Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 29 January 2025 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market saw activity and transaction volumes increase, while yields were seen holding broadly steady.

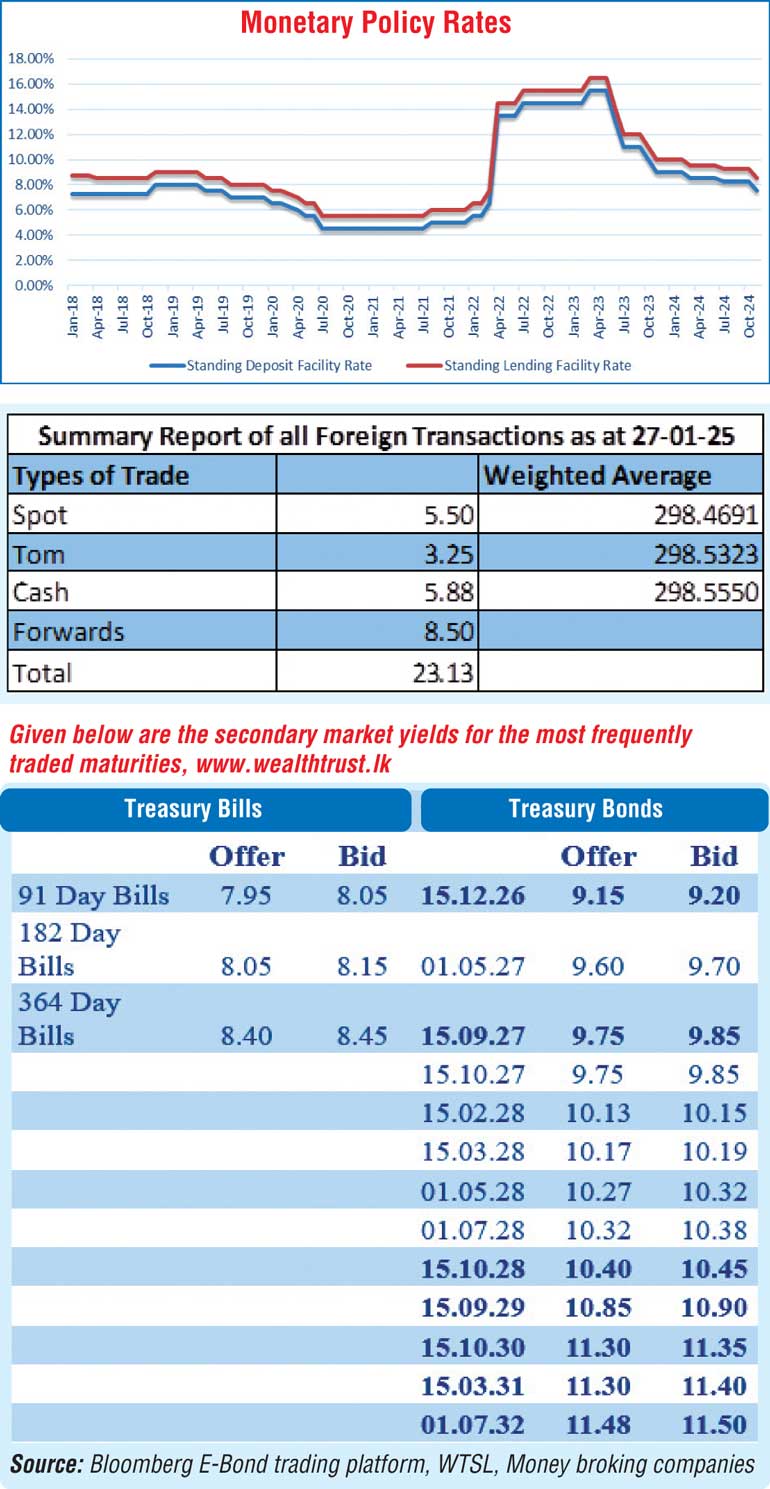

The 01.02.26, 15.05.26 and 01.08.26 were seen trading at the rates of 8.50%, 8.80% and 8.85%-8.90% respectively. The 01.05.27 and 15.06.27 maturities were seen trading at the rates of 9.67% to 9.65% and 9.70%-9.75% respectively. The 15.02.28 and 15.03.28 maturities were seen changing hands at the rates of 10.14%-10.15% and 10.17%-10.18% respectively. The 15.09.29 maturity was seen transacting at the rate of 10.90%. The medium tenor 15.10.30, 15.03.31 and 01.07.32 maturities saw strong interest with trades at the rates of 11.30%-11.35%, 11.31% and 11.46%-11.49% respectively. The medium tenor end of the yield curve was observed bunching up.

