Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 5 January 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

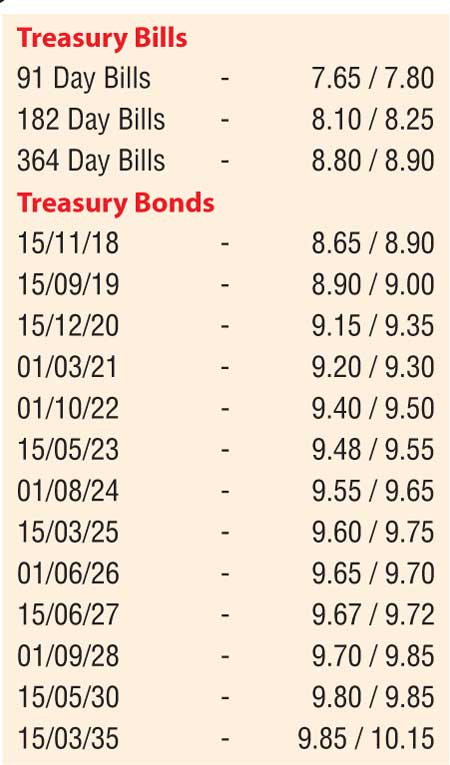

The downward trend in secondary bond market yields intensified yesterday on the back of sustained local buying interest.

The yields on the liquid maturities of 01.03.21, 15.05.23, the two 2026’s (i.e. 01.06.26 and 01.08.26), 15.06.27 and 15.05.30 were seen crashing to intraday lows of 9.20%, 9.45%, 9.62%, 9.65% each and 9.80% respectively against its previous day’s closing levels of 9.40/50, 9.70/85, 9.95/00 each, 9.98/05 and 10.10/25. However, selling interest at these levels resulted in yields increasing marginally from their daily lows.

The total secondary market Treasury bond/bill transacted volumes for 3 January 2018 was Rs. 9.86 billion.

In money markets, the Central Bank’s Open Market Operations (OMO) Department continued to drain out liquidity on a permanent basis as it was seen mopping up excess liquidity by way of two auctions for outright sales of Treasury bills.

In total an amount of Rs. 3 billion was mopped up for 70 and 77 days at weighted averages of 7.60% and 7.62% respectively through the auctions, valued today.

Furthermore, the OMO Department drained out an amount of Rs. 12.93 billion on an overnight basis by way of a repo auction at a weighted average of 7.25% as the net surplus liquidity in the system stood at Rs. 13.97 billion yesterday. The overnight call money and repo rates averaged 8.15% and 7.52% respectively.

Rupee appreciates marginally

The USD/LKR rate on spot contracts appreciated marginally yesterday to close the day at Rs. 153.60/63 on the back of moderate activity as selling interest by banks was seen outweighing importer demand.

The total USD/LKR traded volume for 3 January 2017 was $ 34.35 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 154.60/70; three months - 156.40/60 and six months - 158.90/10.

Reuters: The rupee closed slightly firmer on Thursday, as conversion of the US currency by exporters surpassed mild demand for dollars from importers, dealers said.

The spot rupee ended at 153.60/70 per dollar, compared with Wednesday’s close of 153.70/80.

The currency fell 2.5% last year and 3.9% in 2016.

“Today there were some exporter conversions and the import demand was mild,” said a currency dealer.

Pressure on the currency from imports is expected to prevail until the Central Bank sorts out new regulations for derivatives, which has slowed forward trading in the currency, dealers said.

The central bank, while announcing its key economic policies for the year, said it has allowed for more flexibility in determining the exchange rate based on market conditions.

It has intervened only to smoothen rupee volatility and to build up reserves, the banking regulator said.