Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 2 September 2024 00:27 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market in terms of its activity levels, started off on a slow note last week but picked up somewhat during the week ending 30 August. Yields overall initially declined due to strong buying interest following a revision to the Tentative Treasury bond Issuance/Settlement Calendar, which saw a reduction in the offered volume for 12 September auction (Rs. 300 billion down to Rs. 290 billion) and included the cancellation of a Rs. 30 billion Treasury bond auction which was scheduled for 29 August (last Thursday). However, profit-taking and selling pressure stemming from uncertainties around the upcoming presidential election led to a reversal, with yields increasing week-on-week.

The secondary bond market in terms of its activity levels, started off on a slow note last week but picked up somewhat during the week ending 30 August. Yields overall initially declined due to strong buying interest following a revision to the Tentative Treasury bond Issuance/Settlement Calendar, which saw a reduction in the offered volume for 12 September auction (Rs. 300 billion down to Rs. 290 billion) and included the cancellation of a Rs. 30 billion Treasury bond auction which was scheduled for 29 August (last Thursday). However, profit-taking and selling pressure stemming from uncertainties around the upcoming presidential election led to a reversal, with yields increasing week-on-week.

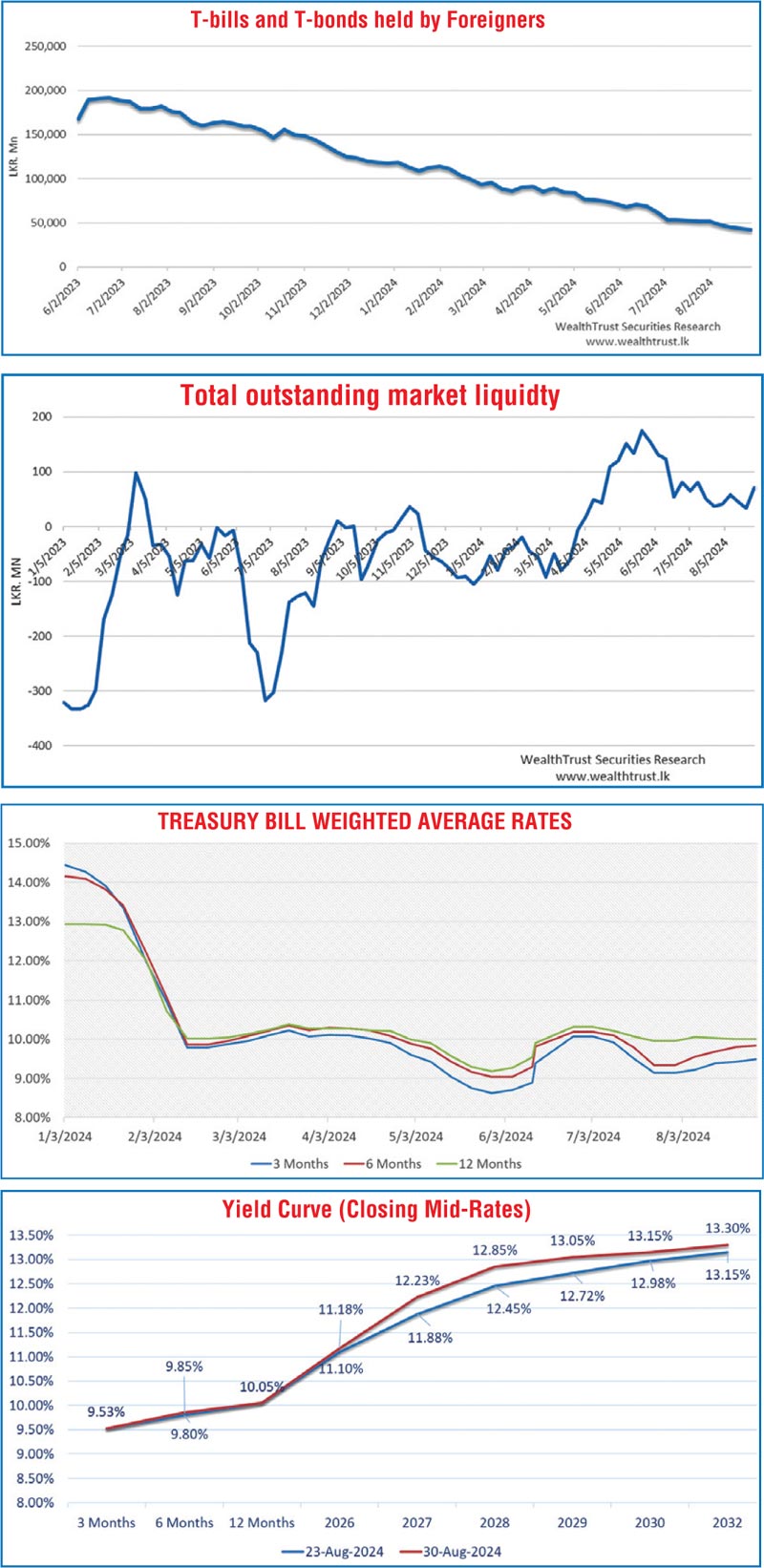

The 2026 tenors remained relatively stable as selling interest was not seen on shorter-duration bonds amidst the prevailing volatility. For example, the 15.12.26 maturity traded within a narrow range of 11.05% to 11.15%, resulting in shorter tenor bonds closing the week broadly steady. In contrast, the rest of the yield curve experienced some volatility. The 2028 tenors saw a rise in yields, with rates on the 15.02.28 and 15.03.28 maturities climbing from intraweek lows of 12.45% to highs of 12.65%. The 01.07.28 maturity followed a similar trend, increasing from an intraweek low of 12.50% to 12.85%. Yields on the 15.06.29 and 15.09.29 maturities also rose sharply, from intraweek lows of 12.70% and 12.75% to highs of 12.95% and 12.98%, respectively. Additionally, the medium-term 15.05.30 and 15.10.30 maturities traded within a range of 13.00% to 13.14%, while the 01.07.32 maturity increased from 13.25% to 13.35%.

As a result, at the close of the week, the yield curve was observed shifting upwards on durations beyond 2026. Market activity was sporadic, while transaction volumes were moderate, as overall market conditions were relatively subdued.

