Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 10 February 2025 02:14 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

The secondary bond market started off last week with yields edging up, carrying over the slight upward momentum from the tail-end of the previous week. Subsequently, a recovery was seen on the back of renewed buying interest kicking in at the elevated levels, which was further supported by the outcome at the weekly Treasury Bills auction. In effect yields were seen moving mostly sideways in range bound trading during the week to close broadly steady week on week. Overall transaction volumes and activity were seen at healthy levels.

The secondary bond market started off last week with yields edging up, carrying over the slight upward momentum from the tail-end of the previous week. Subsequently, a recovery was seen on the back of renewed buying interest kicking in at the elevated levels, which was further supported by the outcome at the weekly Treasury Bills auction. In effect yields were seen moving mostly sideways in range bound trading during the week to close broadly steady week on week. Overall transaction volumes and activity were seen at healthy levels.

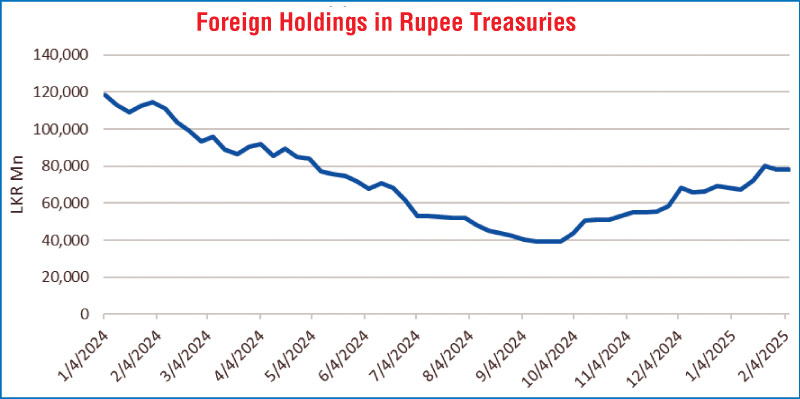

The shorter tenor 01.06.25 and 01.07.25 maturities were seen trading within the range of 8.05%-8.00%. The 2026 tenor 01.08.26 maturity was seen trading at the rate of 8.80% and the 01.05.27 maturity within the range of 10.60%-10.57%.

Majority of the action was focused on the 2028 tenors. The early 2028 tenor 15.02.28 maturity was seen trading within the range of 10.19%-10.14% during the week. The mid-2028 tenor 01.05.28 maturity was seen trading within the range of 10.30%-10.26%. The late-2028 tenor 15.10.28 maturity was seen trading within the range of 10.42%-10.39%.

In addition, the 15.09.29 maturity saw trades within the range of 10.90%-10.84% while the 15.10.30 maturity within the range of 11.30%-11.26%.

