Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 31 January 2020 00:03 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

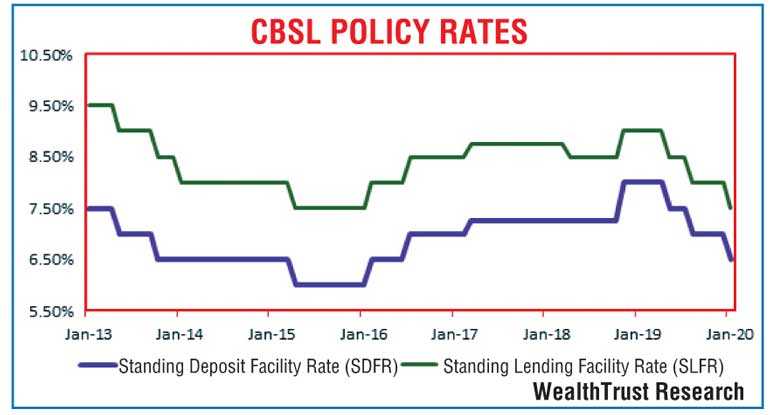

The Central Bank of Sri Lanka cut its policy rates by 50 basis points at its first Monetary Policy announcement for the year 2020. This led to its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility (SLFR) dropping to 6.50% and 7.50% respectively, effective 30 January.

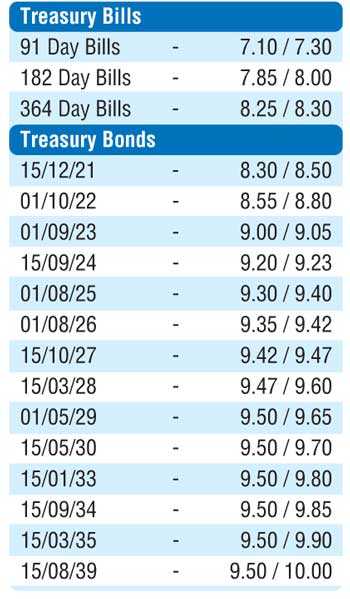

The policy rate cut was followed by activity in the secondary bond market increasing as yields were seen dipping in morning hours of trading leading to the Treasury bond auctions. The dip saw yields hit intraday lows of 9.00%, 9.20% each and 9.18% on the liquid maturities of 01.09.23 and three 2024’s (15.03.24, 15.06.24 and 15.09.24) respectively.

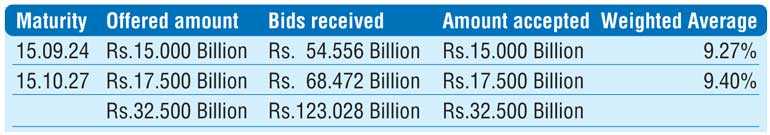

The bond auctions recorded strong outcomes, with the 4 year and 7 month maturity of 15.09.24 recording a weighted average of 9.27%, marginally above its pre-auction level of 9.20/23 while the 7 year and 8 month maturity of 15.10.27 fetched a weighted average of 9.40% against its pre-auction level of 9.40/60. Following the bond auction outcome, activity continued to remain high as the maturities of 15.07.23, three 2024’s (15.03.24, 15.06.24 and 15.09.24) and 15.10.27 were seen changing hands at levels of 8.95%, 9.22% to 9.25% and 9.40% and 9.43% respectively.

In secondary bills, November 2020 to January 2021 maturities were seen changing hands within the range of 8.20% to 8.25% while September 2020 changed hands at 8.05%.

The total secondary market Treasury bond/bill transacted volume for 29 January was Rs. 20.21 billion.

The overnight liquidity surplus was seen increasing further yesterday to Rs. 43.26 billion as the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka was seen draining out an amount of Rs. 10.00 billion at a weighted average of 6.98% by way of an overnight repo auction. The overnight call money and Repo averaged 6.99% and 7.03% respectively.

Rupee steady

An equilibrium Forex market saw the USD/LKR rate on spot contracts close the yesterday unchanged at Rs. 181.45/55 in comparison to its previous day’s closing levels.

The total USD/LKR traded volume for 29 January was $ 84.27 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 month - 181.90/10; 3 months - 182.85/05 and 6 months - 184.25/55.