Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 28 August 2024 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yesterday, initially saw yields decline on the back of strong buying interest.

The secondary bond market yesterday, initially saw yields decline on the back of strong buying interest.

This was attributable to a knee-jerk reaction to a revision to the Tentative Treasury Bond Issuance/ Settlement Calendar, which saw a reduction in offered volumes. Notably, the cancellation of a Rs. 30 b Treasury bond auction which was due to be held on 29 August. However, profit taking selling pressure soon kicked in and drove yields back up, to close broadly steady. Majority of the activity was focused on the earlier hours of the day, with the market virtually in a lull state after.

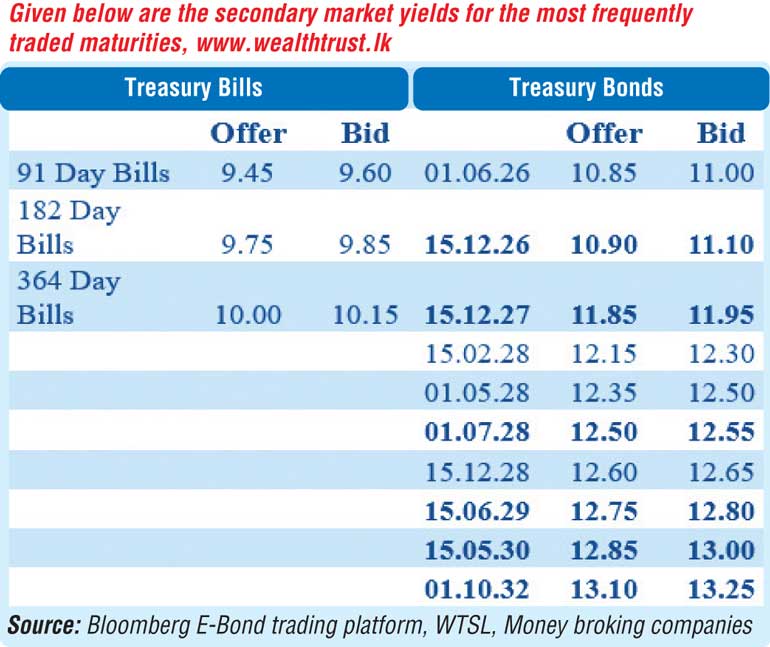

Accordingly, the 01.07.28 maturity was seen trading within the range of 12.60 % to 12.50 %, while the 01.05.28 maturity was seen trading within the range of 12.40 % to 12.35 %. The 15.06.29 and 15.09.29 maturities were seen trading at the rate of 12.75 %.

In contrast, secondary market Treasury bills continued to see demand with November 2024 (close to three months) maturities changing hands within the range of 9.65 % to 9.70 % and February 2025 (close to 6 months) maturities at 9.80 %. Additionally, June 2025 maturities were seen trading at the rate of 10.10 %.

The Treasury bill auction due today will have a total amount of Rs. 100 billion on offer, a reduction of Rs. 20 billion over its previous week. This will consist of Rs. 50 billion on the 91-day, Rs. 30 billion 182-day and Rs. 20 billion on the 364-day maturity. For context, last Wednesday’s Treasury bill auction saw mixed results. The weighted average yields on the shorter tenor securities were seen increasing for the second consecutive week. Accordingly, the rate on the 91-day tenor increased by 03 basis points to 9.42 % and the 182-day tenor by 12 basis points to 9.80 %. In contrast, the 364-day tenor saw its weighted average dip marginally by 02 basis points to 10.01 %, declining for the second week. Despite these varied outcomes, the entire Rs. 120.00 billion on offer was raised at the first phase. The total bids received exceeded the offered amount by 1.94 times.

The Treasury bill auction due today will have a total amount of Rs. 100 billion on offer, a reduction of Rs. 20 billion over its previous week. This will consist of Rs. 50 billion on the 91-day, Rs. 30 billion 182-day and Rs. 20 billion on the 364-day maturity. For context, last Wednesday’s Treasury bill auction saw mixed results. The weighted average yields on the shorter tenor securities were seen increasing for the second consecutive week. Accordingly, the rate on the 91-day tenor increased by 03 basis points to 9.42 % and the 182-day tenor by 12 basis points to 9.80 %. In contrast, the 364-day tenor saw its weighted average dip marginally by 02 basis points to 10.01 %, declining for the second week. Despite these varied outcomes, the entire Rs. 120.00 billion on offer was raised at the first phase. The total bids received exceeded the offered amount by 1.94 times.

The total secondary market Treasury bond/bill transacted volume for 26 August was Rs. 6.26 billion.

In money markets, the weighted average rate on overnight call money was at 8.56% and repo was at 8.70%.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight and 7-day term reverse repo auction for Rs. 17.13 billion and Rs. 40.00 billion at the weighted average rates of 8.49 % and 9.08 % respectively.

The net liquidity surplus stood at Rs. 46.15 billion yesterday as an amount of Rs. 103.28 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.25%.

Forex Market

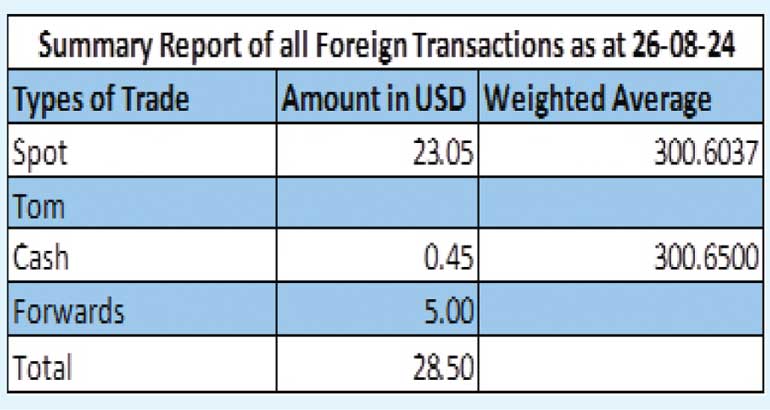

In the Forex market, the USD/LKR rate on spot contracts appreciated significantly to close trading yesterday at Rs. 300.00/300.30 against its previous day’s closing level of Rs. 300.80/301.20.

The total USD/LKR traded volume for 26 August was $ 28.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)