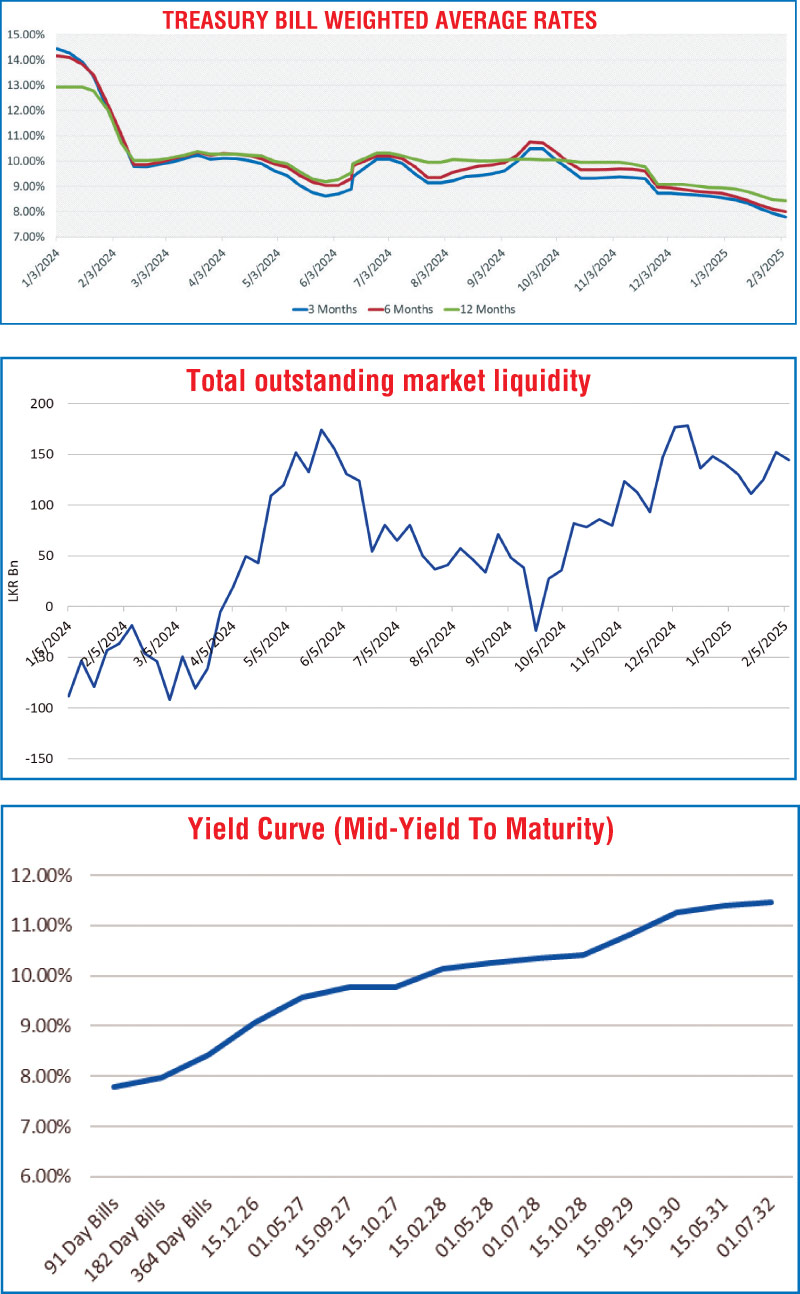

At the weekly Treasury Bill auction held last Wednesday (07), the weighted average rates declined across all three offered maturities for the ninth consecutive week. As such rates were seen continuing on an overall downward trajectory, with a reduction in yields observed on at least one tenor over the last 13 weeks. Accordingly, the weighted average rates on the 91-day tenor dropped by 14 basis points to 7.79%, the 182-day tenor by 09 basis points to 8.00% and the 364-day tenor by 04 basis point to 8.43%. Total bids received exceeded the offered amount by 2.22 times, and the entire Rs. 180.00 billion on offer was successfully raised at the first phase in competitive bidding. The demand extended to the second phase which was also oversubscribed and raised the maximum offered amount of Rs 18.00 billion.

In addition, the details of the upcoming Treasury Bond auction, with a total offered amount of Rs. 67.5 billion scheduled for 13 February (Thursday), have been announced. The auction will be comprised of:

Rs. 37.50 billion: Maturing on 1 September 2028, with a coupon rate of 11.50%.

Rs. 30.00 billion: Maturing on 15 October 2030, with a coupon rate of 11.00%.

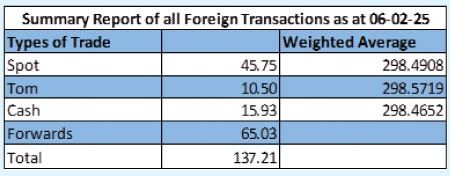

Meanwhile, the foreign holding in Rupee Treasuries recorded a very marginal net outflow of Rs. 10 million for the week ending 6 February 2025, as a result the total holding dipped down to Rs. 77.96 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first three days of the week averaged at

Rs. 41.20 billion.

In money markets, the total outstanding liquidity surplus decreased to Rs. 144.29 billion as at the week ending 7 February 2025, from Rs. 151.96 billion recorded the previous week.

The weighted average interest rate on call money and repo were recorded at 8.00% and 8.01%-8.07% respectively.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,511.92 billion as at 7 February 2025, unchanged from the previous week’s closing level.

Forex market

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating, to close the week at Rs. 297.00/297.50 as against its previous week’s closing level of Rs. 297.80/298.20 and subsequent to trading at a high of Rs. 296.90 and a low of Rs. 300.00.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 82.44 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)