Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 15 December 2017 09:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yields were seen increasing yesterday following the US Federal Reserve’s policy decision to increase rates by 25 basis points coupled with profit-taking on the back of moderate volumes.

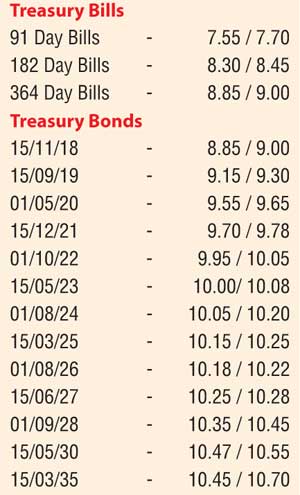

The yields on the liquid 01.05.20, two 2021’s (i.e. 01.03.21 and 01.05.21) and 01.08.26 maturities were seen increasing to intraday highs of 9.57%, 9.73%, 9.77% and 10.22% respectively against its previous day’s closing levels of 9.40/50, 9.63/68, 9.68/75 and 10.12/20 respectively while two-way quotes on the rest of the yield curve were seen increasing and widening.

The total secondary market Treasury bond/bill transacted volumes for 13 December 2017 was Rs.7.75 billion.

The total secondary market Treasury bond/bill transacted volumes for 13 December 2017 was Rs.7.75 billion.

In money markets, the Central Banks Open Market Operations (OMO) Department was seen mopping up excess liquidity by way of a term repo auction. The auction drained out an amount of Rs. 9.23 billion at weighted averages of 7.33% for seven days.

Further, an amount of Rs. 13.27 billion was mopped up on overnight basis at a weighted average of 7.25% as the net surplus liquidity increased to Rs. 30.04 billion yesterday. The overnight call money and repo rates averaged 8.10% and 7.53% respectively.

Rupee closes stronger

In the Forex market, the USD/LKR rates on spot contracts were seen closing the day stronger at Rs. 153.10/20 subsequent to hitting an intraday low of Rs. 153.50 against its previous day’s closing levels of Rs. 153.20/35.

The total USD/LKR traded volume for 13 December was $ 86.45 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 154.15/30; three months - 155.85/00 and six months - 158.65/80.