Sunday Feb 08, 2026

Sunday Feb 08, 2026

Friday, 24 April 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

Cabinet approval by the Government of Sri Lanka for a $ 400 million swap line with the Reserve Bank of India along with several other dollar credit lines in the pipeline led to secondary market bond yields decreasing once again yesterday on the back of renewed buying interest.

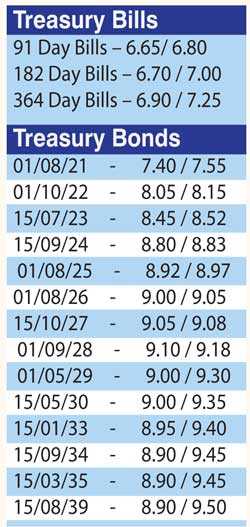

Yields on the liquid maturities of 2023s (i.e. 01.09.23 and 15.12.23), 2024s (i.e. 15.03.24 and 15.09.24), 2025s (i.e. 15.03.25 and 01.08.25) and 15.10.27 dipped to hit intraday lows of 8.47%, 8.60%, 8.80%, 8.81%, 8.90%, 8.98% and 9.08% respectively against its previous day’s closing levels of 8.55/60, 8.60/65, 8.80/90, 8.85/87, 8.95/00, 9.00/05 and 9.17/20.

In addition, trades were witnessed on the maturities of 2021s (i.e. 01.03.21 and 01.05.21), 15.05.23, 2024s (i.e. 01.01.24 and 15.06.24) and 15.06.27 at levels of 7.30%, 7.40%, 8.50%, 8.80%, 8.85% to 8.86% and 9.22% respectively.

Meanwhile, in secondary bills, July 2020, October 2020, November 2020, December 2020, January 2021 and March 2021 maturities were seen changing hands at levels of 6.70% to 6.75%, 6.70%, 7.11% to 7.15%, 7.25% each and 7.32% respectively. The total secondary market Treasury bond/bill transacted volume for 22 April was Rs. 11.25 billion.

In money markets, The Domestic Operations Department (DOD) of the Central Bank of Sri Lanka refrained from conducting any auction yesterday as the overnight net liquidity surplus in the system stood at a high of Rs.116.29 billion. The weighted average rates on overnight call money and repo decreased marginally to 6.41% and 6.56% respectively.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts traded within the range of Rs. 192.00 to 192.80 yesterday.

The total USD/LKR traded volume for 22 April was $ 41.85 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies, economynext.com)