Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 29 July 2024 01:48 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

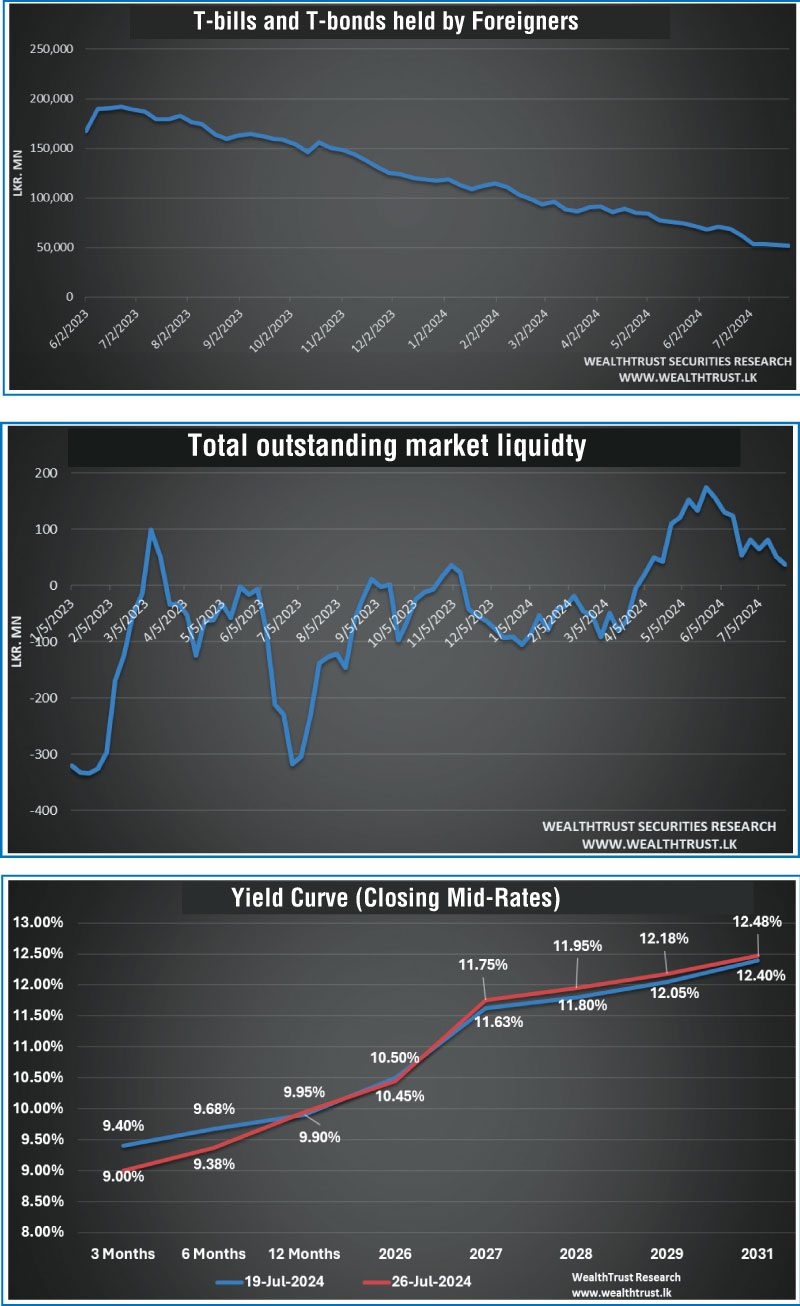

The secondary bond market commenced last week on a subdued note as market participants adopted a watchful stance ahead of the Monetary Policy review. Limited trading activity was observed, and yields remained broadly steady. This sideways trading persisted even after the CBSL delivered the policy rate cut midweek. However, market dynamics shifted following the announcement of the details of the upcoming Rs. 200.00 billion Treasury bond auction and the upcoming Presidential election, leading to an upward movement in yields overall. A notable exception were very short tenor securities (2025-2026 durations) which were seen holding broadly stable. As a result, at the end of the week two-way quotes in the secondary bond market were seen closing higher and the yield curve was observed shifting upwards and steepening.

The secondary bond market commenced last week on a subdued note as market participants adopted a watchful stance ahead of the Monetary Policy review. Limited trading activity was observed, and yields remained broadly steady. This sideways trading persisted even after the CBSL delivered the policy rate cut midweek. However, market dynamics shifted following the announcement of the details of the upcoming Rs. 200.00 billion Treasury bond auction and the upcoming Presidential election, leading to an upward movement in yields overall. A notable exception were very short tenor securities (2025-2026 durations) which were seen holding broadly stable. As a result, at the end of the week two-way quotes in the secondary bond market were seen closing higher and the yield curve was observed shifting upwards and steepening.

Last Wednesday (24) at the 4th monetary policy review for 2024, the Monetary Policy Board of the Central Bank of Sri Lanka resumed monetary easing by reducing its policy rates by 25 basis points. Accordingly, the policy rates were decreased to 8.25% and 9.25% on the Standing Deposit Facility Rate (SLDR) and Standing Lending Facility Rate (SLFR) respectively. However, the Statutory Reserve Ratio (SRR) was kept unchanged at 2.00%. Accordingly, the cumulative reduction in policy rates stand at 725 basis points since the easing cycle began in June 2023.

