Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 12 August 2024 00:30 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market last week saw yields increase further, from already elevated levels, on the back of continued selling pressure. This was attributable to bearish sentiment stemming from the uncertainty around the upcoming presidential election and a continued uptick in yields at primary auction, more prominently at T-bond auctions. This uptick was augmented by foreign selling, as global financial headwinds such as fears of a US recession, caused international investors to take a back foot by exiting emerging markets along with an increase in weighted averages at the weekly Treasury bill auction.

The secondary bond market last week saw yields increase further, from already elevated levels, on the back of continued selling pressure. This was attributable to bearish sentiment stemming from the uncertainty around the upcoming presidential election and a continued uptick in yields at primary auction, more prominently at T-bond auctions. This uptick was augmented by foreign selling, as global financial headwinds such as fears of a US recession, caused international investors to take a back foot by exiting emerging markets along with an increase in weighted averages at the weekly Treasury bill auction.

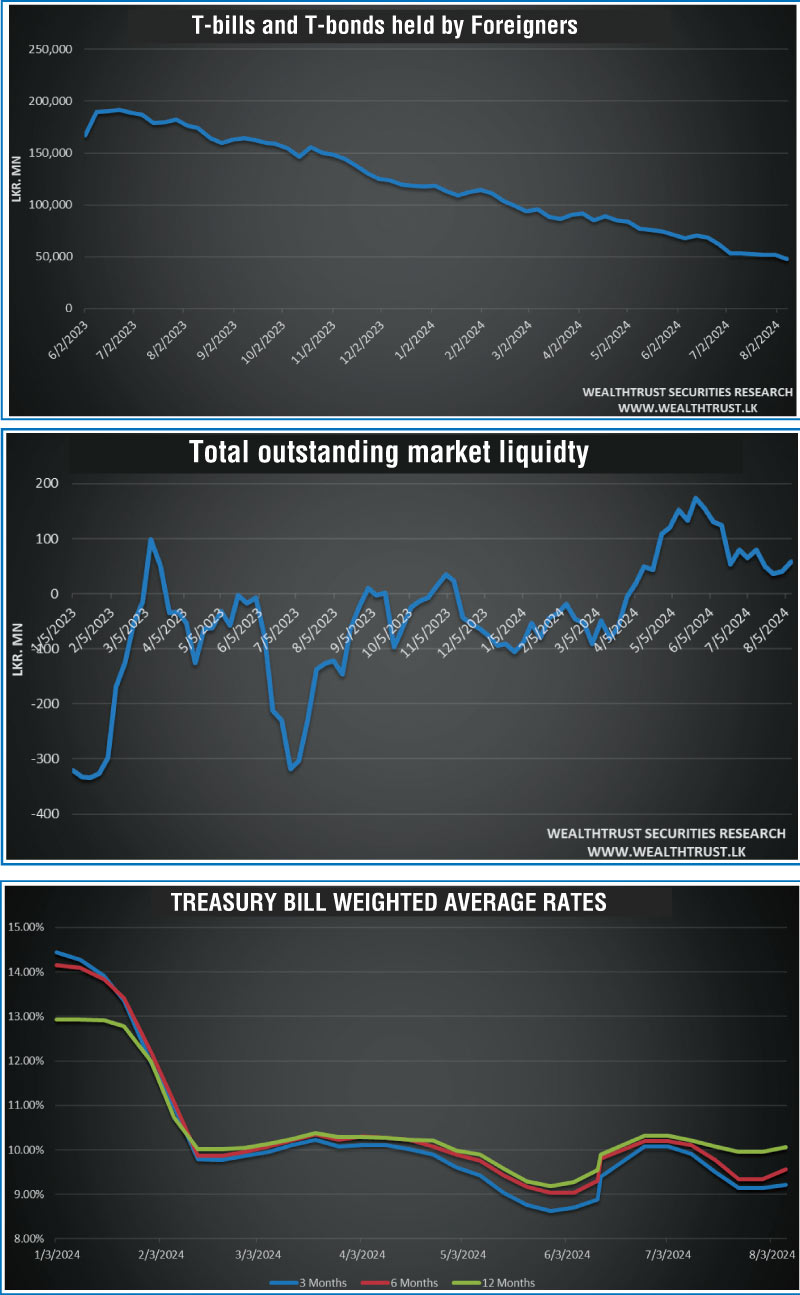

The foreign holding in rupee Treasuries for the week ending 8 August 2024, recorded a net outflow for a fourth consecutive week to the tune of Rs. 3.87 billion. As a result, the overall holding stood at Rs. 48.10 billion. The current levels are now the lowest since March 2023. This marks a drop of 75% since peaking at Rs. 191.91 billion in June of 2023, which followed the initiation of the IMF EFF agreement and the finalisation of the domestic debt optimisation program.

In the secondary bond market, overall activity and transaction volumes were moderate to low, as market participants were seen taking a restrained approach.

