Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 13 March 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

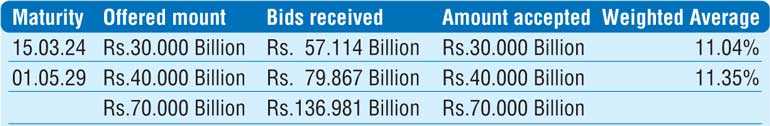

The two Treasury bond auctions conducted yesterday were successfully subscribed for its total offered amount of Rs. 70 billion at its phase I stage. The 5 year maturity of 15.03.2024 recorded a weighted average of 11.04% while the 10 years and 2 month maturity of 01.05.29 recorded a weighted average of 11.35%.

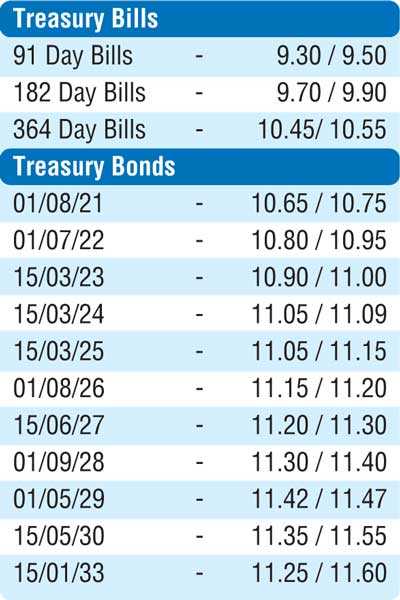

Activity in the secondary bond market picked up yesterday as yields were seen edging up during the latter part of the day following the bond auction outcomes. The auctioned maturities of 15.03.24 and 01.05.29 were seen changing hands at levels of 11.05% to 11.08% and 11.45% respectively. In addition, the maturities of the two 2021’s (i.e. 01.08.21 & 15.12.21), two 2023’s (i.e. 15.03.23 & 15.12.23) and 01.08.26 were seen trading at levels of 10.65% to 10.70%, 10.85% to 10.90% and 11.03% to 11.15% respectively as well. On the short end of the curve, the one year bill and the 01.05.20 bond was seen changing hands at levels of 10.50% and 10.47% to 10.53% respectively.

Today’s Treasury bill auction will see an total amount of Rs. 24 billion on offer consisting of Rs. 3 billion on the 91 day bill, Rs. 5 billion on the 182 day bill and a further Rs. 16 billion on the 364 day bill. At last week’s auction, the weighted average on the 364 day bill was seen dipping to 10.64% while all bids received for 91 day and 182 day bills were rejected.

The total secondary market Treasury bond/bill transacted volumes for 11 March was Rs. 2.45 billion.

In money markets, overnight liquidity stood at Rs. 19.44 billion as the OMO department of Central Bank injected an amount of Rs. 10.00 billion on seven day basis at a weighted average of 9.00% by way of a Reverse Repo auction. Overnight call money and repo averaged 8.91% and 8.92% respectively.

Rupee dips further

In the Forex market, the USD/LKR rate on the spot rate dipped further to close the day at Rs. 178.82/90 against its previous day’s closing levels of Rs. 178.50/65 on the back of continued buying interest from banks and importer demand.

The total USD/LKR traded volume for 11 March was $ 51.20 million.

Some forward USD/LKR rates that prevailed in the market were: 1 month - 179.80/00; 3 months - 181.60/80; 6 months - 184.60/90.