Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 23 June 2023 00:14 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities Ltd

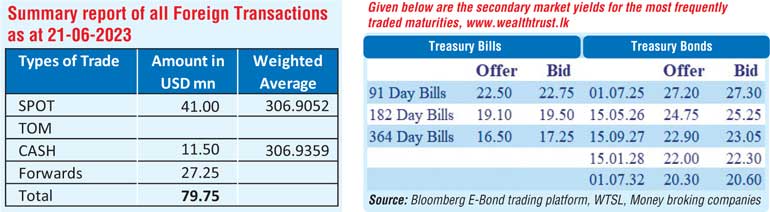

The secondary bond market yields increased yesterday as the liquid maturities of 01.07.25, two 2027’s (i.e., 01.05.27 & 15.09.27) and 01.07.32 hit intraday highs of 27.25%, 23.00% each and 21.00% respectively against its previous day’s closing level of 26.50/65, 22.60/90, 22.60/80 and 19.75/25. In secondary bills, September 2023 and April-May 2024 maturities changed hands at levels of 22.50% and 17.00% to 17.05% respectively.

The total secondary market Treasury bond/bill transacted volume for 21 June 2023 was Rs. 61.41 billion.

In money markets, the weighted average rates on overnight call money and repo were registered at 13.54% and 13.56% respectively as the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of overnight and 6-day reverse repo auctions for a total volume of Rs. 100 billion at weighted average rates of 13.52% and 13.96% respectively. Further an amount of Rs. 74.53 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 14%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen closing the day broadly steady at Rs. 306.75/307.50 subsequent to trading within the range of Rs. 306.50 to Rs. 307 yesterday.

The total USD/LKR traded volume for 21 June was $ 79.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)