Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 3 September 2024 00:29 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The trading week commenced with secondary bond market yields increasing yesterday, after news broke that Sri Lanka’s international sovereign bondholders stressed the urgent need to implement the Joint Working Framework for bond restructuring by mid-September. Accordingly, tenors beyond 2026 saw its yields rise sharply, mainly on the 01.07.28 maturity to an intraday high of 13.00% against its opening low of 12.90% while the 15.12.28 was traded at 13.05%. However, renewed buying interest was seen kicking in at these elevated levels, which helped cap the rate increase and led to a recovery. The market saw considerable activity with sizeable volumes transacted.

On the very short end of the yield curve, the 01.02.26, 01.06.26, 01.08.26 and 15.12.26 maturities saw yields decline from 10.45% to 10.25%, 11.00% to 10.75%, 11.00% to 10.75% and 11.15% to 10.85% respectively, bucking the trend of the rest of the yield curve.

The total secondary market Treasury bond/bill transacted volume for 30 August was Rs. 9.14 billion.

In money markets, the weighted average rate on overnight call money was at 8.57% and repo was at 8.66%.

The net liquidity surplus stood at Rs. 101.54 billion yesterday as an amount of Rs. 124.07 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.25%.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight reverse repo auction for Rs. 22.53 billion at a weighted average rate of 8.46%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts appreciated to close trading yesterday at Rs. 298.80/299.10 against its previous day’s closing level of Rs. 299.20/299.60.

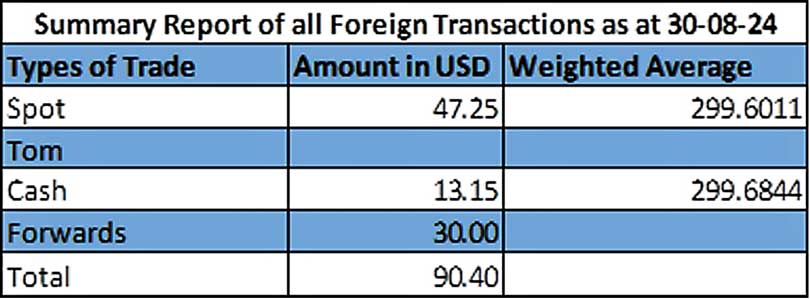

The total USD/LKR traded volume for 30 August was $ 90.40 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)