Meanwhile in secondary market bills, May (a little over 3 months), July (approximately 6 months) and December 2025 (close to 1 year) maturities were seen trading at the rates of 8.03%, 8.15%-8.10% and 8.58%-8.45%.

This comes ahead of an action-packed week. Firstly, today will see the inaugural Monetary Policy Announcement for the Year 2025.

For context, at the sixth and final Monetary Policy Announcement of 2024, the Central Bank of Sri Lanka (CBSL) introduced a significant policy shift by adopting a single policy interest rate mechanism. This move replaced the Standing Lending Facility Rate (SLFR) and Standing Deposit Facility Rate (SDFR) with a new Overnight Policy Rate (OPR) as the primary monetary policy tool.

The OPR is designed to steer the Average Weighted Call Money Rate (AWCMR) towards the announced target. As of this policy review, the OPR was set at 8.00%, positioned 50 basis points below the prevailing AWCMR at that time.

Additionally, adjustments were made to the Standing Facilities, with the SLFR set at 8.50% and the SDFR at 7.50%, reflecting a 75-basis point reduction and resulting in further easing. This decision contributed to a cumulative 800 basis points reduction in standing facility rates since the easing cycle began in June 2023.

As per the official press release for the previous MPA: The Board stated that the decision to ease monetary policy was after a comprehensive assessment of economic conditions, aiming to guide inflation towards the 5% target while supporting growth. The decision was driven by stronger-than-expected deflationary pressures, declining inflation expectations, improving external sector conditions, and limited room for further reductions in market lending rates.

In an article titled “Sri Lanka Preview: Three reason rates likely on hold in January” Bloomberg Economics opined that The Central Bank of Sri Lanka is likely to hold its policy rate at 8.00% at its 29 Jan. meeting citing three key reasons:

Temporary deflation: They believe recent price declines will reverse, with inflation returning by May and stabilising at 5% by end-2025. CBSL is expected to overlook short-term price movements, viewing deflation as a correction of past price surges.

Risk of overheating: Further easing, they argue, could push real rates below the neutral 2.5%-3.0% range in 2026, potentially triggering excessive imports and draining FX reserves.

Closing output gap: Analysts suggest the negative output gap will close by end-2025 without additional monetary easing, reducing the need for further rate cuts.

This comes ahead of the Treasury bill auction also due today, which will have a total amount of Rs. 182.50 billion on offer, an increase of Rs. 27.50 billion over the previous week. This will consist of Rs. 42.50 billion on the 91-day maturity, Rs 60.00 billion on the 182-day and Rs. 80.00 billion on the 364-day maturity.

For reference, at the last Treasury bill auction on 22/01/2025, weighted average rates declined across all three maturities for the seventh consecutive week.

91-day: ↓ 21 bps to 8.12%

182-day: ↓ 19 bps to 8.25%

364-day: ↓ 17 bps to 8.63%

Total bids exceeded the

Rs. 155 billion offer by 2.91 times, securing full subscription in Phase 1. A heavily oversubscribed Phase 2 raised an additional Rs. 15.50 billion, out of a massive Rs. 189.33 billion market interest.

In addition, the details of the upcoming Treasury bond auction, with a total offered amount of Rs. 40.00 billion scheduled for 30 January (this Thursday), have been announced. The auction will be comprised of:

Rs. 25.00 billion: Maturing on 15 December 2029, with a coupon rate of 11.00%.

Rs. 15.00 billion: Maturing on 1 June 2033, with a coupon rate of 09.00%.

The total secondary market Treasury bond/bill transacted volume for 27 January was Rs. 7.80 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.00% and 8.06% respectively. The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of a six-day term repo auction for Rs. 10.00 billion at the weighted average rate of 8.14%.

The net liquidity surplus stood at

Rs. 158.86 billion yesterday. No funds were withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.50%, while an amount of

Rs. 168.86 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.50%.

Forex market

In the forex market, the USD/LKR rate on spot contracts closed the day appreciating significantly to

Rs. 297.05/297.15 against its previous day’s closing level of Rs. 298.50/298.60.

The total USD/LKR traded volume for 27 January was

$ 23.13 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)