Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 6 May 2020 00:40 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

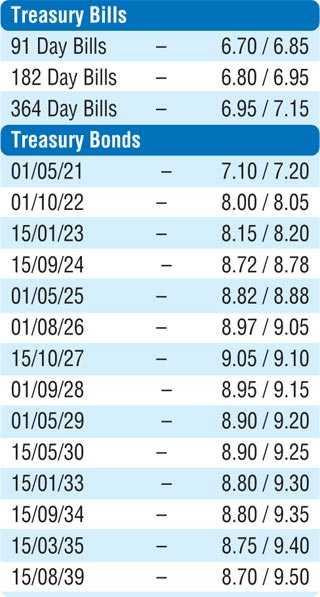

The secondary market bond yields increased further yesterday with continued selling interest on the maturities of 2024s (i.e. 15.03.24, 15.06.24 & 15.09.24) and 15.10.27 saw its yields hit intraday highs of 8.70%, 8.75% each and 9.07% respectively against its previous day’s closing levels of 8.65/70, 8.68/75, 8.70/75 and 9.00/05. Furthermore, maturities consisting of the 01.10.22, 15.01.23, 2025s (i.e. 15.03.25 & 01.05.25) and 01.08.26 traded at levels of 8.00% to 8.03%, 8.15% to 8.18%, 8.85%, 8.80% to 8.85% and 9.02% to 9.04% respectively.

The secondary market bond yields increased further yesterday with continued selling interest on the maturities of 2024s (i.e. 15.03.24, 15.06.24 & 15.09.24) and 15.10.27 saw its yields hit intraday highs of 8.70%, 8.75% each and 9.07% respectively against its previous day’s closing levels of 8.65/70, 8.68/75, 8.70/75 and 9.00/05. Furthermore, maturities consisting of the 01.10.22, 15.01.23, 2025s (i.e. 15.03.25 & 01.05.25) and 01.08.26 traded at levels of 8.00% to 8.03%, 8.15% to 8.18%, 8.85%, 8.80% to 8.85% and 9.02% to 9.04% respectively.

The total secondary market Treasury bond/bill transacted volume for 4 May was Rs. 20.90 billion.

In money markets, an injection by the DOD (Domestic Operations Department) of Central Bank for an amount of Rs. 15 billion for 06 days drew no bids as the overnight net liquidity surplus in the system stood at Rs. 142.50 billion yesterday. The weighted average rates on overnight call money and repo stood at 6.41% and 6.56% respectively.

Rupee remains mostly unchanged

In the Forex market, the USD/LKR rate on spot contracts traded within the range of Rs. 188.75 to Rs. 189.25 yesterday.

The total USD/LKR traded volume for 04 April was $ 36.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)