Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 7 June 2022 03:42 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The start of a new trading week saw secondary market bond yields increasing marginally yesterday during morning hours of trading on the back of profit taking driven selling interest.

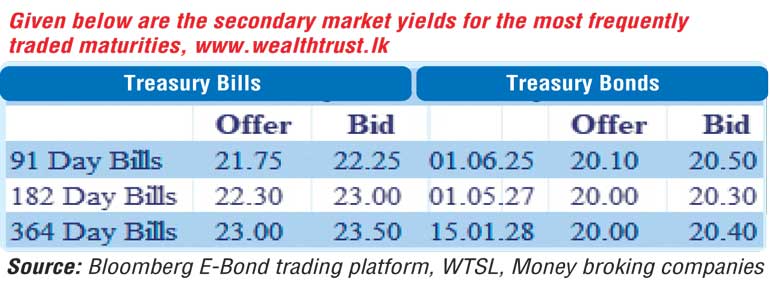

Yields on the liquid maturities of 01.06.25, 01.05.27 and 15.01.28 were seen increasing to intraday highs of 20.25%, 20.22% and 20.33% respectively against its previous day’s closing levels of 20.00/20, 20.00/30 and 20.00/40. Nevertheless, buying interest at these levels curtailed any further upward movement while closing levels were broadly steady against its previous day’s closings.

The secondary bills remained active as well, with the maturities of June and August 2022 along with 2 June 2023 changing hands at levels of 17.00% to 17.25%, 21.80% to 22.00% and 22.95% to 23.25% respectively.

The total secondary market Treasury bond/bill transacted volume for 3 June 2022 was Rs. 9.38 billion.

In money markets, the net liquidity deficit stood at Rs. 564.58 billion yesterday as an amount of Rs. 205.16 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 13.50% against an amount of Rs. 769.74 billion withdrawn from Central Bank’s SLFR (Standard Deposit Facility Rate) of 14.50%. The weighted average rates on overnight Call money and REPO stood at 14.50% each.

Forex market

In the forex market, the middle rate for USD/LKR spot contracts appreciated to Rs. 360.2773 yesterday against its previous day’s Rs. 360.30.

The total USD/LKR traded volume for 3 June 2022 was $ 14.98 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)