Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 7 May 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

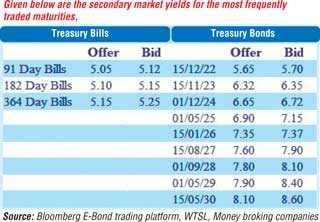

The yields in the secondary bond market continued to decline for a fourth consecutive day on the back of continued buying interest, mainly centring the very short end of the yield curve.

The yields on the liquid maturities of 2022’s (i.e. 01.10.22 and 15.11.22), 2023’s (i.e. 15.03.23, 15.07.23, 01.09.23 and 15.11.23) and 01.12.24 were seen declining further to intraday lows of 5.67% each, 5.99%, 6.25% each, 6.35% and 6.70% respectively while maturities of 2026’s (i.e. 15.01.26, 01.02.26 and 01.08.26) changed hands at levels of 7.35% to 7.38%, 7.32% and 7.65% respectively.

The total secondary market Treasury bond/bill transacted volume for 5 May 2021 was Rs. 29.39 billion.

In the money market, weighted average rates on overnight call money and repo was registered at 4.66% and 4.68% respectively as the overnight net surplus liquidity increased further to Rs. 150.55 billion yesterday.

USD/LKR

In Forex markets, the USD/LKR on spot contract were traded at level of Rs. 199.90 yesterday while one-month forward contracts saw buying interest at Rs. 199.75.

The total USD/LKR traded volume for 5 May 2021 was $ 14.80 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)