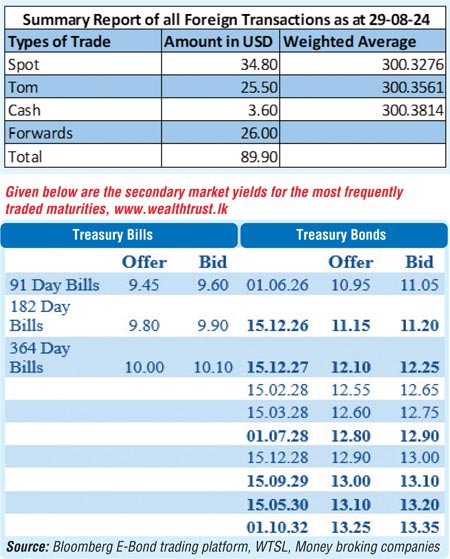

Meanwhile, the weekly Treasury bill auction conducted last Wednesday, saw yields on shorter tenors rise for the third consecutive week, with the 91-day and 182-day tenors increasing by 7 and 4 basis points to 9.49% and 9.84%, respectively. In contrast, the 364-day tenor remained steady at 10.01%. The auction fully raised the Rs. 100 billion on offer, with bids exceeding the amount offered by 1.86 times. Notably, 97% of the funds were secured through the 91- and 182-day tenors, both of which raised more than their respective offered amounts, while the 364-day maturity saw less demand.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 65.74 billion.

The foreign holding in rupee Treasuries continued to steadily decline, recording a net outflow for the seventh straight week, amounting to of Rs. 1.46 billion for the week ending 29 August 2024. As a result, the overall holding stood at Rs. 42.07 billion, falling to the lowest levels since February 2023.

In money markets, the total outstanding liquidity surplus increased steeply to Rs. 71.04 billion by the week ending 30 August as compared to a surplus of Rs. 33.98 billion from the previous week. The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of overnight reverse repo auctions and a 7-day term reverse repo auction at weighted average rates of 8.47% and 9.08% respectively. The weighted average interest rate on call money and repo ranged between 8.52% to 8.75% and 8.65% to 8.74% respectively.

The Central Bank of Sri Lankas (CBSL) holding of Government Securities was seen closing the week ending 30 August at Rs. 2,555.62 billion, unchanged against the previous week’s level.

On the inflation front, the Colombo Consumer Price Index - CCPI (Base: 2021=100) for the month of August 2024 decelerated to 0.50% on a year-on-year basis as against 2.40% recorded in July 2024. This undershot both a Bloomberg forecast of 1.90% and the Central Bank of Sri Lanka’s target of 5.00% (as it has since March). The deceleration was partly attributable to a reduction in electricity tariffs by 22.50% in July, lower food prices and lower impact from the statistical base effects.

Despite some volatility during the week, the USD/LKR rate closed at Rs 299.20/299.60, subsequent to trading at a high of Rs. 298.35 and a low of Rs. 301.40, appreciating in comparison to its previous week’s closing level of Rs. 299.70/300.00.

The daily USD/LKR average traded volume for the first four trading days of the week stood at a healthy $ 69.70 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)