Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Wednesday, 5 February 2025 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market on Monday started the week with yields edging up on the back of moderate activity and transaction volumes. However, renewed buying interest was seen kicking in at the elevated levels curtailing further upwards movement. Despite the partial recovery, market two-way quotes were seen closing the day higher.

The secondary bond market on Monday started the week with yields edging up on the back of moderate activity and transaction volumes. However, renewed buying interest was seen kicking in at the elevated levels curtailing further upwards movement. Despite the partial recovery, market two-way quotes were seen closing the day higher.

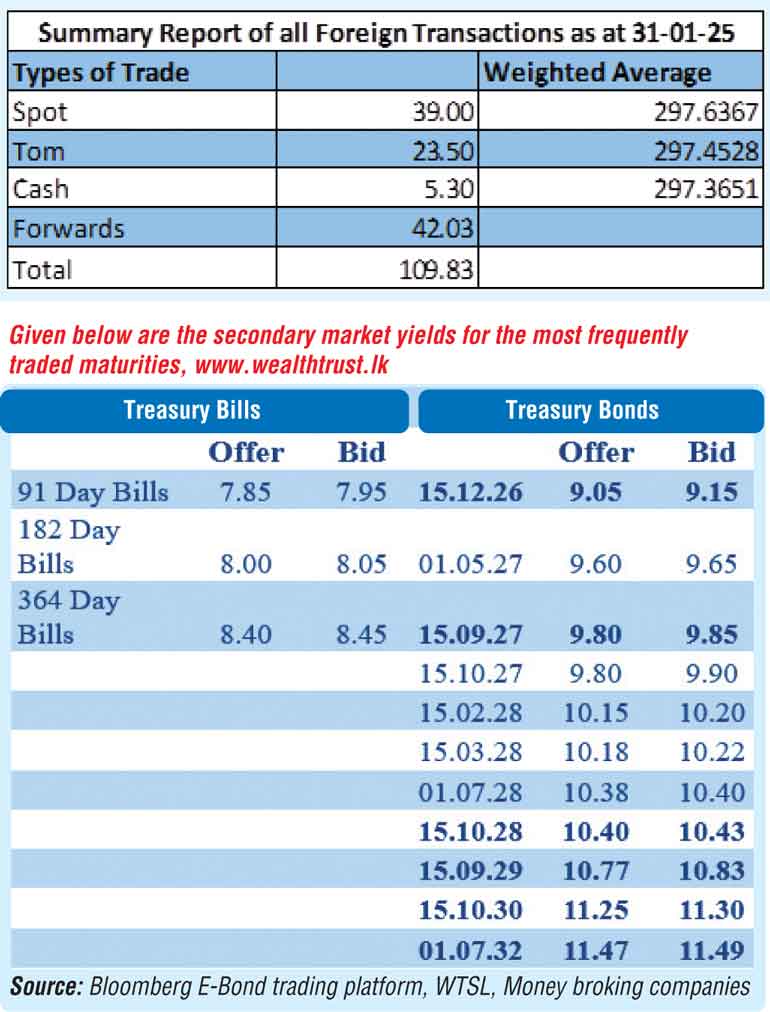

Limited trades were observed mainly on the 2018 maturities with 15.03.28, 01.05.28, 01.07.28, 15.10.28 and 15.12.28 maturities changing hands at levels of 10.20%, 10.30%, 10.39% to 10.40%, 10.40% to 10.42% and 10.50% respectively. In addition, 2027 maturities (i.e. 01.05.27, 15.10.27 and 15.12.27) and 2031 maturities (i.e. 15.05.31 and 15.12.31) traded at levels of 9.60% to 9.62%, 9.80%, 9.90%, 11.40% to 11.409% and 11.40% to 11.50% respectively.

This comes ahead of the Treasury Bill auction due today, which will have a total amount of Rs. 180.00 billion on offer, a decrease of Rs. 2.50 billion over the previous week. This will consist of Rs. 30.00 billion on the 91-day maturity, Rs 60.00 billion on the 182-day and Rs. 90.00 billion on the 364-day maturity.

For reference, at the last Treasury Bill auction held on 29 January 2025, weighted average rates declined across all three maturities for the 8th consecutive week. Last week’s drop was particularly steep, with the rate on the three-month tenor falling to an over three-year low, falling below 8.00% for the first time since late December 2021. Week-on-week change in weighted average yields:

n 91-day: ↓ 19 bps to 7.93%

n182-day: ↓ 16 bps to 8.09%

n364-day: ↓ 16 bps to 8.47%

Total bids received exceeded the offered amount by 2.62 times, and the entire Rs. 182.50 billion on offer was successfully raised at the 1st phase in competitive bidding. A heavily oversubscribed Phase 2 raised an additional Rs. 18.25 billion, out of a massive Rs. 134.40 billion market interest. The total secondary market Treasury Bond/Bill transacted volume for 31 January was Rs. 11.39 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.00% and 8.07% respectively.

The net liquidity surplus stood at Rs. 184.95 billion yesterday. Rs. 1.54 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.50%, while an amount of Rs. 186.49 billion was deposited at the Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.50%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating to

Rs. 299.60/299.75 against its previous day’s closing level of

Rs. 297.80/298.20.

The total USD/LKR traded volume for 31 January was $ 109.83 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)