Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Friday, 27 September 2024 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market rallied once again yesterday, extending its bullish streak to a fourth straight session. A wave of aggressive buying sent yields plummeting to new lows, fuelled by elevated market activity and a flurry of high-volume trades.

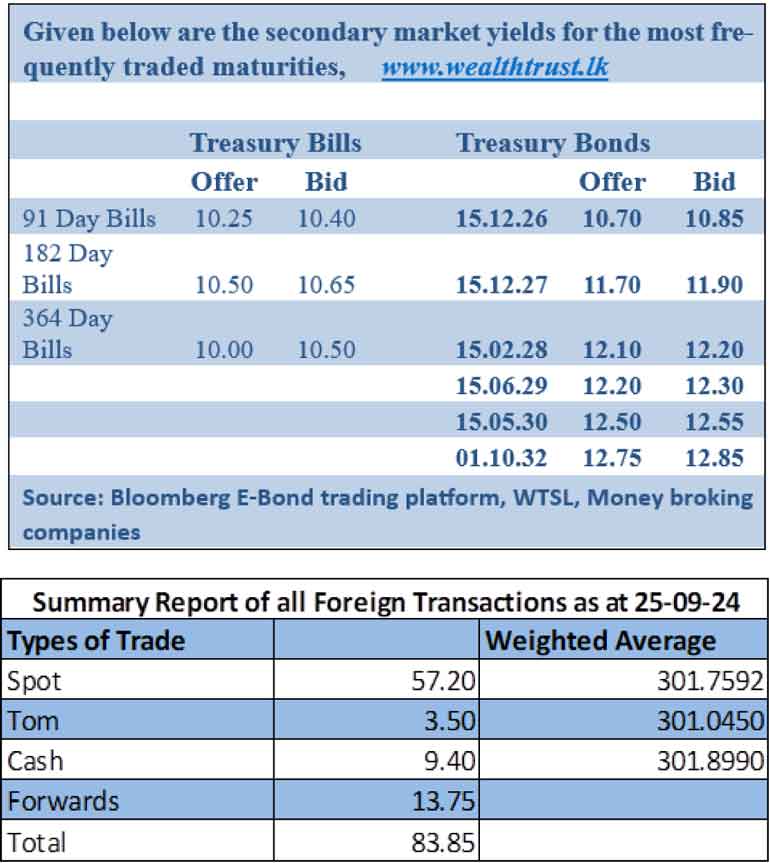

Yields on the 2028 tenors, notably the liquid 15.02.28 maturity dropped to an intraday low of 12.00%, down from a high of 12.30%. Likewise, the popular 15.06.29 and 15.09.29 maturities saw yields fall sharply, from 12.50% to 12.18% and from 12.36% to 12.30%, respectively. The shorter tenors – 15.05.26, 01.06.26, and 15.12.26 – traded lower, with yields ranging between 10.80% and 10.50%. Meanwhile, yields on the 15.09.27 and 15.12.27 maturities dropped, slipping from 11.80% to 11.64%. Additionally, trades were observed on the medium tenor 15.05.30/15.10.30 maturities trading down from 12.54% to 12.50%.

Much of the activity concentrated on the recently auctioned bonds, particularly the 15.02.28 and 15.06.29 maturities, which were issued at the weighted average rates of 13.79% and 13.98% respectively on the 12 September. Reflecting a decrease of around 180 basis points in a period of just two weeks.

This comes ahead of the highly anticipated 5th Monetary Policy Review announcement for the year 2024, due today at 7.30 a.m., 27 September 2024.

For reference, at the 4th Monetary Policy Review for 2024 (24 July 2024), the Monetary Policy Board of the Central Bank of Sri Lanka resumed monetary easing by reducing its policy rates by 25 basis points. Accordingly, the policy rates were decreased to 8.25% and 9.25% on the Standing Deposit Facility Rate (SLDR) and Standing Lending Facility Rate (SLFR) respectively. However, the Statutory Reserve Ratio (SRR) was kept unchanged at 2.00%. Accordingly, the cumulative reduction in policy rates stood at 725 basis points since the easing cycle began in June 2023.

The total secondary market Treasury bond/bill transacted volume for 25 September was Rs. 68.26 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.61% and 8.95% respectively. The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight repo auction for Rs. 20.09 billion at a weighted average rate of 8.58%.

The net liquidity surplus stood at Rs. 82.96 yesterday. An amount of Rs. 5.66 billion was withdrawn from the Central Banks SLFR (Standing Lending Facility Rate) of 9.25% as against an amount of Rs. 108.70 billion deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.25%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day considerably higher at Rs. 299.90/300.10 against its previous day’s closing level of Rs. 300.30/300.80.

The total USD/LKR traded volume for 25 September was $ 83.85 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)