Tuesday Mar 03, 2026

Tuesday Mar 03, 2026

Monday, 22 January 2018 01:07 - - {{hitsCtrl.values.hits}}

Foreign buying returns back to the bond market

By Wealth Trust Securities

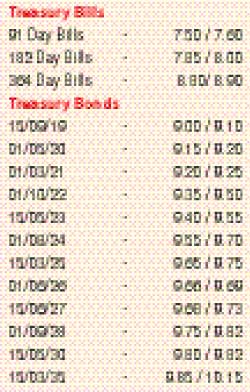

The yields in the secondary bond market fluctuated during the week ending 19 January as it increased during the early part of the week leading to the weekly bill auction and decreased towards the latter part of the week.

The liquid maturities of 01.03.21, two 2026s (i.e. 01.06.26 and 01.08.26) and 15.05.30 saw their yields increasing to weekly highs of 9.30%, 9.89%, 9.90% and 10.00% respectively in comparison with the previous week’s closing levels of 9.14/22, 9.58/65, 9.55/63 and 9.80/00. The increase in the 364 day bill weighted average at the weekly Treasury bill auction coupled with local selling interest were seen as the main reasons behind the increase while Central Bank calls for lead managers/book runners for the issue of $ 2 billion sovereign bonds was seen as the reason behind the dip with yields hitting weekly lows of 9.20%, 9.62% each and 9.80%.

The foreign holding in rupee bonds was seen recording an inflow to the tune of Rs. 5.25 billion for the week ending 17 January 2018, reversing its outflows witnessed over the previous two weeks.

The daily secondary market Treasury bond/bill transacted volume for the first three days of the week averaged Rs.7.33 billion.

In money markets, average net liquidity was seen decreasing to Rs. 11.68 billion during the week against its previous week’s average of Rs. 37.82 billion as the OMO Department of the Central Bank of Sri Lanka was seen conducting an overnight Reverse Repo auction on Friday against the overnight repo auctions it conducted during the rest of the week within the range of 7.25% to 7.28%. The overnight call money and repo rates averaged 8.15% and 7.55% respectively for the week.

Rupee closes steadily

In Forex markets during the week, the rupee rate on spot contracts closed the week mostly unchanged at Rs. 153.95/00, subsequently trading within the range of Rs. 153.80-Rs. 153.95.

The daily USD/LKR average traded volume for the three days of the week stood at $ 53.62 million. Some of the forward dollar rates that prevailed in the market were one month - 154.70/80; three months - 156.35/45 and six months - 158.80/90.