Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 23 March 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

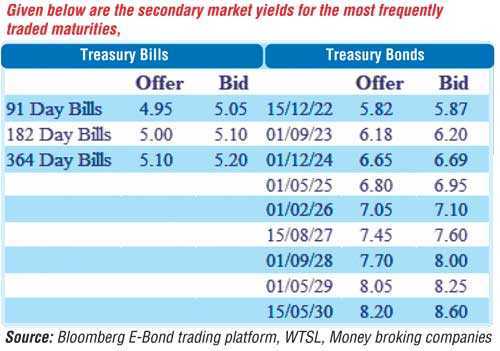

The fresh trading week commenced on a lacklustre note as secondary bond market yields remained mostly unchanged yesterday. The maturities of 2022’s (i.e. 01.10.22 and 15.12.22), 15.01.23, other 2023’s (i.e. 15.05.23 and 15.07.23), 01.01.24, 15.06.24 and 01.12.24 changed hands at levels of 5.83% to 5.85%, 5.95%, 6.15% to 6.20%, 6.40%, 6.56% to 6.60% and 6.65% to 6.68% respectively.

The fresh trading week commenced on a lacklustre note as secondary bond market yields remained mostly unchanged yesterday. The maturities of 2022’s (i.e. 01.10.22 and 15.12.22), 15.01.23, other 2023’s (i.e. 15.05.23 and 15.07.23), 01.01.24, 15.06.24 and 01.12.24 changed hands at levels of 5.83% to 5.85%, 5.95%, 6.15% to 6.20%, 6.40%, 6.56% to 6.60% and 6.65% to 6.68% respectively.

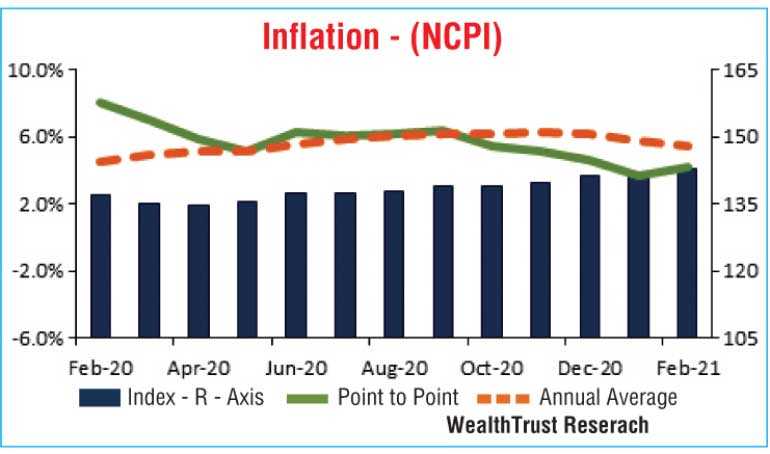

In the meantime, National Consumer Price Index (NCPI) for the month of February increased for the first time in five months to 4.2% on point to point when compared against its previous month’s figure of 3.7%, while its annual average decreased further to 5.5% from 5.8%.

The total secondary market Treasury bond/bill transacted volume for 19 March was Rs. 5.75 billion.

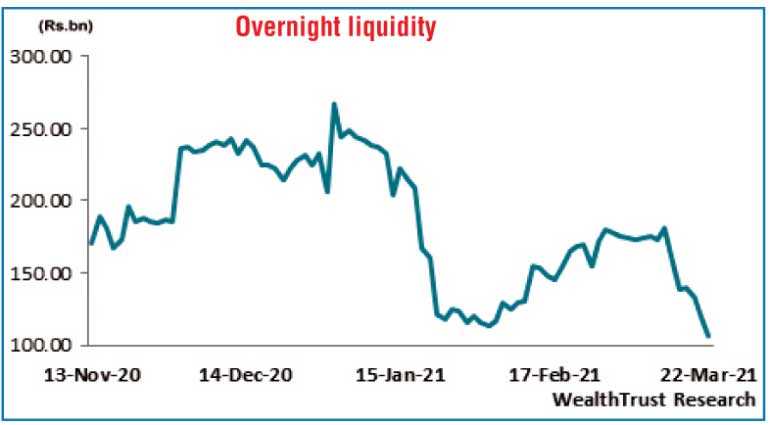

In money markets, Rs. 127.19 billion was seen deposited at Central Banks SDFR of 4.50% while an amount of Rs. 20.50 billion was withdrawn from it SLFR of 5.50% resulting in a net liquidity surplus of Rs. 106.69 billion, which was over a nine-month low. The weighted average rates on call money and repo registered at 4.55% and 4.58% respectively.

USD/LKR

In the Forex market, USD/LKR rate on the more active one-week forward contracts were seen closing the day at Rs. 199/199.50 in comparison to its previous day’s closing level of Rs. 198/199.

The total USD/LKR traded volume for 19 March was $ 59.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies