Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 5 February 2021 00:03 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

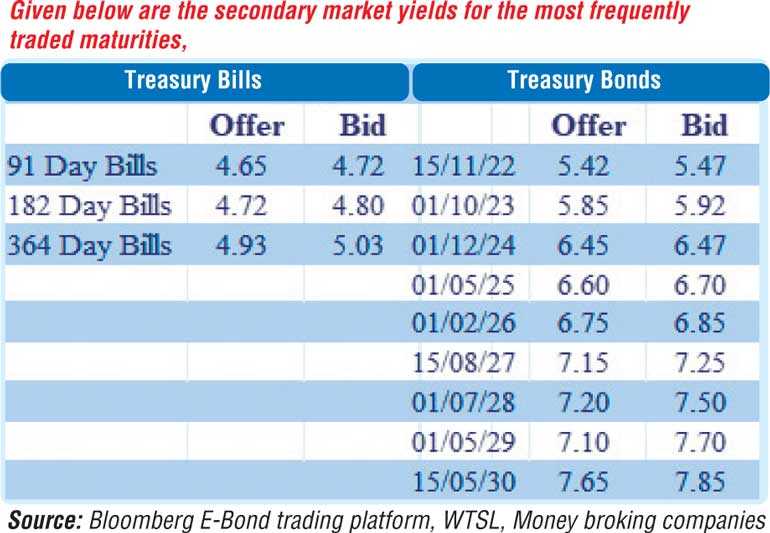

The secondary bond market yields increased yesterday, with the 2022’s (i.e. 01.10.22 and 15.12.22), 01.10.23, 2024’s (i.e. 15.09.24 and 01.12.24) and 01.02.26 maturities hitting highs of 5.43%, 5.45%, 5.85%, 6.37%, 6.47% and 6.80% respectively, when compared with the previous day’s closing level of 5.35/40, 5.40/43, 5.75/80, 6.30/35, 6.37/40 and 6.70/80. Furthermore, limited activity was also witnessed of the 01.08.26 maturity at levels of 6.83% to 6.84%. In the secondary bill market, 23 April maturity changed hands at 4.65%.

The secondary bond market yields increased yesterday, with the 2022’s (i.e. 01.10.22 and 15.12.22), 01.10.23, 2024’s (i.e. 15.09.24 and 01.12.24) and 01.02.26 maturities hitting highs of 5.43%, 5.45%, 5.85%, 6.37%, 6.47% and 6.80% respectively, when compared with the previous day’s closing level of 5.35/40, 5.40/43, 5.75/80, 6.30/35, 6.37/40 and 6.70/80. Furthermore, limited activity was also witnessed of the 01.08.26 maturity at levels of 6.83% to 6.84%. In the secondary bill market, 23 April maturity changed hands at 4.65%.

The total secondary market Treasury bond/bill transacted volumes for 2 February was Rs. 8.05 billion.

In the money market, weighted average rates on overnight call money and repos remained steady at 4.55% and 4.57% respectively with the net surplus liquidity standing at Rs. 113.04 billion.

Rupee appreciates

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating marginally to close the day at Rs. 193.00/194.00 against its previous day’s closing level of Rs. 194.50/196.00, subsequent to trading within a range of Rs. 193.60 to Rs. 195.00.

The total USD/LKR traded volume for 2 February was $ 104.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)