for credit and strong FX reserves (as a result of current account surpluses) as explanations favouring a rate cut.

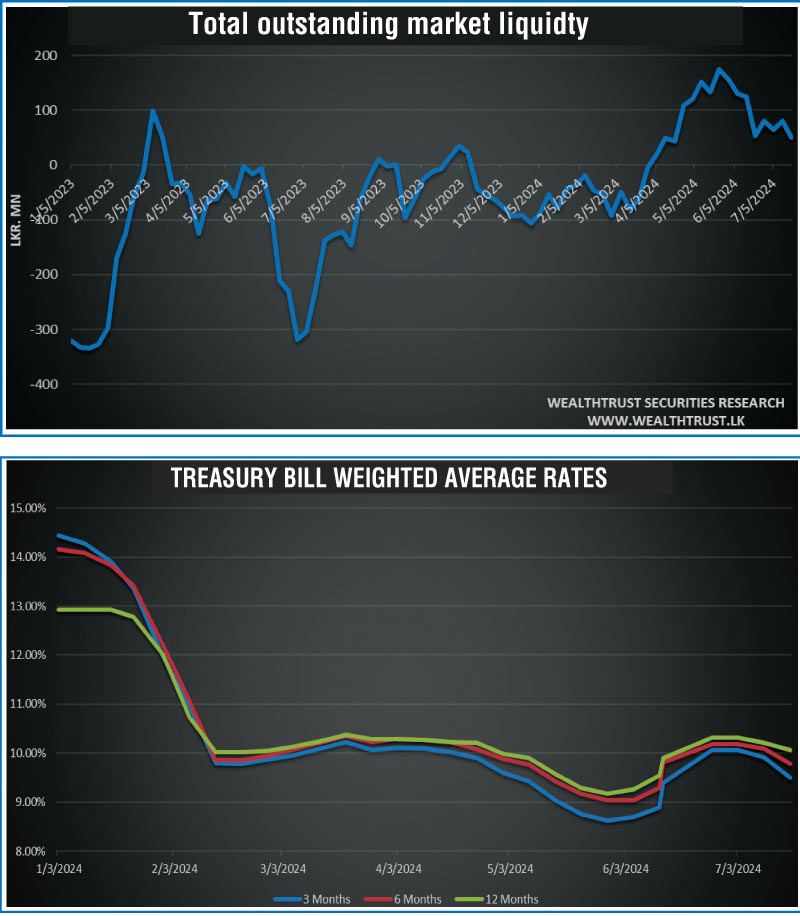

Furthermore, the improvement in sentiment had a positive outcome on the weekly Treasury bill auction held last Wednesday, where the entire Rs. 110.00 billion offered was fully subscribed, with bids exceeding the offered amount by 2.8 times. This marked the second consecutive week of declining weighted average rates. Last week’s decline was particularly steep. The yield on the 91-day tenor dropped by 36 basis points to 9.55%, the 182-day fell by 32 basis points to 9.78%, and the 364-day decreased by 14 basis points to 10.07%. An additional Rs. 11.00 billion, being the maximum aggregate amount on offer, was raised at the second phase, out of the total market subscription of a staggering Rs. 115.024 billion.

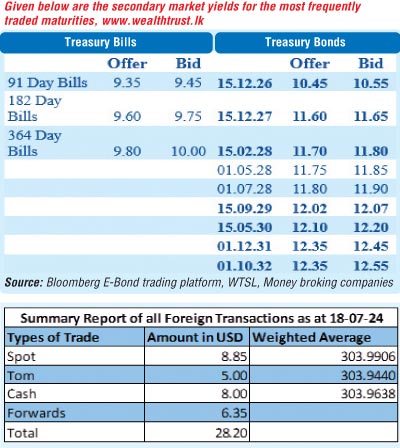

In the secondary bond market, buying interest mainly on the 2026 maturities (i.e. 01.02.26 and 01.08.26) saw its yield dip to a weekly low of 10.15% and 10.35% respectively against its weekly high of 10.45% and 10.50%. The yield on the popular liquid 15.12.27 maturity was seen declining to intraweek lows of 11.60% from intraweek highs of 11.80%, on the back of sizeable volumes. The 2028 tenors also followed suit. The yield on the 15.02.28, 01.05.28 and 01.07.28 maturities dropped down from 11.80% to 11.68%, 11.90% to 11.75%, and 12.00% to 11.80% respectively. Similarly, the 15.09.29 maturity dropped from 12.10% to 12.00% intraweek. Additionally, trades were observed on the medium tenor 15.05.30 maturity at the rate of 12.15%.

As such, two-way quotes across the yield curve registered a dip at the close of the week, resulting in the yield curve recording a marginal parallel shift downwards week-on week.

Meanwhile, the foreign holding in rupee Treasuries for the week ending 18 July 2024, recorded a net outflow to the tune of Rs. 451.00 million. As a result, the overall holding stood at Rs. 52.67 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 33.63 billion.

In money markets, the total outstanding liquidity surplus decreased to Rs. 50.08 billion by the week ending 19 July from its previous week’s surplus of Rs. 80.40 billion. The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of overnight reverse repo auctions and 7-day term reverse repos at weighted average rates of 8.71% to 9.01%. The weighted average interest rate on call money and repo ranged between 8.75% to 8.77% and 8.96% to 9.08% respectively.

The Central Bank of Sri Lankas (CBSL) holding of Government Securities was registered at Rs. 2,595.62 billion as at 19 July 2024, unchanged from the previous week’s level.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating during the week to close at Rs. 303.55/306.65. This is as against its previous week’s closing level of Rs. 301.70/302.00 and subsequent to trading at a high of Rs. 300.92 and a low of Rs. 304.05.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 33.78 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)