Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 30 October 2023 00:22 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

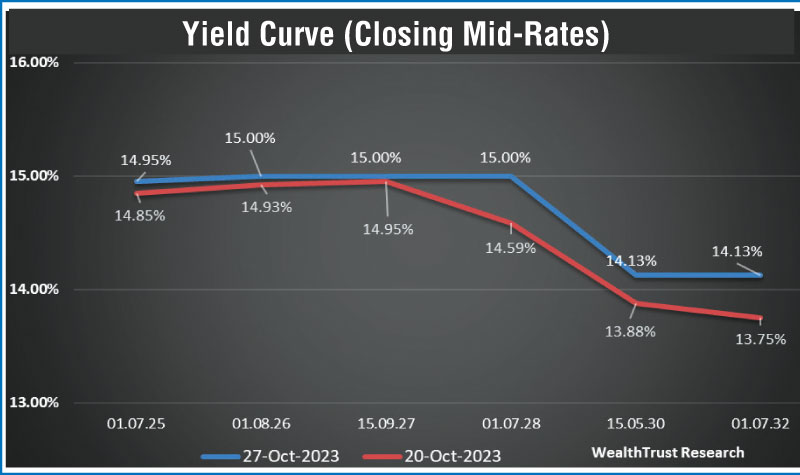

The secondary bond market was off to a lethargic start during the trading week ending 27 October as activity began at a moderate pace compared to the week prior with yields holding broadly steady. Then, the short end of the yield curve comprising of the 2026 and 2028 maturities witnessed mixed signals mid-week and on Thursday as the 2026 yield dipped to an intraweek low of 14.90% while the 2028 yield edged up to 14.80%. Following the bond auction announcement, yields on both tenures moved up on Friday to 15.00% along with two-way quotes on tenures beyond 2028 as well, leading to a flatting of the yield curve. Additionally, trades were seen on the 01.06.25, the two 27’s (i.e., 01.05.27 and 15.09.27) and 01.07.32 maturities at levels of 15.00% to 14.90%, 15.10% to 15.00% and 14.10% respectively.

The secondary bond market was off to a lethargic start during the trading week ending 27 October as activity began at a moderate pace compared to the week prior with yields holding broadly steady. Then, the short end of the yield curve comprising of the 2026 and 2028 maturities witnessed mixed signals mid-week and on Thursday as the 2026 yield dipped to an intraweek low of 14.90% while the 2028 yield edged up to 14.80%. Following the bond auction announcement, yields on both tenures moved up on Friday to 15.00% along with two-way quotes on tenures beyond 2028 as well, leading to a flatting of the yield curve. Additionally, trades were seen on the 01.06.25, the two 27’s (i.e., 01.05.27 and 15.09.27) and 01.07.32 maturities at levels of 15.00% to 14.90%, 15.10% to 15.00% and 14.10% respectively.

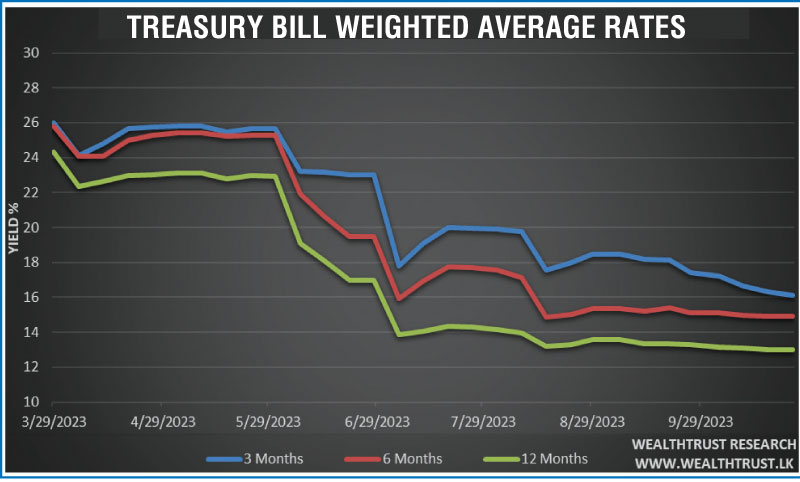

The response for last week’s Treasury Bill auction was a bullish one once again. In particular, the 91-day bill continued to see the most demand, causing its weighted average to drop by 20 basis points, as bids totalled Rs. 114.15 billion against an offered amount of only Rs. 60.00 billion. Accordingly, the weighted average on the 91-day bill dropped to 16.10%, while the 182-day bill dropped by 01 basis point to 14.93% and the 364-day bill remained unchanged at 13.02%. An amount of Rs. 116.50 billion or 86.30% was raised of the total offered amount of Rs. 135 billion at the 1st phase of the auction while an additional amount of Rs. 31.37 billion was raised at the 2nd phase on all three maturities at its respective weighted averages.

