Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 9 December 2024 00:24 - - {{hitsCtrl.values.hits}}

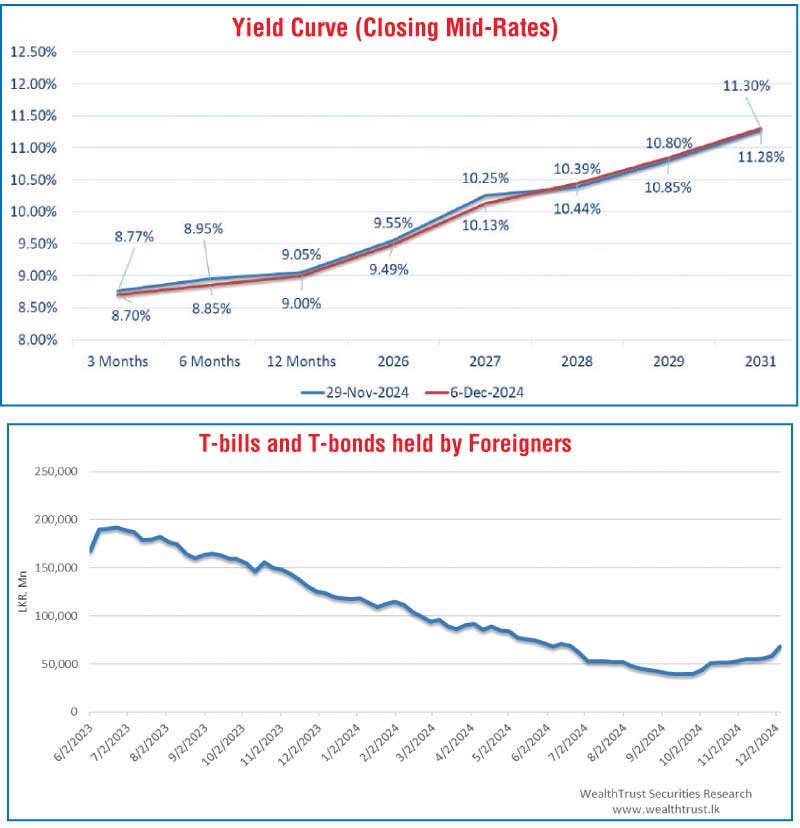

The secondary bond market last week saw yields fluctuate in range bound trading. Notably, 2027 and shorter tenors saw concentrated demand push yields lower; however, the rest of the yield curve was seen edging up slightly at the close of the week on the back of profit taking pressure.

The secondary bond market last week saw yields fluctuate in range bound trading. Notably, 2027 and shorter tenors saw concentrated demand push yields lower; however, the rest of the yield curve was seen edging up slightly at the close of the week on the back of profit taking pressure.

This was despite a midweek recovery that saw yields momentarily decline. As such two-way quotes were seen closing higher week-on-week on tenors over 2027, resulting in a steepening of the yield curve as well. Overall market activity and transaction volumes were observed at healthy levels.

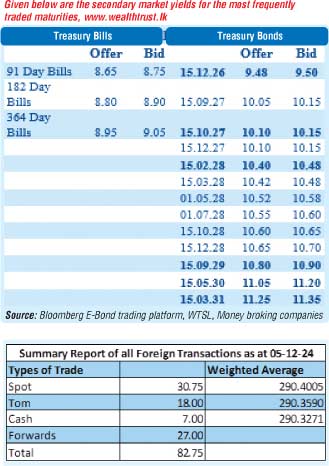

Accordingly, the 15.12.26 maturity was seen trading within the range of 9.50%-9.43%. The 01.05.27, 15.10.27 maturities saw yields decline from intraweek highs to lows of 10.22%-9.95% and 10.32%-10.05% respectively. The 15.02.28, 01.05.28 and 15.10.28 maturities were seen trading within the ranges of 10.57%-10.40%, 10.60%-10.45% and 10.65%-10.60% respectively. The 15.09.29 maturity was observed changing hands within the range of 10.90%-10.80% and the 01.12.31 maturity within the range of 11.43%-11.40%.

