Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 2 February 2024 00:12 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yesterday remained active while selling interest drove yields up following eight consecutive trading days of declines. The increase in yields was mainly attributed to the news that Sri Lanka’s external debt private creditors have threatened to lobby the International Monetary Fund to block the next tranche of funding under the Extended Fund Facility program if the Government fails to make sufficient progress regarding their concerns, which weighed down on investor sentiment.

Trading continued to be focused on the popular 2026 (01.02.26, 01.06.26 and 01.08.26) and 2028 (15.01.28, 01.05.28, 01.07.28, 01.09.28, 15.12.28) durations from intraday lows of 12.20% and 13.00% respectively to intraday highs of 12.45% and 13.15%. Trades were also observed on the maturities of the 01.06.25, 15.09.27, 15.05.30, 15.05.31 and 01.07.32 at levels of 11.65% to 12.00%, 13.00%, 13.33% to 13.40%, 13.50% to 13.55% and 13.50% to 13.60% respectively.

The total secondary market Treasury bond/bill transacted volume for 31st January was Rs. 121.67 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 9.14% and 9.46% respectively while the net liquidity stood at a deficit of Rs. 80.04 billion yesterday.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight and 28-day term reverse repo auctions for Rs. 77.03 billion and 30.00 billion at weighted average rates of 9.21% and 10.77% respectively. An amount of Rs. 14.81 billion was withdrawn from Central Banks SLFR (Standing Lending Facility Rate) of 10.00 while an amount of Rs. 11.80 billion was deposited at the SDFR (Standing Deposit Facility Rate) of 9.00%.

Forex Market

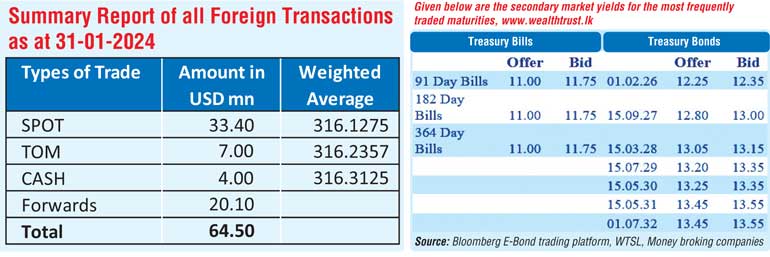

In the Forex market, the USD/LKR rate on spot contracts closed the day appreciating further to Rs. 313.25/313.50 yesterday against its previous day’s closing level of Rs. 315.50/315.70. The rupee continues on its advance, having ended January as the second-best performing currency in the world as per a Bloomberg report.

The total USD/LKR traded volume for 31 January was $ 64.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)