Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 6 November 2024 00:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

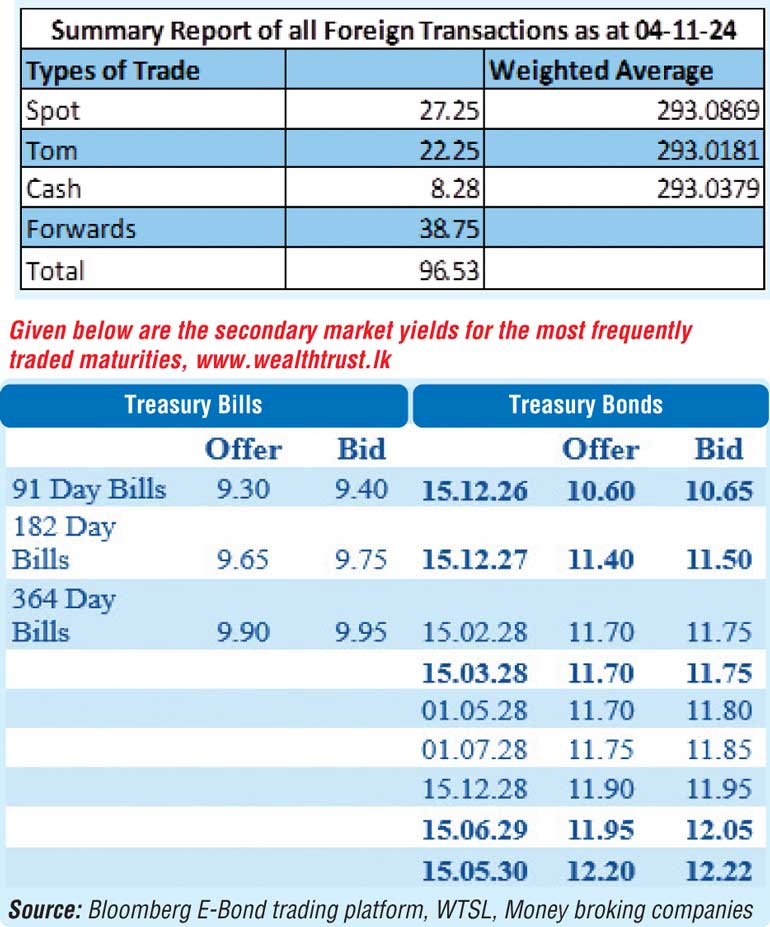

Yields in the secondary bond market edged lower yesterday, driven by sporadic bouts of buying interest, particularly on popular and liquid maturities. However, these gains faced resistance as profit-taking led to selling pressure. Despite market activity showing a considerable increase compared to the virtual standstill of the previous day, trading volumes were moderate, and overall activity remained somewhat subdued relative to the recent past. The 2026 tenors of 01.02.26, 01.06.26 and 15.12.26 changed hands at the rates of 10.12%, 10.46% and 10.65% to 10.60% respectively. The 2027 tenors saw the bulk of the action yesterday, accordingly the 15.01.27, 01.05.27, 15.09.27 and 15.12.27 maturities traded at the rates of 10.77%-10.70%, 11.43%-11.37%, 11.49%-11.45% and 11.45%-11.43% respectively. The popular and liquid 15.02.28 and 15.03.28 maturities were seen trading within the range of 11.72% to 11.70%. The relatively longer 2028 tenor 15.12.28 maturity, changed hands at the rates of 11.95%. The medium tenor 15.05.30 and 01.10.32 maturities were seen transacting at the rate of 12.20 and 12.30-12.31% respectively.

This comes ahead of the Treasury bill auction due today, which will have a total amount of Rs. 175.00 billion on offer, an increase of Rs. 30.00 billion over the previous week. This will consist of Rs. 60.00 billion on the 91-day, Rs. 85.00 billion on the 182-day and Rs. 30.00 billion on the 364-day maturities.

For context, at the weekly Treasury bill auction conducted last Wednesday, weighted average rates increased marginally on the shorter tenors, marking the first rise in six weeks. The week prior, rates remained unchanged after four weeks of steady declines. Specifically, the weighted average rate on the 91-day tenor rose by 3 basis points to 9.35%, while the 182-day tenor also increased by 3 basis points to 9.68%. However, the 364-day tenor’s weighted average rate remained unchanged at 9.95%. Total bids received exceeded the offered amount by 2.05 times, and the full Rs. 145.00 billion on offer was successfully raised in the first phase. In addition, Rs. 8.03 billion was raised at phase 2 on the 182- and 364-day tenors. The total secondary market Treasury bond/bill transacted volume for 4 November was Rs. 3.55 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.57% and 8.77% respectively. The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight and 7-day term reverse repo auction for Rs. 16.67 billion and

Rs. 50.00 billion at the weighted average rates of 8.49% and 8.65% respectively.

The net liquidity surplus stood at

Rs. 98.35 billion yesterday.

Rs. 0.55 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 9.25%, while an amount of Rs. 165.57 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 8.25%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day broadly at

Rs. 293.00/293.15 as compared to 293.00/293.20. The total USD/LKR traded volume for 4 November was $ 96.53 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)