Saturday Feb 28, 2026

Saturday Feb 28, 2026

Tuesday, 28 May 2024 01:23 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market on 22 May 2024 kicked off the week on a subdued note, with thin overall transaction volumes and yields edging up on sporadic bouts of selling interest. Overall, market participants were observed adopting a wait-and-see approach ahead of the monetary policy announcement due today.

The secondary bond market on 22 May 2024 kicked off the week on a subdued note, with thin overall transaction volumes and yields edging up on sporadic bouts of selling interest. Overall, market participants were observed adopting a wait-and-see approach ahead of the monetary policy announcement due today.

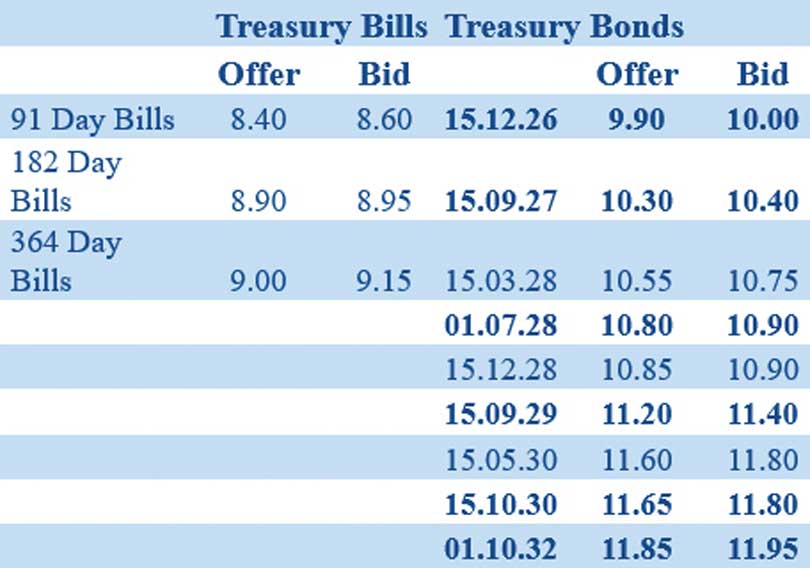

Limited trades were observed on select maturities. Notably, the yield on the liquid 01.07.28 maturity was seen creeping from 10.80% to 10.85% on moderately active trade. Additionally, the 15.09.27 maturity was seen trading at 10.35% and the medium tenor 01.10.32 maturity was seen trading up from an intraday low of 11.83% to 11.90%.

For context, at the previous monetary policy review announced on 26 March 2024, the Central Bank resumed its monetary easing strategy, cutting policy rates for the sixth time since June 2023. The 50-basis point reduction lowered the Standing Deposit Facility Rate (SDFR) to 8.50% and the Standing Lending Facility Rate (SLFR) to 9.50%, resulting in a cumulative decrease of 700 basis points or 7.00% since June 2023.

A Bloomberg report titled “SRI LANKA PREVIEW: Key Rates Likely to Fall by 50 Bps in May” forecasts that the Central Bank of Sri Lanka (CBSL) will cut its standing deposit and lending rates by 50 basis points to 8% and 9%, respectively, at today’s Monetary Policy Announcement. This expectation is driven by several factors as cited below:

There has been a significant reduction in inflation, which stood at 1.5% year-on-year in April (CCPI), below the 5% target.

Real interest rates are far above the long-term average, necessitating a reduction to stimulate demand.

There has been a sufficient accumulation of foreign exchange reserves, providing a buffer against potential capital outflows resulting from lower rates.

There has been a sufficient accumulation of foreign exchange reserves, providing a buffer against potential capital outflows resulting from lower rates.

The total secondary market Treasury bond/bill transacted volume for 22 May was Rs. 16.57 billion.

In money markets, the weighted average rate on overnight call money was at 8.65% and repo was at 8.74%.

The net liquidity surplus stood at Rs. 182.38 billion yesterday as an amount of Rs. 9.50 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 9.50% against an amount of Rs. 204.85 billion deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%.

Further, the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of a 7 day term reverse repo auction for Rs. 15.00 billion at the weighted average rates of 8.90%.

Forex Market

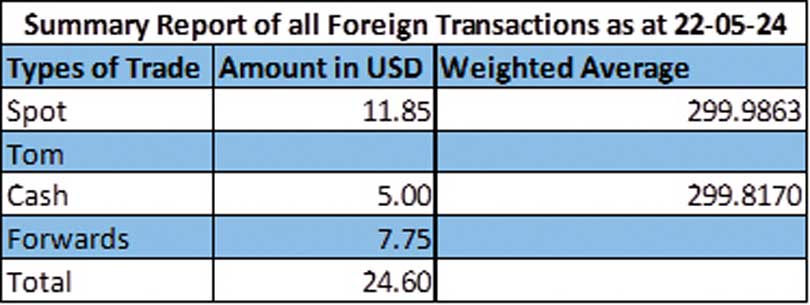

In the Forex market, the USD/LKR rate on spot contracts closed the day edging up marginally, at Rs. 300.50/300.70 against its previous day’s closing level of Rs. 300.10/300.30.

The total USD/LKR traded volume for 22 May was $ 24.60 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking

companies)