Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 7 July 2023 00:14 - - {{hitsCtrl.values.hits}}

By Courtesy Wealth Trust Securities Ltd

By Courtesy Wealth Trust Securities Ltd

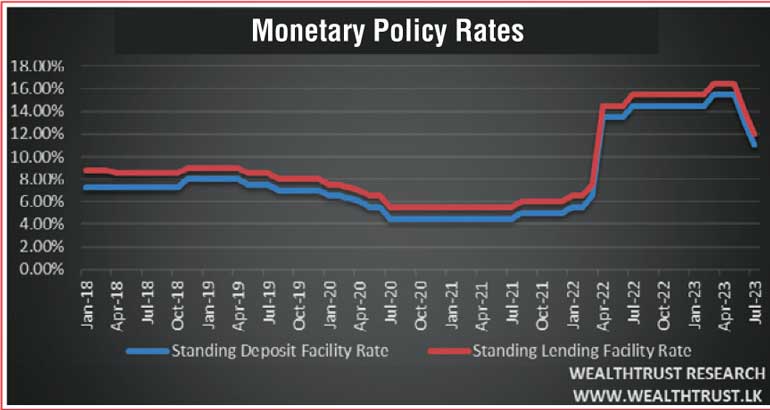

The Central Bank of Sri Lanka continued on its monetary easing cycle by reducing its monetary policy rates for a second consecutive announcement at its fifth review meeting for the year 2023, which was announced yesterday morning. A decrease of 200 basis points saw the Standing Deposit Facility Rate (SDFR) and Standing lending Facility Rate (SLFR) dip to 11% and 12% respectively accumulating a total decrease of 450 basis points or 4.5% over the last two policy announcements.

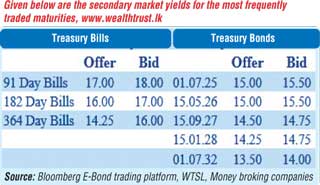

Meanwhile, secondary market bond yields were volatile yesterday, as it decreased initially following the policy announcement and increased thereafter on the back of selling interest. The yields on the liquid maturities of 01.07.25, 15.05.26, 15.09.27 and 01.07.32 hit intraday lows of 13.75%, 14%, 13.5% and 12.50% respectively during the early part of the day before hitting intraday highs of 15% each and 13.75% respectively during the later part of the day.

The total secondary market Treasury bond/bill transacted volume for 5 July 2023 was Rs. 46.92 billion.

In money markets, the weighted average rates on overnight call money and repo were registered at 11.52% and 12% respectively as the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight and 7-day reverse repo auctions for a total volume of Rs. 131.00 billion at weighted average rates of 11.70% and 12% respectively. Further an amount of Rs. 161.57 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 12% against an amount of Rs. 19.80 billion deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 11%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day at Rs. 310.00/313.00 yesterday against its previous day’s closing level of Rs. 306.50/308.00.

The total USD/LKR traded volume for 05 July was $ 73.85 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)