As per the official press release: The Board aimed to signal the continuation of the eased monetary policy to reduce market lending rates and boost economic activity, given the benign inflation outlook. It stated the decision followed a careful assessment of macroeconomic developments and risks.

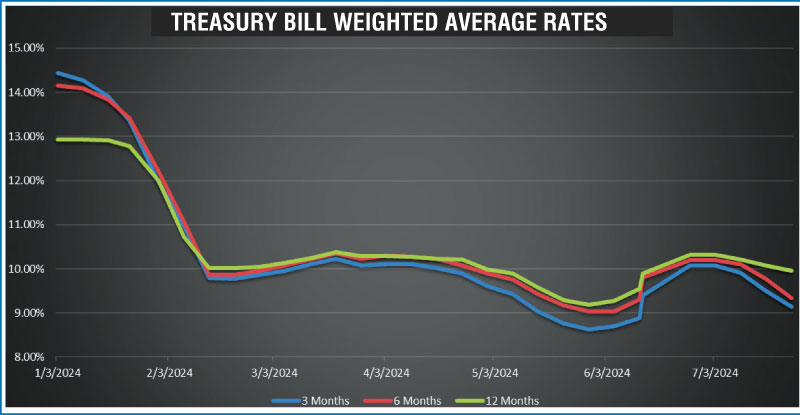

Meanwhile, at the weekly Treasury bill auction also held last Wednesday, the entire Rs. 160.00 billion offered was fully subscribed. This marked the third consecutive week of declining weighted average rates. The 91-day yield dropped by 41 basis points to 9.14%, the 182-day yield fell by 44 basis points to 9.34%, and the 364-day yield decreased by 12 basis points to 9.95%. This outcome also expressed the market inclination towards shorter tenor securities. Resulting in a downward shift in the T-bill section of the yield curve, and a steepening of the overall yield curve.

The upcoming round of Treasury bond auctions with a total of Rs. 200 billion on offer, is due to be held this Tuesday, the 30 July. The auction will comprise of Rs. 80.00 billion from a bond due on 15 February 2028 bearing a coupon of 10.75%, Rs. 80.00 billion from a bond due on 15 October 2030 bearing a coupon of 11.00% and Rs. 40.00 billion from a bond due on 1 June 2033 bearing a coupon of 09.00%.

For context, the previous Rs. 138.00 billion Treasury bond auction held on the 11 of July went undersubscribed. Raising only 95.12% or Rs. 131.27 billion across all phases, despite total bids exceeding the offer by 1.82 times. The 15.12.27 maturity was issued at a weighted average yield of 11.78%, above market expectations. The entire Rs. 58.00 billion offered on the 15.12.27 maturity was taken up at the first phase. The 01.12.31 maturity, issued at a weighted average yield of 12.31%, also exceeded pre-auction rates. However, only Rs. 73.24 billion of the Rs. 80.00 billion offered was raised across both phases. In secondary bonds market, the yield on the 15.12.27 maturity was seen up from an intraweek low of 11.60% to an intraweek high of 11.75%. Similarly, the yield on the 15.02.28 and 01.07.28 maturities were seen moving up to intraweek highs of 11.90% and 11.95% from intraweek lows of 11.70% and 11.80% respectively. This trend extended to medium tenor bonds as well, with the yield on the 15.09.29 and 15.05.30 maturities moving up to intraweek highs of 12.18% and 12.30% from intraweek lows 12.00% and 12.15% respectively. However, very short tenors such as the 01.06.25 maturity saw its yield decline intraweek from 10.15% to 10.00%, while the 01.06.26 maturity saw its yield holding within the range of 10.20% to 10.30%.

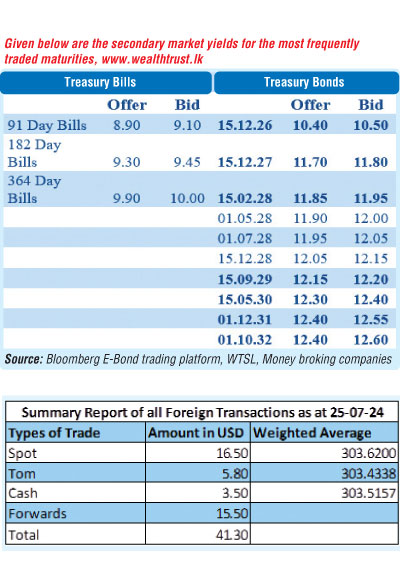

The foreign holding in rupee Treasuries for the week ending 25 July 2024, recorded a net outflow for the second consecutive week to the tune of Rs. 689.00 million. As a result, the overall holding stood at Rs. 51.98 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 24.49 billion.

In money markets, the total outstanding liquidity surplus decreased to Rs. 36.96 billion by the week ending 26 July from its previous week’s surplus of Rs. 50.08 billion. The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of overnight reverse repo auctions and a 7-day term reverse repo auction at weighted average rates of 8.43% to 9.03%. The weighted average interest rate on call money and repo ranged between 8.54% to 8.76% and 8.62% to 8.91% respectively.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,575.62 billion at 26 July 2024 down from the previous week’s level of Rs. 2,595.62 billion.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating during the week to close the week at Rs. 303.10/303.20 against its previous week’s closing level of Rs. 303.55/303.65 and subsequent to trading at a high of Rs. 303.05 and a low of Rs. 304.00.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 40.43 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)