Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Wednesday, 4 December 2024 00:20 - - {{hitsCtrl.values.hits}}

The secondary bond market yesterday saw yields move up on profit taking pressure, as market participants looked to book profits from the recent bull-run that was set off by the Central Bank monetary policy easing last week. Trading activity and transaction volumes were seen at moderate levels.

The secondary bond market yesterday saw yields move up on profit taking pressure, as market participants looked to book profits from the recent bull-run that was set off by the Central Bank monetary policy easing last week. Trading activity and transaction volumes were seen at moderate levels.

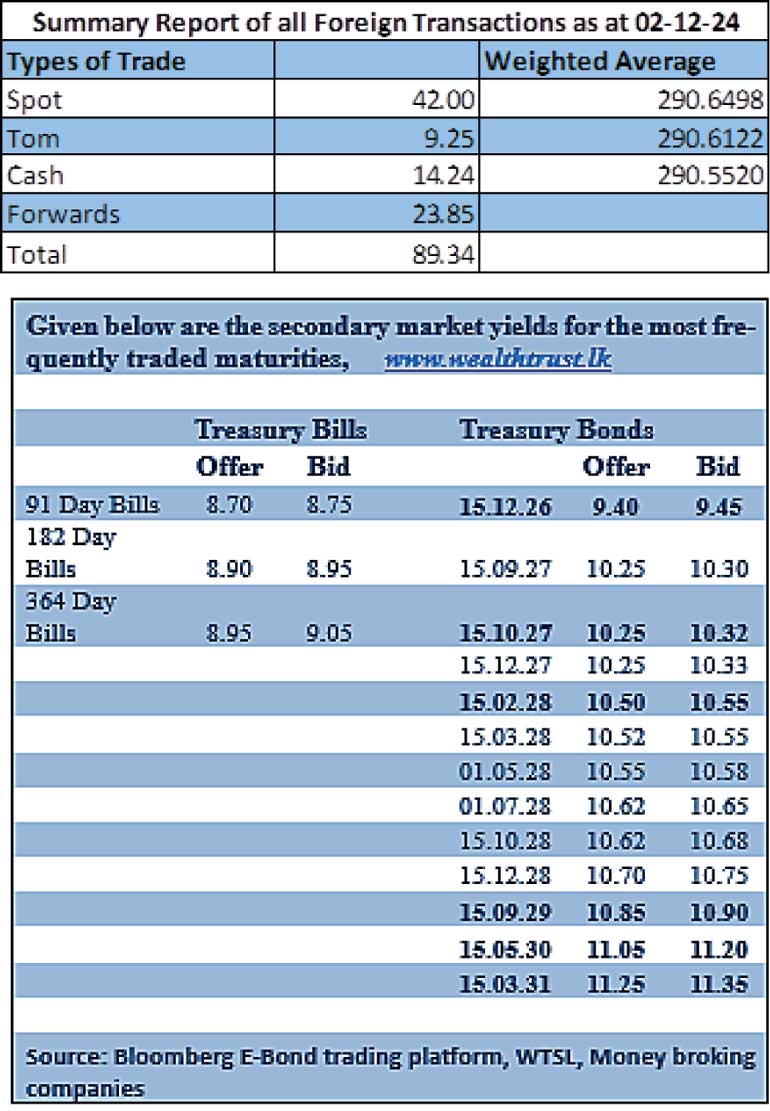

The 15.12.26 maturity was seen trading at the rate of 9.45%, broadly steady. However, the yield on the 01.05.27 maturity was seen increasing from an intraday low to a high of 10.19%-10.22% while the 15.10.27 maturity was seen trading at the elevated rate of 10.32%. The 2028 tenors followed suit, with the bulk of the trading focused on these maturities. The yield on the 15.02.28 and 15.03.28 maturities increased from 10.45% to 10.57% intraday. The 01.05.28, 15.10.28 and 15.12.28 maturities traded up the ranges of 10.50%-10.58%, 10.60%-10.65% and at the rate of 10.70% respectively. This comes ahead of the Treasury bill auction also due today, which will have a total amount of Rs. 192.50 billion on offer, an increase of Rs. 67.50 billion over the previous week. This will consist of Rs. 58.50 billion on the 91-day maturity and Rs. 67 billion each on the 182-day and 364-day maturities.

For reference, at the weekly Treasury bill auction conducted last Wednesday (28), weighted average rates were seen declining steeply following the monetary policy announcement. This marked the third consecutive week where rates were seen declining across the board where the weighted average rate on the 91-day tenor decreased by 57 basis points to 8.73%, the 182-day tenor by 63 basis points to 8.97%, and the 364-day tenor by 70 basis points to 9.08%. Total bids received exceeded the offered amount by 2.85 times, and the entire Rs. 125 billion on offer was successfully raised at the first phase.

The total secondary market Treasury bond/bill transacted volume for 2 December was Rs. 8.86 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.15% and 8.27% respectively. The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight and seven-day term reverse repo auctions for Rs. 23.33 billion and Rs. 50.00 billion at the weighted average rate of 8.07% and 8.21% respectively.

The net liquidity surplus stood at Rs. 127.89 billion yesterday. Rs. 4.10 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.50%, while an amount of Rs. 205.32 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.50%.

Forex market

In the forex market, the USD/LKR rate on spot contracts closed the day appreciating marginally to Rs. 290.50/290.55 as against 290.65/290.70 the previous day.

The total USD/LKR traded volume for 2 December was $ 89.34 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)