The Central Bank of Sri Lanka (CBSL) is due to conduct a round of Treasury Bond auctions today, which will see a total offered amount of Rs. 45 billion. The auctions will have on offer Rs. 22.50 billion each on 15 March 2028 maturity bearing a coupon rate of 10.75% and 15 March 2031 maturity bearing a coupon of 11.25%.

This is a precursor in a fresh round of bond auctions as announced in the tentative advance bond calendar that includes another round due on 13 November which is set to have the largest offered amount in Sri Lanka’s history, amounting to Rs. 250 billion.

For reference, at the previous bond auctions conducted on the 12 October, an amount of Rs. 27.50 billion was taken up in total against a total offered amount of Rs. 25.00 billion which included an additional amount offered through the direct issuance window on the 01.08.2026 maturity. The weighted average rates were recorded at 15.24% and 13.56% on the 01.08.2026 and 15.05.2030 maturities respectively.

The foreign holding in Rupee bonds and bills recorded a decline with a net outflow of 3.60% for the reporting period compared to the week prior. This is in contrast with last week’s large net foreign inflow of 6.64% on a week-on-week basis.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 27.68 billion.

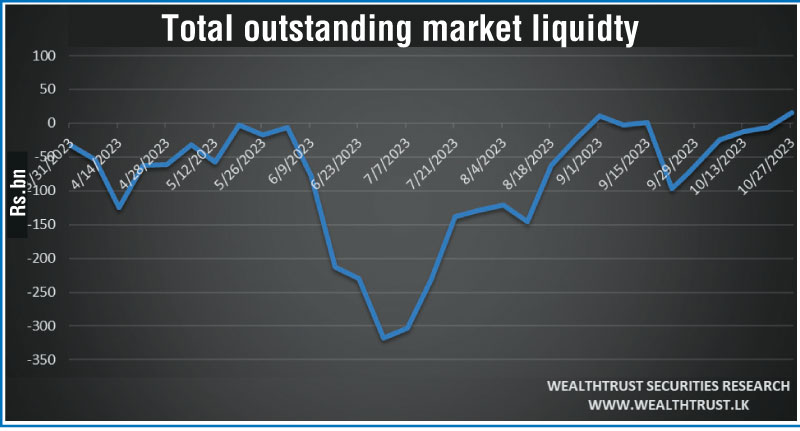

In money markets, the total outstanding liquidity recorded a surplus of Rs. 15.33 billion by the week ending 27 October, from its previous week’s deficit of Rs. 6.72 billion. The Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight to 31-day Reverse repo auctions at weighted average yields ranging from 10.12% to 13.04%.

The Central Bank of Sri Lankas (CBSL) holding of Gov. Security’s was registered at Rs. 2,839.35 billion, unchanged against its previous week’s level.

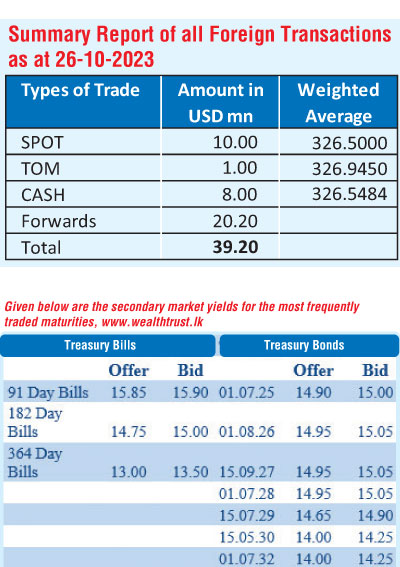

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating marginally during the week to close the week at Rs. 327.20/327.40 against its previous weeks closing level of Rs. 325.75/326.25, subsequent to trading at a high of Rs. 326.00 and a low of Rs. 327.40.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 32.86 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)