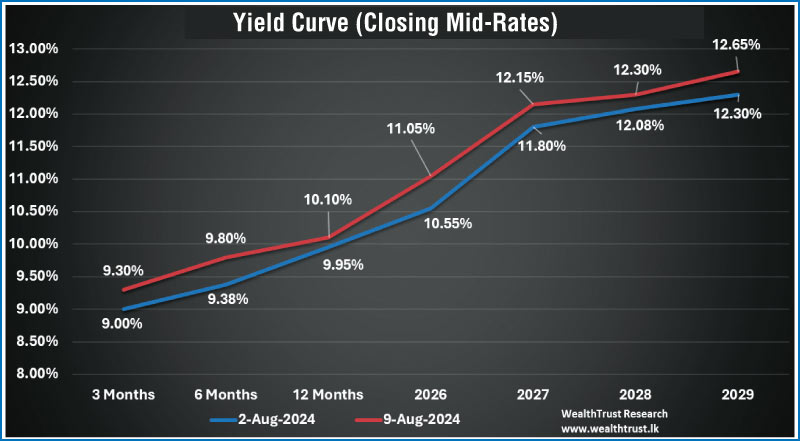

In particular, the short to medium tenor bond (2025-2029 durations) yields increased steeply during the week, which led to activity slowing down by end week while two-way quotes widened. In conclusion, the yield curve was observed shifting upwards and flattening at the elevated levels.

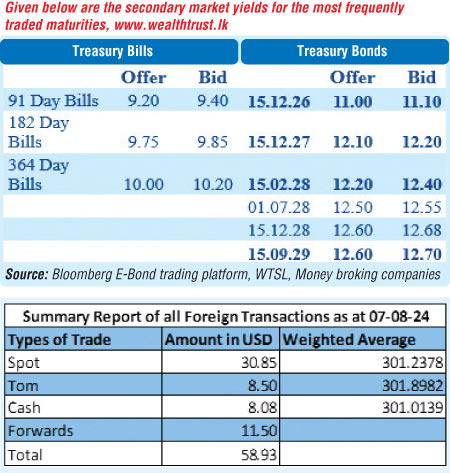

Accordingly, the yield on the 15.12.26 maturity was seen climbing steeply to an intraweek high of 11.05% from an intraweek low of 10.70%. The yield on the 15.12.27 maturity increased to a high of 12.30% against an intraweek low of 11.95%. Similarly, the 2028 tenors followed suit, as yields on the 01.07.28 and 15.12.28 maturities were seen trading up from 12.30% to 12.50% and 12.45% to 12.65% respectively. The 15.09.29 maturity also saw its yield rise from 12.40% to 12.65%. Additionally, the yield on the medium tenor 15.10.30 maturity was observed increasing marginally from 12.805% to 12.85%, showcasing the more pronounced increase on the short end of the curve.

This week, a fresh round of Treasury bond auctions totalling Rs. 60.00 billion is scheduled to be held on Tuesday, 13 August. The auction will comprise of Rs. 45.00 billion from a new 15 June 2029 maturity bearing a coupon of 11.75% and Rs. 15.00 billion from 1 October 2032 maturity bearing a coupon of 9.00%.

For context, the previous round of Treasury bond auctions conducted on 30 July went undersubscribed. An amount of only Rs. 146.26 billion (73.13%) was raised out of the total Rs. 200.00 billion offered, despite total bids exceeding the offer by 1.72 times. The 15.02.28 maturity was fully subscribed and issued at a weighted average yield of 12.07%, above pre-auction rates. The 15.10.30 maturity was undersubscribed and issued at a weighted average rate of 12.55%, also above market expectations. The 01.06.33 maturity was issued at 12.83%, aligned with pre-auction rates but also failed to raise the entire offered amount.

Meanwhile at the weekly Treasury bill auction conducted last Wednesday, weighted average yields increased across the board, reversing a declining trend prior. Accordingly, the rate on the 91-day tenor increased by 08 basis points to 9.22%, the 182-day tenor by 22 basis points to 9.56% and the 364-day tenor by 11 basis points to 10.06%. The auction raised an amount of Rs. 146.18 billion or 94.31% against a total offered amount of Rs. 155.00 billion, at the 1st phase.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 35.68 billion.

In money markets, the total outstanding liquidity surplus increased to Rs. 57.39 billion by the week ending 9 August from its previous week’s surplus of Rs. 40.92 billion. The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of overnight reverse repo auctions and a 7-day term reverse repo auction at weighted average rates of 8.46% to 8.84%. The weighted average interest rate on call money and repo ranged between 8.54% to 8.58% and 8.76% to 8.88% respectively.

The Central Bank of Sri Lankas (CBSL) holding of Government Securities was registered at Rs. 2,575.62 billion on 9 August 2024 unchanged from the previous week’s level.

Forex Market

In the Forex market, the USD/LKR rate appreciated noticeably during the week, closing at Rs. 300.00/300.20, compared to the previous week’s closing level of Rs. 301.95/302.00 and subsequent to trading below Rs. 300.00, at a high of Rs. 299.98 and a low of Rs. 302.40 from the start of the week.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 52.88 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)