Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 13 September 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

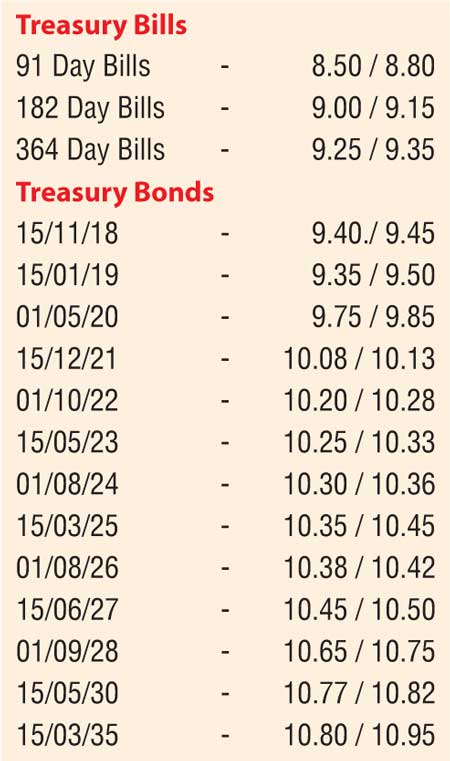

The yields in the secondary bond market continued its decreasing trend across the yield curve yesterday on the back of continued foreign buying amidst high activity once again ahead of today’s weekly Treasury bill auction.

The liquid three 2021’s maturities (i.e. 01.03.21, 01.08.21 and 15.12.21), the two 2022 maturities (i.e. 01.07.22 and 01.10.22), 01.08.24 and 01.08.26 were seen dipping to intraday lows of 10.09%, 10.10% each, 10.20%, 10.23%, 10.35%, and 10.40% respectively from its opening highs of 10.15%, 10.17%, 10.15%, 10.24%, 10.28%, 10.40% and 10.48%.

In addition, on the long end of the curve, the 01.09.28 and 15.05.30 maturities were seen dipping to daily lows of 10.75% each while on the short end 2019 maturities were seen changing hands within the range of 9.40% to 9.65% as well.

Today’s Treasury bill auction will see an total amount of Rs. 23 billion on offer consisting of Rs. 13 billion on the 182 day bill and a further Rs. 10 billion on the 364 day bill. At last week’s auction, weighted averages were seen dipping to 9.23% and 9.58% respectively.

The total secondary market Treasury bond/bill transacted volumes for 11 September 2017 was Rs. 14.74 billion.

In money markets, overnight liquidity was seen increasing to Rs. 32.82 billion yesterday as the OMO department of Central Bank drained out Rs 9.95 billion on an overnight basis at a weighted average of 7.27% by way of a Repo auction. Call money and repo averaged 7.98% and 8.08% respectively.

In the Forex market, the USD/LKR rate on the spot rate dipped marginally to close the day at Rs. 152.85/90 against its previous day’s closing levels of Rs. 152.80/85 as mild importer demand outpaced export conversions.

The total USD/LKR traded volume for the 11 September 2017 was $ 46.41 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 153.55/70; three months - 155.00/10 and six months - 157.20/30.