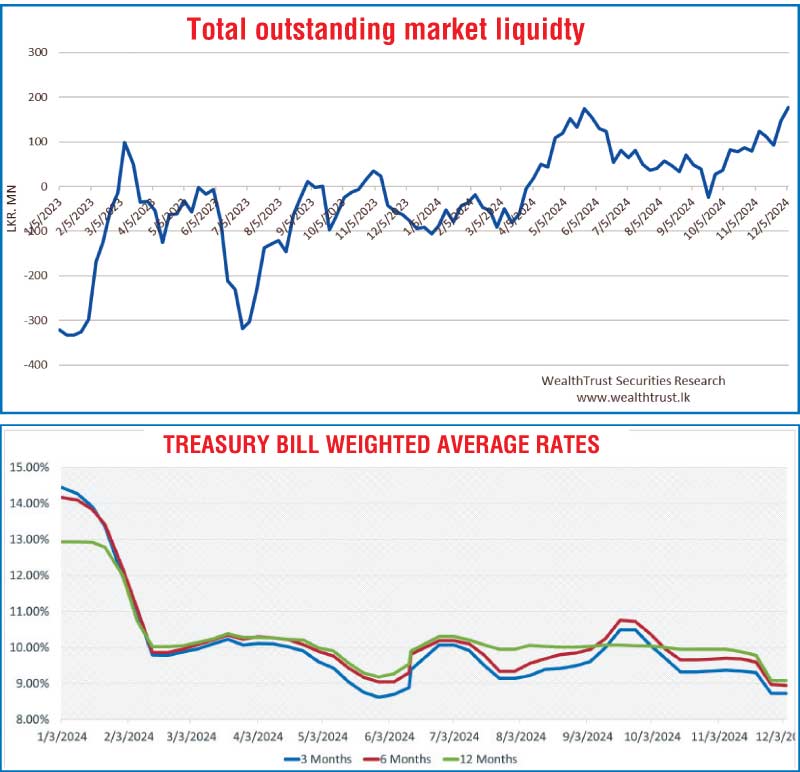

At the weekly Treasury bill auction conducted last Wednesday (4 December), weighted average rates were seen holding broadly steady. This followed three consecutive weeks of decline on all three maturities prior. Accordingly, the weighted average rates on the 91-day tenor remained unchanged at 8.73% and the 364-day tenor at 9.08%. However, the weighted average yield on the 182-day tenor declined by 03 basis points to 8.94%. Total bids received exceeded the offered amount by 2.09 times, and the entire Rs 192.50 billion on offer was successfully raised at the first phase.

For the week ended on 6 December 2024, the foreign holdings in Sri Lankan rupee-denominated Treasury securities saw a net inflow of Rs 9.74 billion, the largest weekly inflow since September 2023. This marked the 12th consecutive week of positive inflows. As a result, total foreign holdings reached Rs 68.15 billion, reaching the highest level in 24 weeks.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 30.15 billion.

In money markets, total outstanding liquidity increased to Rs. 176.87 billion as at the week ending 6 December, up from Rs. 146.91 billion recorded the previous week. As such total outstanding liquidity was seen hitting the highest level recorded since March 2021. The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of overnight reverse repo auctions and a seven-day term reverse repo auctions at weighted average rates of 8.07% to 8.21% respectively. The weighted average interest rate on call money and repo ranged between 8.07% to 8.16% and 8.24% to 8.36% respectively.

The Central Bank of Sri Lanka (CBSL) holding of Government Securities was registered at Rs. 2,515.62 billion as at the 6 December 2024, unchanged from the previous week’s level.

Forex market

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating, to close the week at Rs. 290.40/290.48 as against its previous week’s closing level of Rs. 290.65/290.75 and subsequent to trading at a high of Rs. 290.35 and a low of Rs. 290.70.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 77.58 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)